Hello everyone! Today, we’re diving into the concept of ICT Breakaway Gaps a trading idea that’s both straightforward and intricate. Whether you’re new to trading or have been in the game for years, this guide aims to break down this concept in simple terms.

To fully grasp ICT Breakaway Gaps, it’s helpful to know about Fair Value Gaps, Inverse Fair Value Gaps, Breaker Blocks, and Balanced Price Ranges. Don’t worry if these terms are new to you; we’ll touch on them as we go along.

What Is an ICT Breakaway Gap?

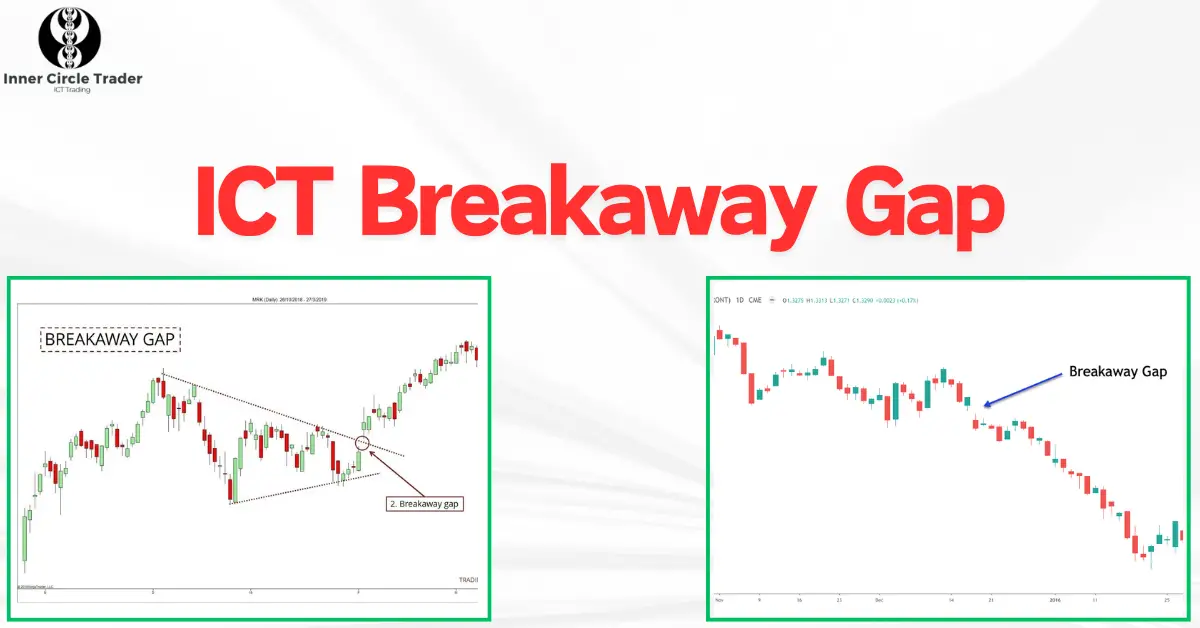

An ICT Breakaway Gap is a type of gap on a price chart that forms after a strong price movement and remains unfilled. In other words, after the price makes a big move up or down, it leaves a gap that the price doesn’t come back to fill. It’s called a “breakaway” because the price breaks away from a previous level and doesn’t return to that gap.

Why Does the Breakaway Gap Matter?

Breakaway Gaps are significant because they signal strong momentum in the market. When a gap remains unfilled, it often indicates that the price will continue moving in the same direction. This can offer trading opportunities for those who recognize the pattern early.

How to Identify an ICT Breakaway Gap

Spotting a Breakaway Gap involves looking for a gap that forms after the price breaks through a swing high or swing low and then doesn’t retrace to fill that gap. Here’s how you can identify one:

- Strong Price Move: Look for a significant upward or downward movement in price.

- Gap Formation: Notice if a gap is created during this move.

- No Retracement: Observe whether the price fails to return to fill this gap.

Recognizing these gaps early can give you an edge in anticipating future price movements.

Types of ICT Breakaway Gaps

There are two main types of Breakaway Gaps:

1. Bullish Breakaway Gap

A Bullish Breakaway Gap occurs when the price breaks above a previous high with strong upward momentum, creating a gap that remains unfilled. This suggests that buyers are in control, and the price may continue to rise.

Reasons Why It Remains Unfilled:

- Breaker Block: After breaking a previous high, the price may encounter a support zone known as a Breaker Block, which prevents it from falling back to fill the gap.

- Inverse Fair Value Gap: If the price moves up through a bearish Fair Value Gap, it creates a bullish Inverse Fair Value Gap that acts as support.

- Balanced Price Range: When a new bullish Fair Value Gap overlaps a previous bearish one, the overlapping area becomes a Balanced Price Range, offering additional support.

2. Bearish Breakaway Gap

A Bearish Breakaway Gap happens when the price breaks below a previous low with strong downward momentum, leaving an unfilled gap. This indicates that sellers are dominating, and the price may continue to drop.

Reasons Why It Remains Unfilled:

- Breaker Block: After breaking a previous low, the price may hit a resistance zone (Breaker Block) that stops it from rising back to fill the gap.

- Inverse Fair Value Gap: If the price moves down through a bullish Fair Value Gap, it forms a bearish Inverse Fair Value Gap acting as resistance.

- Balanced Price Range: An overlapping area between a new bearish Fair Value Gap and an old bullish one creates a Balanced Price Range that resists upward movement.

Putting It All Together

Understanding why Breakaway Gaps remain unfilled helps you anticipate continued price movement in the direction of the gap. By recognizing supporting factors like Breaker Blocks, Inverse Fair Value Gaps, and Balanced Price Ranges, you can make more informed trading decisions.

Final Thoughts

ICT Breakaway Gaps can be a valuable tool in your trading toolkit. They signal strong market sentiment and can help you identify potential trading opportunities. Remember, the key is to spot them early and understand the reasons why the price may not return to fill the gap.

Happy trading, and may the markets be ever in your favor!

Frequently Asked Questions:

A Fair Value Gap is a price range on a chart where little to no trading has occurred, usually due to rapid price movement. It’s important because the price often retraces to fill these gaps, offering potential trading opportunities.

A Breaker Block is a support or resistance zone formed after the price breaks through a previous high or low. It can prevent the price from retracing, which helps maintain the momentum in the direction of the breakaway.

Yes, Breakaway Gaps can occur in any financial market stocks, forex, commodities and on various timeframes. However, they are more significant on higher timeframes due to the larger number of traders involved.

You can use Breakaway Gaps to identify strong market momentum. If you spot a Breakaway Gap that remains unfilled, it may indicate a good opportunity to enter a trade in the direction of the gap.

A Breakaway Gap occurs at the start of a significant price move and often remains unfilled, signaling strong momentum. A Common Gap typically happens within a trading range and is more likely to be filled as the price retraces.