Break of Structure (BOS) is an important concept in Forex trading that points to a major change in how currency prices are moving. Imagine it like a train changing its tracks.

How to Spot a Break of Structure?

- When Prices End Higher or Lower than Before:

- Think of a candle as a way to picture price movements over time. If the price at the end of a candle is higher than the highest point it reached before, it’s like the price is climbing a new step on a staircase – that’s a BOS going upwards.

- If the price at the end of a candle is lower than the lowest point before, it’s like the price is stepping down to a new level – and that’s a BOS going downwards.

- Seeing Higher Peaks Without Lower Dips in Uptrends:

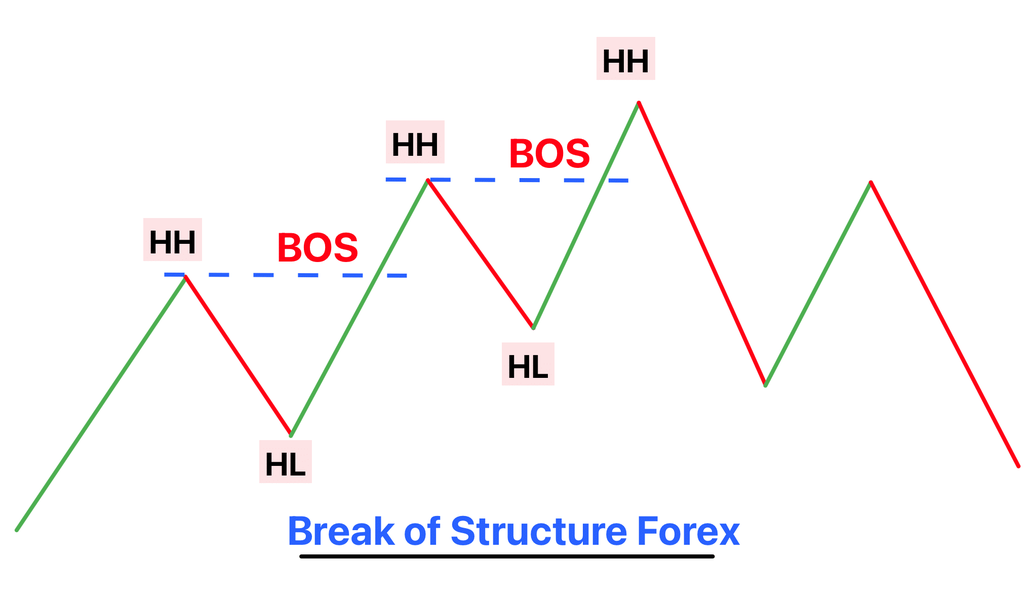

- In an uptrend (when prices are generally going up), a BOS is confirmed when prices reach new highs without dropping below their previous low points. It’s like a hiker going up a hill, reaching higher points without slipping back down to the lower points they passed before.

- This pattern of reaching higher points without falling back shows that the trend of rising prices is strong and likely to keep going.

These simple ways to identify a BOS help traders figure out where the market might be headed next – whether it’s likely to continue in the same direction or start moving the other way. As we explore more, we’ll see how these signs can be used to make smart trading choices.

Differentiating Between Minor and Significant Break of Structure (BOS)

Minor vs. Significant BOS

- Minor BOS:

- Think of these as small blips or fluctuations in the market. They happen when prices slightly exceed previous highs or lows but don’t indicate a major shift in market trend.

- Minor BOS often occurs due to short-term market noise or minor news impacts. They don’t typically lead to long-lasting changes in the market direction.

- Significant BOS:

- These are the game-changers. A significant BOS is when the price movement clearly and strongly breaks through previous support or resistance levels.

- It usually happens with substantial trading volume and might be triggered by major economic events or changes in market sentiment. Significant BOS often signals a more durable change in the market trend.

Break of Structure as an Indicator

BOS Indicating Trend Reversals or Continuations

- Trend Reversals:

- When a significant BOS happens against the current trend direction (like a strong downward move in an uptrend), it might indicate a trend reversal. It’s like a strong wave hitting against the tide, suggesting a potential change in the flow.

- Trend Continuations:

- If the BOS aligns with the current trend (like prices reaching new highs in an uptrend), it often signals a trend continuation. It’s akin to the wind getting stronger in the same direction, pushing the trend further along.

Implications of Higher Highs and Lower Lows

- Higher Highs in Uptrends:

- In an uptrend, higher highs occur when each new peak in price is higher than the previous one. It’s a sign of strong buying pressure and often indicates that the uptrend is likely to continue.

- Lower Lows in Downtrends:

- Conversely, in a downtrend, lower lows mean each new bottom is lower than the last. This signals strong selling pressure and typically suggests that the downtrend will keep going.

- Role in Identifying BOS:

- These patterns help traders distinguish between minor and significant BOS. A consistent pattern of higher highs or lower lows supports the idea of a significant BOS, reinforcing the notion of a strong, ongoing trend.

Market Structure Shifts and Break of Structure

Defining a Market Structure Shift

- What is a Market Structure Shift?

- In Forex trading, a market structure shift refers to a fundamental change in the overall direction or pattern of the market. It’s like a sea change, where the previous trend (upward or downward) alters course significantly.

- This shift is not just a one-off price movement but a series of movements indicating a new, sustained trend direction.

Relationship Between Market Structure Shifts and Breaks in Structure

- Interconnection of BOS and Market Structure Shifts:

- Break of Structure (BOS) is often the first hint of a possible market structure shift. When you see a BOS, it’s like spotting the first sign of change in the market’s behavior.

- However, not every BOS leads to a market structure shift. While a BOS can be a temporary fluctuation, a market structure shift is recognized only when there are consistent and significant BOS patterns that redefine the trend.

- Validating a Market Structure Shift with BOS:

- To confirm a market structure shift, traders look for a series of significant BOS events. This could be multiple instances where new highs are higher than previous ones in an uptrend or new lows are lower in a downtrend.

- The consistency and strength of these BOS events help traders differentiate between a mere short-term trend and a genuine, long-lasting market structure shift.

Identifying Series of BOS as Indicators of New Trends

- Series of BOS as a Trend Indicator:

- A sequence of BOS events, particularly significant ones, is a strong indicator of a new emerging trend.

- In an uptrend, a series of higher highs and higher lows, each breaking past previous levels, signals a robust upward trend. Conversely, in a downtrend, a series of lower lows and lower highs indicates a strengthening downward trend.

- Importance in Trading Strategies:

- Recognizing these patterns is crucial for Forex traders in strategizing their entries and exits. It helps in riding the wave of the new trend early or exiting positions before the trend reverses.

- By closely monitoring these BOS patterns, traders can more accurately predict the onset of market structure shifts, allowing them to adjust their strategies in line with the new market direction.

Smart Money Concepts in Forex Break of Structure (BOS)

Explanation of Smart Money and Its Influence on Forex Markets

- What is Smart Money?

- In Forex trading, “Smart Money” refers to the investments and trades made by experienced, well-informed market players like institutional investors, banks, and hedge funds. These entities are considered “smart” because of their extensive market knowledge, resources, and ability to influence market trends.

- Influence of Smart Money in Forex:

- Smart Money often sets the tone for market movements. Their large trades can significantly impact currency prices, effectively guiding the market’s direction.

- The actions of Smart Money are closely watched by individual traders, as they can provide clues about upcoming market trends or shifts.

How Smart Money Patterns are Reflected in BOS

- Smart Money and Market Structures:

- Smart Money is often behind the formation of key market structures, including BOS. When Smart Money decides to make large moves, it can create the significant price changes that characterize a BOS.

- For example, if Smart Money starts selling a currency pair heavily, it might break past a support level, signaling a BOS and potentially indicating a new downtrend.

- Patterns to Watch:

- Traders often look for patterns like consistent higher highs or lower lows as signs of Smart Money’s influence. Repeated BOS in a particular direction can suggest that Smart Money is actively pushing the market in that way.

Strategies for Trading BOS in Forex Markets

- Entry and Exit Points:

- Use BOS as a signal for when to enter or exit trades. For instance, entering a buy trade when there’s a BOS indicating an uptrend (price breaks above resistance) and exiting or selling when there’s a BOS showing a potential downtrend (price breaks below support).

- Trend Following:

- In an established trend, look for BOS as a confirmation to continue trading in the direction of the trend. For example, in an uptrend, each new BOS upwards can be an opportunity to buy.

- Counter-Trend Trading:

- More experienced traders might use BOS as a signal for counter-trend moves, entering trades when there’s a BOS against the prevailing trend, anticipating a reversal.

Conclusion

To wrap up our discussion on Break of Structure (BOS) in Forex trading, let’s revisit the key points we’ve covered in simple terms.

- BOS is a Big Deal in Forex: We’ve learned that BOS is when currency prices make a significant move, breaking past previous highs or lows. It’s a signal that something important is happening in the market.

- Minor vs. Major BOS: We talked about the difference between small, everyday BOS (which are like minor market hiccups) and big, game-changing BOS (which are like major market shifts).

- Spotting New Trends with BOS: A series of BOS events can help us spot the start of a new trend in the market, like a currency consistently getting stronger or weaker.

- Smart Money and BOS: We also looked at how the big players (called Smart Money) in the market often drive these BOS events. By watching BOS, we can get a sense of what these big players are up to.

- Trading with BOS: We discussed how to use BOS in trading, like deciding when to buy or sell. We also talked about the importance of not just relying on BOS alone, but using it alongside other trading tools and staying aware of market news.

- Risk Management is Key: We highlighted how crucial it is to manage risks, like setting limits on potential losses, especially when trading based on BOS.

- Keep Learning and Adapting: Finally, the world of Forex trading is always changing, so it’s important to keep learning and adjusting our strategies.