Understanding the financial markets can be challenging, but with the right tools, you can navigate them successfully. One such tool is the ICT Breaker Block strategy. As an experienced trader, I’ve seen how effective this concept can be in identifying key support and resistance levels after a shift in market direction. In this guide, we’ll simplify the ICT Breaker Block strategy, making it accessible for both new and seasoned traders.

What is an ICT Breaker Block?

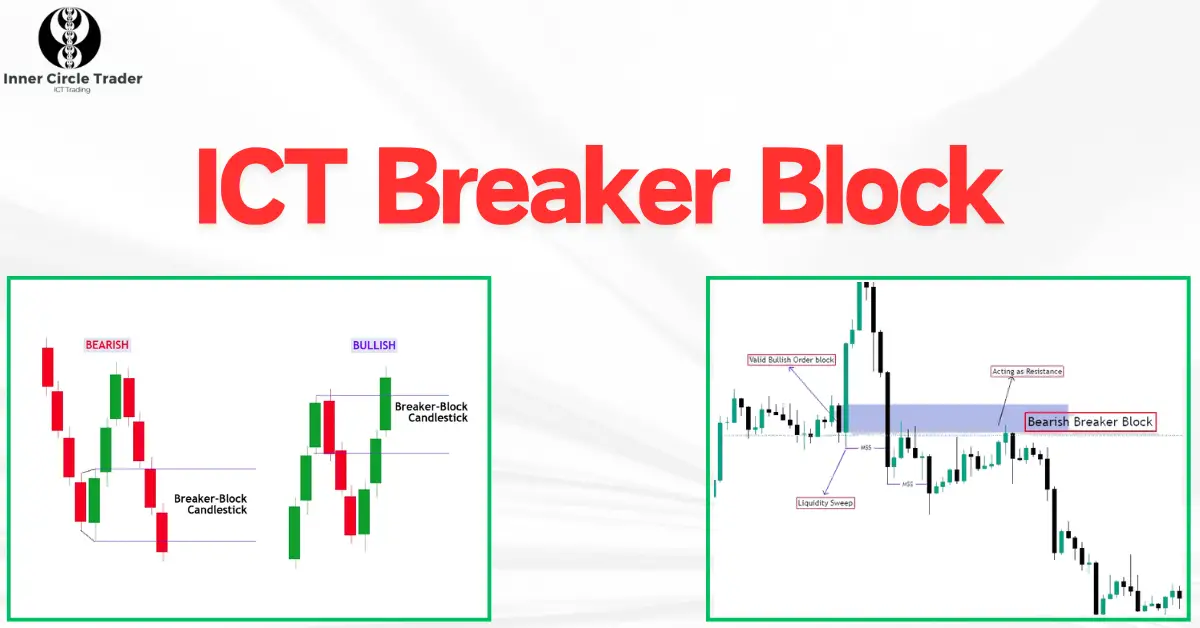

An ICT Breaker Block is essentially a failed order block that leads to a change in the market’s direction. Imagine an order block as an area where large players, like banks or institutions, place big buy or sell orders, causing the price to reverse or stall. When the price doesn’t respect this area and moves past it, the failed order block becomes a breaker block. This new zone then acts as a level of support or resistance, signaling a potential trading opportunity.

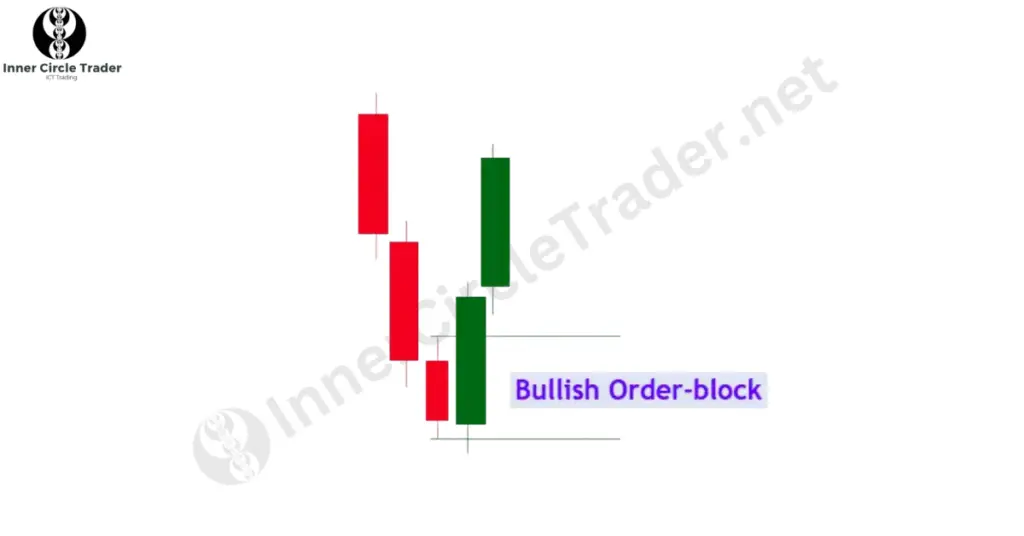

Understanding Order Blocks

Before diving deeper into breaker blocks, it’s important to understand what an order block is. An order block is a price area where significant buying or selling has occurred, often leading to a price reversal or continuation. It’s where the “smart money” has left a footprint. When an order block fails meaning the price moves beyond it it transforms into a breaker block. This shift is crucial for traders looking to capitalize on market movements.

Types of ICT Breaker Blocks

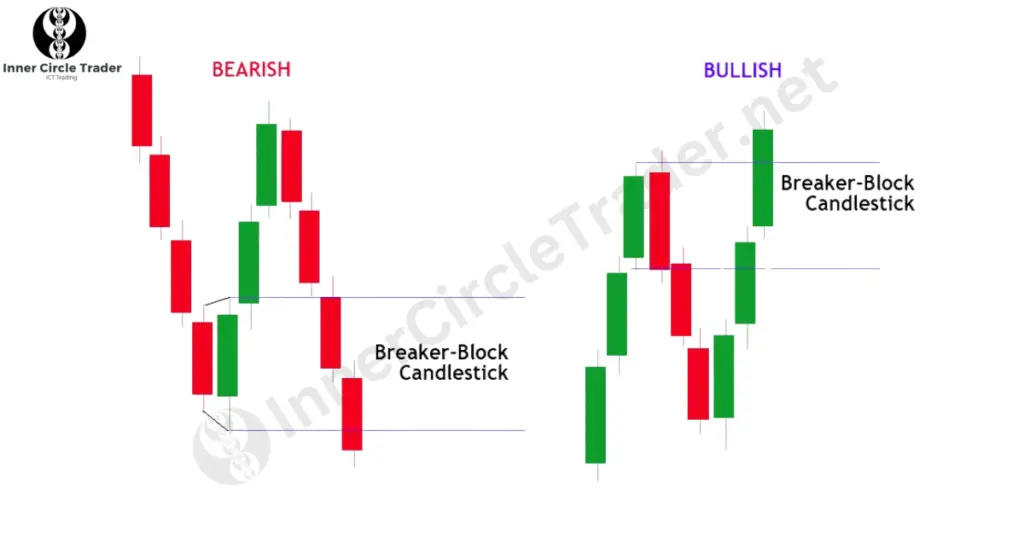

There are two main types of breaker blocks: the bullish breaker block and the bearish breaker block. Let’s explore each one in detail.

Bullish Breaker Block

A bullish breaker block forms when a bearish order block fails. Initially, the price is expected to drop from a bearish order block because sellers are in control. However, instead of continuing down, the price reverses and closes above the high of the bearish order block. This indicates that sellers couldn’t maintain control and buyers have taken over. The failed bearish order block now becomes a bullish breaker block, acting as a support level.

For example, imagine the price is falling and hits a bearish order block at $100. Traders expect it to keep dropping, but instead, it climbs and closes above $100. This area around $100 now becomes a bullish breaker block. Traders might look to buy when the price returns to this level, expecting it to act as support.

Bearish Breaker Block

A bearish breaker block occurs when a bullish order block fails. Initially, the price is expected to rise from a bullish order block because buyers are in control. However, instead of going up, the price reverses and closes below the low of the bullish order block. This suggests that buyers couldn’t keep the momentum, and sellers have taken charge. The failed bullish order block becomes a bearish breaker block, acting as a resistance level.

For instance, suppose the price is rising and reaches a bullish order block at $50. Traders anticipate it will keep climbing, but instead, it drops and closes below $50. This area around $50 now becomes a bearish breaker block. Traders might look to sell when the price comes back to this level, expecting it to act as resistance.

How to Identify an ICT Breaker Block

To spot a breaker block, you need to follow a few steps. First, find an order block by looking for areas where the price has previously reversed due to large buying or selling. Next, watch for failure; see if the price moves beyond this order block, closing above its high (for a bearish order block) or below its low (for a bullish order block). Confirm that there’s a change in market structure, indicating a shift in control between buyers and sellers. Finally, mark the failed order block as a breaker block, which now serves as a new support or resistance level.

ICT Breaker Block Trading Strategy

Incorporating breaker blocks into your trading strategy involves several steps. Begin by determining the market trend to decide whether to focus on bullish or bearish breaker blocks. Wait patiently for the price to reach significant areas on the chart, like previous highs or lows. On a lower time frame, observe if the market is changing direction; for example, in an uptrend, watch for lower highs and lower lows signaling a potential downtrend.

Identify a failed order block that aligns with the market shift. When the price retraces to the breaker block, consider entering the trade. Place your stop loss just beyond the breaker block to manage risk. Remember, risk management is key; always know where you’ll exit the trade if it doesn’t go your way.

Best Time Frames for Trading Breaker Blocks

Your choice of time frame depends on your trading style. For long-term traders, daily or 4-hour charts help identify major breaker blocks and trends. Short-term traders might prefer 15-minute or 5-minute charts to spot more frequent opportunities. It’s important to experiment with different time frames to see what works best for you.

Best Markets for the Breaker Block Strategy

While the breaker block strategy was first used in indices like the NASDAQ and S&P 500, it’s also effective in other markets. Forex pairs like GBP/USD and EUR/USD respond well due to high liquidity. Metals such as Gold (XAU/USD) offer good opportunities because of their volatility. Although the strategy can be applied to indices and stocks, it may require adjustments for market behavior. Choose markets that you’re familiar with and that have enough movement to make the strategy worthwhile.

Breaker Blocks vs. Order Blocks

Understanding the difference between breaker blocks and order blocks is crucial. An order block is an area indicating potential reversal or continuation due to large institutional orders. A breaker block, on the other hand, is a failed order block that has been breached, leading to a market shift and acting as a new support or resistance. In simple terms, an order block is where the price might change direction, while a breaker block is where the price failed to hold, signaling a possible new trend.

Conclusion

Mastering the ICT Breaker Block strategy can add a valuable tool to your trading arsenal. By understanding how to identify and trade breaker blocks, you can better anticipate market moves and make more informed trading decisions. Focus on the basics, manage your risk carefully, and continuously learn from your trading experiences.

Frequently Asked Questions (FAQs)

Breaker blocks help traders identify new support and resistance levels after a market shift. When an order block fails, it signals that the expected move didn’t happen, and the area can now be used to anticipate where the price might reverse again. This provides traders with opportunities to enter or exit trades based on this new information.

Yes, the breaker block strategy is versatile and can be applied to various markets, including forex, commodities, indices, and stocks. It’s most effective in markets with high liquidity and volatility, where significant institutional trading activity influences price movements.

Risk management is crucial when trading breaker blocks. Always set a stop loss when entering a trade based on a breaker block. Place your stop loss just beyond the breaker block to protect against unexpected market moves. Additionally, never risk more than a small percentage of your trading capital on a single trade.

The breaker block strategy can be suitable for beginners due to its straightforward concept. However, new traders should take the time to understand market structure, practice identifying breaker blocks on demo accounts, and learn about risk management before trading with real money.

A bullish breaker block forms when a bearish order block fails and the price closes above it, acting as support. A bearish breaker block occurs when a bullish order block fails and the price closes below it, acting as resistance. Understanding the type of breaker block helps you decide whether to look for buying or selling opportunities.