In the complex world of trading, the ability to anticipate market reversals is invaluable. Bearish order blocks, a concept deeply rooted in technical analysis, offer traders this foresight, marking potential shifts from bullish to bearish momentum. This comprehensive guide delves into the intricacies of bearish order blocks, equipping traders with the knowledge to identify, utilize, and navigate these pivotal patterns for optimized trading strategies.

Introduction to Bearish Order Blocks

Bearish order blocks are essentially snapshots of market sentiment, capturing the moment when the tide turns from bullish enthusiasm to bearish dominance. These patterns are critical for traders aiming to capitalize on the early stages of a market downturn.

What Are Bearish Order Blocks?

- Definition: Bearish order blocks are identified on trading charts as specific patterns indicating a shift in market dynamics from an uptrend to a downtrend.

- Significance: They signal the presence of significant selling pressure, often initiated by institutional traders, and mark potential reversal points in the market.

Identifying Bearish Order Blocks

Recognizing bearish order blocks is a skill that combines art with science, requiring an understanding of market psychology and meticulous analysis.

Key Characteristics

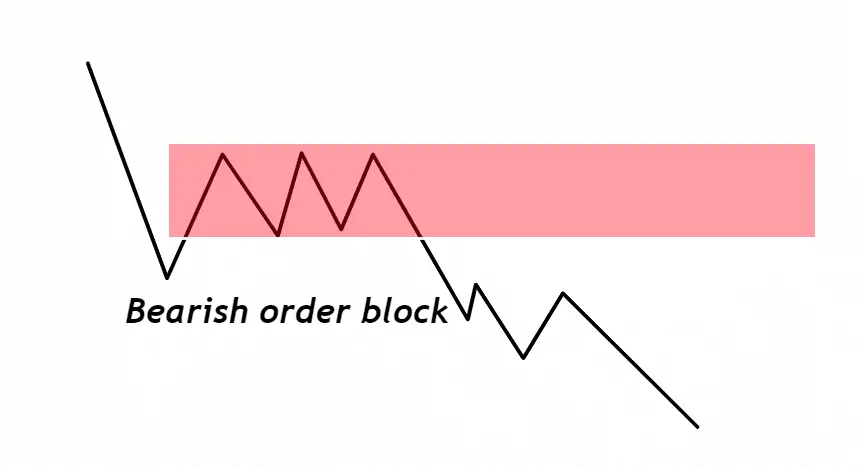

- Preceding Uptrend: Look for a period of bullish momentum, indicating the market is ripe for a reversal.

- Consolidation Phase: Identify a consolidation or a small range of price action at the peak of the uptrend, suggesting the accumulation of sell orders.

- Sharp Price Decline: Confirmation comes with a subsequent sharp decline, indicating sellers have overtaken buyers.

Step-by-Step Identification Process

- Spot the Uptrend: Begin by identifying a clear uptrend on the chart.

- Look for the High: Find the last significant high before a notable price drop.

- Identify the Block: Seek out a block of candles with smaller bodies and longer wicks, representing the battle between buyers and sellers.

- Confirm with a Decline: A sharp decline following the block solidifies its status as a bearish order block.

The Strategic Importance

Understanding and leveraging bearish order blocks can significantly enhance trading strategies, providing insights into potential market reversals.

Benefits of Trading Bearish Order Blocks

- Early Warning: They offer an early indication of a potential downtrend, allowing traders to adjust their strategies accordingly.

- Profit Opportunities: By identifying these blocks, traders can position themselves to profit from upcoming market declines.

- Risk Management: Bearish order blocks help in setting strategic stop-loss points, minimizing potential losses.

Trading Strategies

Trading strategies that involve bearish order blocks are designed to capitalize on potential market reversals from bullish to bearish momentum. These strategies require a keen eye for technical analysis, precise timing for entry and exit points, and robust risk management practices. Here’s a detailed breakdown of how traders can develop and implement strategies around bearish order blocks for optimal trading outcomes.

Identifying Bearish Order Block Opportunities

- Market Analysis:

- Regularly scan charts for assets showing a strong uptrend, as bearish order blocks typically form after a period of bullish momentum.

- Use higher time frames for analysis (e.g., 4-hour or daily charts) to identify more significant and reliable order blocks.

- Order Block Identification:

- Look for a noticeable consolidation or a range of candles with relatively small bodies and long wicks at the end of an uptrend, indicating a struggle between buyers and sellers.

- Identify the specific candle or series of candles that represent the last push by bulls before a notable price decline, signaling the bearish order block.

Entry Strategy

- Confirmation:

- Wait for additional signals that confirm the market’s bearish sentiment, such as a bearish engulfing pattern, a sharp increase in volume during the decline, or a break below the consolidation range.

- Consider confirmation from technical indicators, like a crossover in moving averages, RSI falling below key levels (e.g., 70), or MACD turning negative.

- Entering the Trade:

- Place a short position just below the bearish order block or upon confirmation of downward momentum continuation.

- For added confirmation, some traders wait for a retest of the order block area, entering when the price rejects this level, indicating that it now acts as resistance.

Exit Strategy

- Take-Profit Points:

- Identify key support levels below the entry point that could act as potential take-profit areas.

- Use a trailing stop-loss to capitalize on extended downtrends while protecting gains.

- Stop-Loss Orders:

- Set a stop-loss order just above the bearish order block or the high of the confirmation candle to minimize potential losses if the market moves unexpectedly upward.

Risk Management

- Position Sizing:

- Determine the size of your trade based on the distance between your entry point and stop-loss order, ensuring you’re only risking a predetermined percentage of your trading capital (commonly 1-2%).

- Portfolio Allocation:

- Spread risk across multiple trades rather than concentrating a significant portion of your capital in a single position.

Additional Considerations

- Market Context: Always consider the broader market environment and economic indicators that might influence price action, such as news releases or changes in monetary policy.

- Patience and Discipline: Wait for clear bearish order block formations and confirmations before entering trades. Stick to your trading plan, and avoid emotional decision-making.

- Review and Adapt: Regularly review your trades to identify what worked and what didn’t. Adapt your strategy as needed based on your findings and changes in market conditions.

Trading with bearish order blocks involves a strategic blend of technical analysis, disciplined execution, and meticulous risk management. By carefully identifying these opportunities, confirming bearish momentum, and managing trades with precision, traders can leverage bearish order blocks to enhance their trading performance and navigate market reversals more effectively.

Best Practices and Common Pitfalls

Maximizing the effectiveness of trading with bearish order blocks requires awareness of best practices and potential pitfalls.

Best Practices

- Multiple Confirmations: Don’t rely solely on the bearish order block; use additional indicators for confirmation.

- Market Context: Always consider the broader market trends and economic indicators before making a trade.

- Continuous Learning: Regularly review your trades to refine your strategy and adapt to changing market conditions.

Common Pitfalls to Avoid

- Ignoring Market Context: Failing to consider overall market trends can lead to misguided trades.

- Overreliance on a Single Indicator: Bearish order blocks should be one part of a comprehensive trading strategy.

- Neglecting Risk Management: Proper stop-loss placement and position sizing are crucial to preserving capital.

Conclusion

Bearish order blocks offer traders a powerful tool for anticipating market reversals, presenting opportunities for profit and enhanced risk management. By mastering the identification and application of these patterns, traders can significantly improve their trading strategies, making more informed decisions that align with market dynamics. Remember, successful trading requires a blend of knowledge, discipline, and continuous adaptation to the ever-changing market landscape.