In the dynamic world of trading, understanding the nuances of Bullish Order Block is crucial for success. Among these, the concept of bullish order blocks stands out as a powerful indicator of potential upward market movements. This guide delves into the essence of bullish order blocks, offering traders insights on identifying, trading, and leveraging these blocks for better trading outcomes.

Understanding Bullish Order Blocks

What Is a Bullish Order Block?

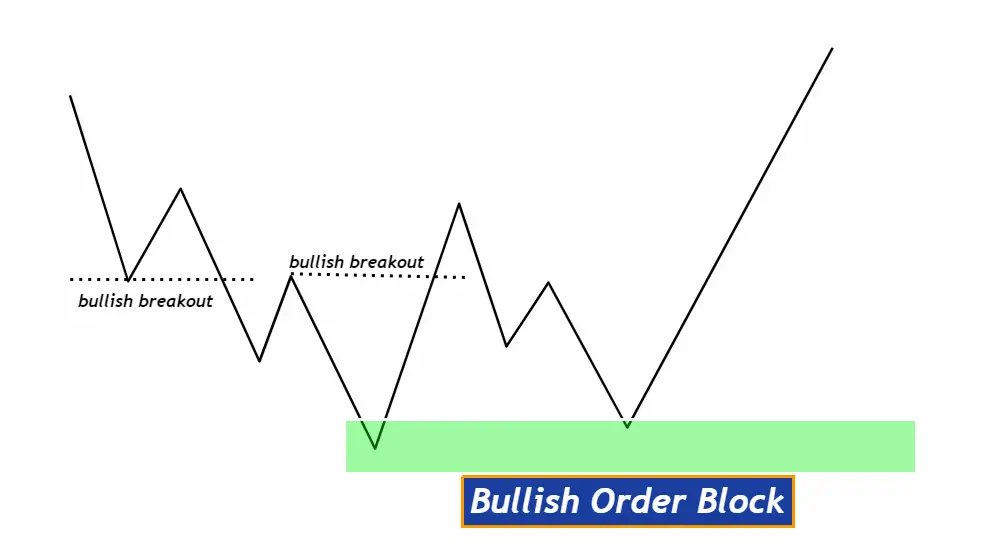

A bullish order block is a specific area on a price chart marked by significant buying activity in the past, which indicates strong interest from buyers. These blocks are pivotal because they often precede upward price movements, making them essential for traders to monitor.

How Bullish Order Blocks Form

Bullish order blocks are characterized by:

- Accumulation of Buy Orders: Large traders or institutional investors place substantial buy orders, propelling the price upwards.

- Retracement Zones: They typically emerge after a downtrend or a pullback, signaling a potential shift to an uptrend.

The Role of Bullish Order Blocks in Market Trends

These blocks serve as:

- Indicators of Institutional Interest: Signifying areas where the market’s big players might re-enter, indicating future price directions.

- Support Levels: Acting as strong support zones, they often lead to bullish reversals.

- Momentum Shifts: Early identification can help traders spot shifts from bearish to bullish trends.

Identifying Bullish Order Blocks

Identifying bullish order blocks is a critical skill for traders looking to capitalize on potential upward market movements. These order blocks are areas on the price chart where significant buying has occurred in the past, indicating a strong interest from buyers that often precedes upward price movements. Recognizing these zones allows traders to align their strategies with the momentum of large market players, improving the odds of successful trades.

Key Indicators to Look For

To spot bullish order blocks on a chart, traders should focus on specific indicators:

- Previous Strong Buying Areas: Search for chart areas where there was a significant upward price movement following a period of consolidation or retracement. These are likely spots where bullish order blocks have formed.

- Increased Volume: A bullish order block is often accompanied by a spike in trading volume. This increase indicates strong buying interest and adds validity to the order block as a potential support zone.

Chart Patterns and Bullish Order Blocks

Understanding chart patterns is essential in identifying bullish order blocks:

- Consolidation Before a Breakout: Look for periods of price consolidation that are followed by a strong upward breakout. The consolidation period may indicate the formation of a bullish order block.

- Retest of Breakout Areas: After a breakout, the price may retest the breakout area. If this area aligns with a previous consolidation zone, it can be considered a bullish order block.

The Difference Between Bullish Order Blocks and Other Price Signals

It’s important to distinguish bullish order blocks from other price signals:

- Not Just Any Support Zone: While many areas on a chart can act as support, bullish order blocks are unique because they are backed by a history of significant buying activity from institutional investors or large traders.

- More Than Just a Candlestick Pattern: Unlike simple candlestick patterns that might indicate short-term buying interest, bullish order blocks are identified through a combination of factors including price action, volume, and historical context. They suggest a stronger and more sustained level of support due to the involvement of major market participants.

Identifying bullish order blocks involves a keen analysis of chart patterns, volume, and historical price action. By recognizing these zones, traders can better time their entry and exit points, manage risk, and align their trades with the underlying momentum of the market.

How to Trade Bullish Order Blocks

Trading bullish order blocks effectively is about leveraging significant areas of buying interest to anticipate and capitalize on potential upward price movements. These blocks signal where large players have previously entered the market, offering insights into potential future support levels. Here’s a comprehensive approach to trading these pivotal areas:

Entry Strategies

When considering entering a trade based on a bullish order block, keep the following strategies in mind:

- Wait for a Retest: Look for the price to retest the order block area. A successful retest indicates the market respects this level as support, offering a safer entry point.

- Confirmation Signals: Beyond the retest, seek additional confirmation through candlestick patterns (e.g., bullish engulfing, hammer) or indicators (e.g., RSI divergence, moving averages crossover) that suggest a continuation of the upward trend.

Risk Management

Effective risk management is crucial to safeguard your capital:

- Setting Stop Losses: Place your stop loss just below the bullish order block. This positioning protects against the risk of a false breakout and limits potential losses if the market moves against your position.

- Determining Position Size: Calculate your position size based on the distance to your stop loss and your acceptable risk level. This strategy helps manage the monetary impact if the trade does not go as planned.

Exit Strategies

Knowing when to exit is as important as knowing when to enter:

- Taking Profits: Set your take-profit levels at significant resistance levels above the order block or consider using a trailing stop loss to maximize gains while protecting profits.

- Signs of Reversal: Be vigilant for signs of a bearish reversal, such as a decisive break below the bullish order block on increased volume, which may signal it’s time to exit the trade.

Tips and Best Practices

Maximize your trading efficiency with these additional tips:

- Monitor Economic News: Be aware of scheduled economic releases or news events that could impact market sentiment and influence the strength of the bullish order block.

- Use Technical Analysis Tools: Complement your analysis with other technical tools and indicators to reinforce your trading decisions. Tools like Fibonacci retracement levels, MACD, or pivot points can provide additional layers of confirmation.

- Practice on a Demo Account: Before applying these strategies with real money, practice identifying and trading bullish order blocks in a demo account. This practice will help you refine your skills without financial risk.

Trading bullish order blocks involves precise strategy, patience, and practice. By identifying these key areas, applying disciplined entry and exit strategies, and managing risk effectively, traders can improve their chances of capturing profitable opportunities in the markets.

Conclusion

Grasping the concept of bullish order blocks is a game-changer for traders seeking to capitalize on market opportunities. These blocks not only signal potential upward movements but also offer a glimpse into the actions of the market’s major players. Through diligent identification, strategic trading, and rigorous risk management, traders can improve their chances of success.

Embrace the journey of continuous learning and practice. Starting with demo accounts can build the confidence and experience necessary for successful live trading. This guide aims to equip traders with the knowledge to navigate the complexities of bullish order blocks, paving the way for more informed and profitable trading decisions.