As someone who’s spent years navigating the ups and downs of the trading world, I’ve come to appreciate strategies that simplify decision-making while maximizing potential gains. One such strategy is the ICT OTE, which stands for Inner Circle Trader’s Optimal Trade Entry. This method helps traders find the best points to enter a trade based on price retracements in a trending market. Whether you’re new to trading or have been at it for a while, understanding ICT OTE can enhance your trading toolkit.

What is ICT OTE?

The ICT Optimal Trade Entry is a strategy that identifies ideal entry points in the market using specific Fibonacci retracement levels. In simple terms, it’s about finding spots where the price is likely to reverse during a pullback within a trend. This approach aims to balance risk and reward, giving you a higher chance of a profitable trade.

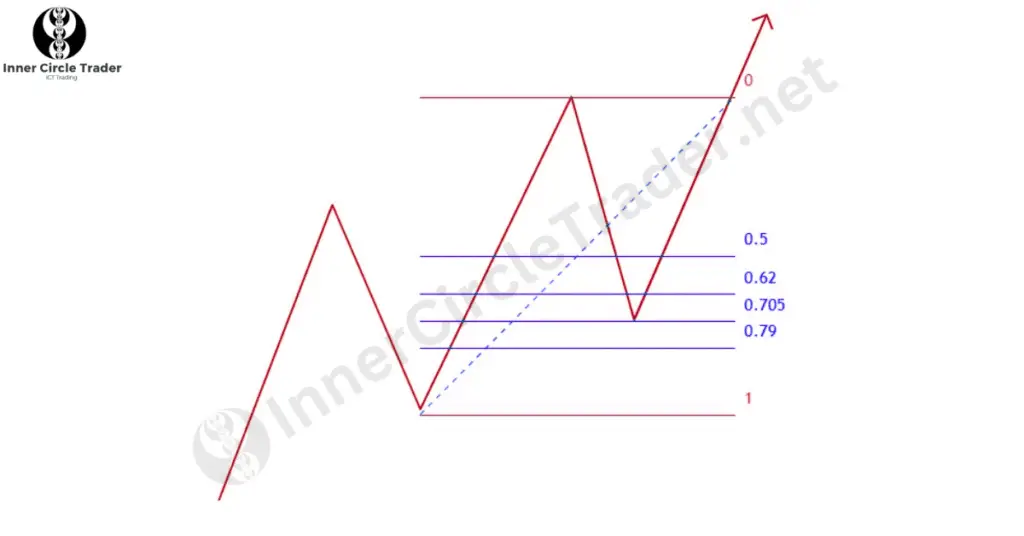

In trending markets whether moving up or down prices don’t go straight in one direction. They move in waves, pulling back before continuing in the trend’s direction. The ICT OTE strategy capitalizes on these natural retracements to help you join the trend at optimal times.

Understanding Fibonacci Levels in ICT OTE

To use the ICT OTE strategy, you’ll need to set up your Fibonacci retracement tool with specific levels:

- 0%: The starting point of the move.

- 50%: The equilibrium point.

- 62%, 70.5%, 79%: Key retracement levels where price may reverse.

- 100%: The end of the move.

- -50%, -100%, -200%: Potential target levels for taking profits.

These levels help you visualize potential areas where the price might change direction, allowing for optimal trade entries.

How to Identify ICT OTE

- Set Up Your Fibonacci Tool: Adjust your Fibonacci retracement settings to include the ICT-specific levels mentioned above.

- Identify the Dealing Range: Look for a clear high and low that define the current trend’s move.

- Apply the Fibonacci Retracement:

- In an uptrend, draw the Fibonacci from the low (0%) to the high (100%).

- In a downtrend, draw from the high (0%) to the low (100%).

- Find the Optimal Entry Zone: Focus on the area between the 62% and 79% retracement levels. The 70.5% level is considered the precise OTE point.

To spot the best place to enter a trade, start by identifying the recent high and low prices to define the ICT dealing range.

Trading ICT OTE in a Bullish Market

In a rising market, prices make higher highs and higher lows. Here’s how to apply ICT OTE:

- Identify the Upward Move: Spot the recent significant low and high.

- Draw the Fibonacci Retracement: From the low to the high of this move.

- Wait for the Retracement: Monitor as the price pulls back toward the 62%-79% levels.

- Look for Entry Signals: Watch for signs like price rejection or a shift in market structure on a lower timeframe.

- Enter the Trade: Once confirmed, initiate a buy trade at the OTE level.

- Set Stop-Loss and Take-Profit: Place your stop-loss below the recent low and plan your profit targets using the negative Fibonacci levels or previous highs.

After you’ve found the ICT dealing range, draw the Fibonacci retracement from the low to the high of this range. This will help you mark the OTE levels where you can consider entering a buy trade.

After you’ve pinpointed the ICT OTE price level, wait for the price to pull back and test this level.

When the price reaches the ICT OTE area, you can either enter a buy trade right away or wait for confirmation signals, such as a price rejection or an ICT Market Structure Shift (MSS) on a lower timeframe.

As shown in the illustration below:

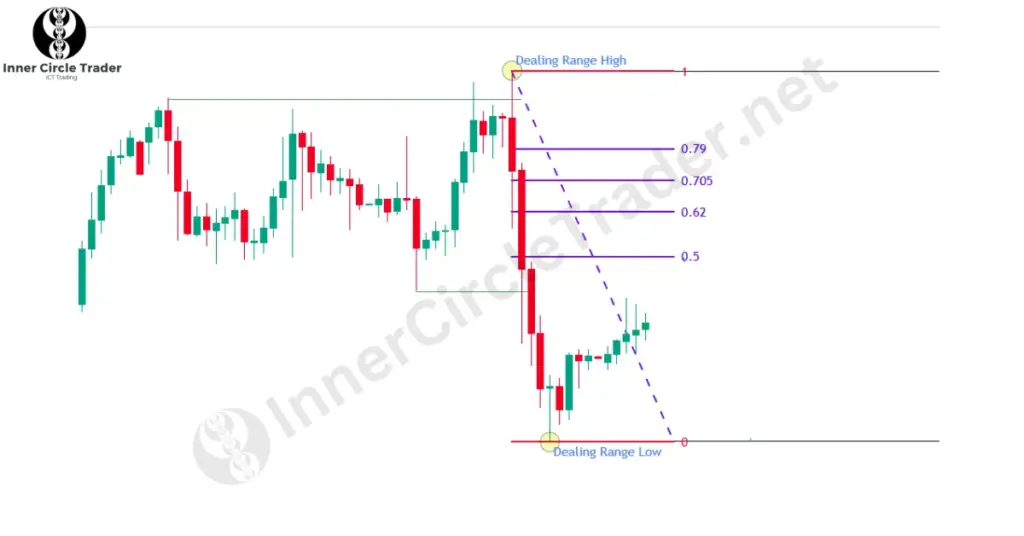

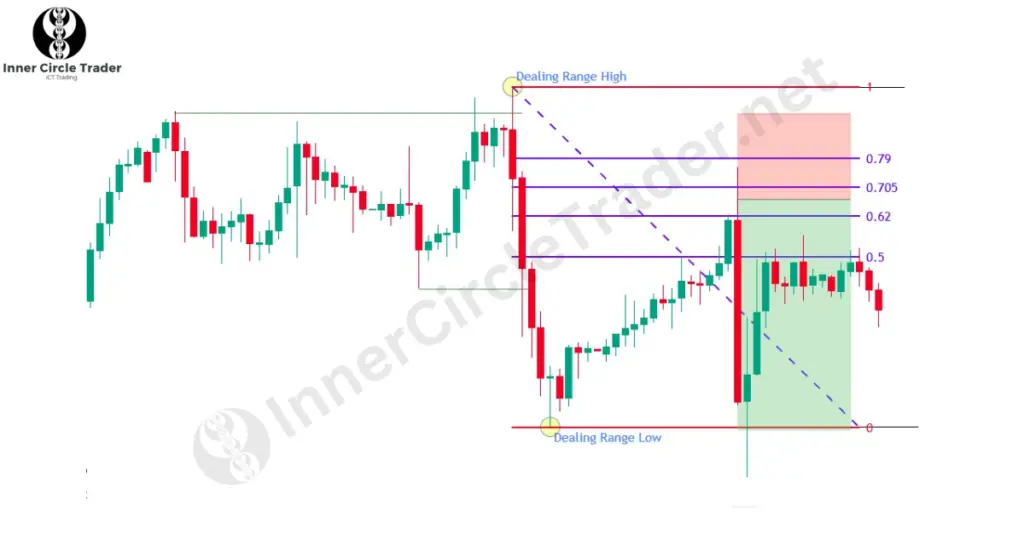

Trading ICT OTE in a Bearish Market

In a falling market, prices make lower lows and lower highs. Here’s how to use ICT OTE:

- Identify the Downward Move: Find the recent significant high and low.

- Draw the Fibonacci Retracement: From the high to the low of this move.

- Wait for the Retracement: Watch as the price retraces upward to the 62%-79% levels.

- Look for Entry Signals: Look for indications like price rejection or a market structure shift on a lower timeframe.

- Enter the Trade: Once confirmed, initiate a sell trade at the OTE level.

- Set Stop-Loss and Take-Profit: Place your stop-loss above the recent high and set profit targets using the negative Fibonacci levels or previous lows.

Once you’ve identified the dealing range, draw the Fibonacci retracement tool from the highest point to the lowest point of that range. This will help you find the OTE levels where you might consider entering a sell trade.

After you’ve spotted the OTE level, wait patiently for the price to rally back up and test this area.

When the price reaches the OTE zone, you have two options: you can enter a sell trade immediately, or you can wait for additional confirmation signals, like a price rejection or an ICT Market Structure Shift (MSS) on a lower timeframe.

Refer to the illustration below to see how this process unfolds.

Final Thoughts

The ICT OTE strategy is a valuable tool for finding optimal entry points in trending markets. It balances risk and reward by identifying areas where the price is likely to reverse. However, no strategy is foolproof. Always use proper risk management by setting stop-loss orders and not risking more than you can afford to lose. Practice this strategy on a demo account to get comfortable before applying it to real trades.

FAQs About the ICT OTE Trading Strategy:

Yes, the ICT OTE strategy is versatile and can be applied to scalping, day trading, and swing trading. It works across different timeframes because market retracements happen in all trading styles.

The main tool you’ll need is a Fibonacci retracement tool that allows you to customize levels. Most trading platforms, like TradingView, offer this feature.

Absolutely. While it involves understanding some technical concepts, the strategy is straightforward once you get the hang of using Fibonacci retracements and identifying trends.

ICT OTE helps you enter trades at points where the risk is balanced with the potential reward. By entering at optimal levels, you can set tighter stop-loss orders, reducing the amount you’re risking on each trade.

Yes, combining ICT OTE with other strategies like support and resistance levels, candlestick patterns, or moving averages can strengthen your trade setups and provide additional confirmation.