The world of trading is filled with strategies that promise to unlock the secrets of market success. Among these, the Judas Swing stands out as a fascinating concept within Inner Circle Trading (ICT) that offers a unique window into the deceptive nature of financial markets. This comprehensive guide delves deep into the Judas Swing, providing traders with the knowledge and tools needed to navigate and profit from these deceptive market movements.

Introduction to the Judas Swing

At its core, the Judas Swing is a market behavior pattern that signifies a false directional move followed by a sharp reversal. Named after the biblical figure Judas Iscariot, for its betraying nature, this strategy reveals the underlying manipulations by major market players, aiming to trap unwary traders. Understanding the Judas Swing is crucial for those looking to gain an edge in a market environment where the only constant is change.

The Essence of the Judas Swing

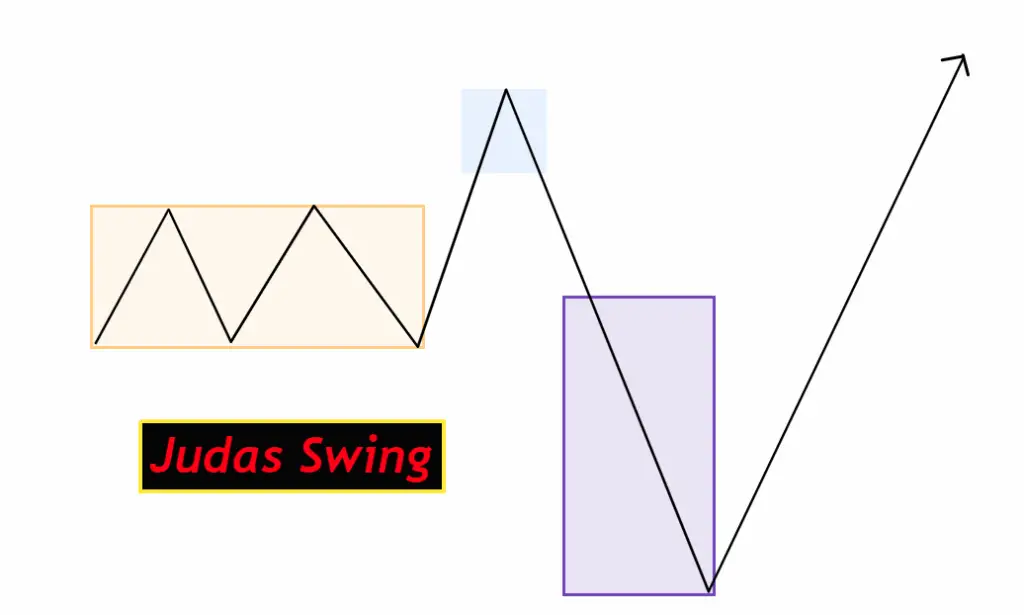

- Definition: A deceptive market move indicating a strong trend that suddenly reverses.

- Origin: Rooted in Inner Circle Trading principles, highlighting institutional manipulation.

How the Judas Swing Works

The operation of the Judas Swing is intricate, involving several stages that traders must recognize and understand to successfully navigate its waters.

Identifying Market Conditions

Key to spotting a Judas Swing, traders must watch for low liquidity times and assess overall market sentiment. Significant levels of support and resistance are crucial markers, as the initial move often aims to breach these boundaries, triggering a flood of reactive trades.

The Mechanism Behind the Judas Swing

Initial Setup and Trigger

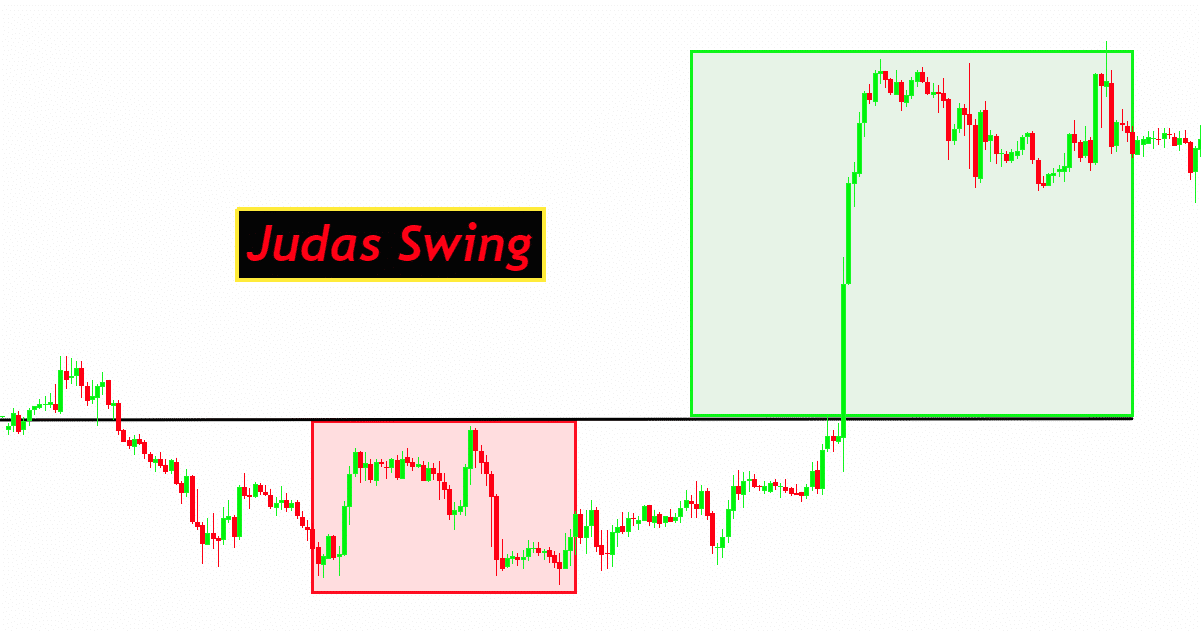

The Judas Swing typically unfolds during periods of significant market events or the opening hours of major trading sessions, such as London or New York, when liquidity is ripe for manipulation. It begins with a strong price movement that appears to break through key support or resistance levels, suggesting a clear market direction. This movement, often driven by institutional traders, aims to trigger retail traders’ stop-loss orders, enticing them into making premature decisions based on the apparent breakout.

The Deceptive Move

As the price breaks through these critical levels, volume spikes, indicating heightened trading activity. Retail traders, fearing missing out on a significant market move, jump in, further fueling the initial trend. However, this move is deceptive, designed to accumulate or distribute positions at more favorable prices by manipulating the market sentiment.

The Sharp Reversal

The crux of the Judas Swing occurs shortly after this initial breakout or breakdown. Just as traders settle into their positions, expecting the trend to continue, the market swiftly reverses direction. This reversal is not gradual but sharp and decisive, often erasing the gains of the initial move in a fraction of the time it took to form. The reversal exposes the initial move as a manipulation, revealing the market’s true intent and leaving those on the wrong side of the move facing unexpected losses.

Advantages of Trading the Judas Swing

Trading the Judas Swing, a concept deeply embedded in the practices of Inner Circle Trading (ICT), provides traders with a unique edge by exploiting the inherent deceptiveness of market movements. This strategy, characterized by a false breakout followed by a sharp reversal, can significantly enhance a trader’s performance if correctly identified and acted upon. Here are the key advantages of incorporating the Judas Swing into your trading strategy:

Enhanced Market Insight

Understanding Market Manipulation

- Insight into Institutional Behavior: Trading the Judas Swing equips traders with the ability to decipher the actions and intentions of institutional players, offering insights into the timing and direction of significant market moves.

- Anticipation of False Breakouts: It enables traders to recognize and anticipate false breakouts, reducing the likelihood of entering trades based on misleading market signals.

Psychological Edge

- Psychological Fortitude: Mastering the Judas Swing fosters a psychological edge, allowing traders to remain calm and collected during deceptive market moves that might panic others.

- Increased Confidence: Understanding this phenomenon builds confidence in one’s trading decisions, as it relies on recognizing patterns that reflect deeper market dynamics.

Improved Entry and Exit Points

Precision in Trading

- Optimal Entry Points: The Judas Swing offers traders the opportunity to enter trades at or near the reversal point, potentially maximizing profit from the ensuing price movement.

- Strategic Exits: It also aids in identifying strategic exit points before the market reverses direction, thus locking in profits and minimizing losses.

Enhanced Risk Management

Protection Against Market Volatility

- Avoidance of False Signals: By understanding the mechanics behind the Judas Swing, traders can better avoid false signals that lead to poor trade entries, thereby protecting their capital.

- Informed Stop-Loss Placement: Traders can place stop-loss orders more strategically, beyond the typical range of the Judas Swing, to prevent being stopped out by volatility.

Capitalizing on Market Volatility

Leveraging Market Dynamics

- Quick Profits: The Judas Swing, by nature, occurs quickly and can lead to rapid profit opportunities, especially in fast-moving markets where the initial false move is swiftly followed by a significant reversal.

- Volatility as an Ally: This approach turns market volatility from a threat into an ally, as traders who can identify the Judas Swing can leverage these sharp movements for their gain.

Broad Applicability Across Markets

Versatility of the Strategy

- Multiple Market Suitability: The principles behind the Judas Swing apply not only to forex but also to stocks, commodities, and cryptocurrencies, making it a versatile strategy for diverse market participants.

- Adaptability to Various Trading Styles: Whether one prefers day trading, swing trading, or even scalping, the Judas Swing provides actionable insights that can enhance trading strategies across different timeframes and styles.

Identifying a Judas Swing: A Step-by-Step Guide

Successfully identifying a Judas Swing involves meticulous observation and analysis, from recognizing the pre-conditions to confirming the reversal.

Steps for Identification

- Market Conditions: Focus on times of low liquidity and significant market levels.

- Initial Move: Look for a sharp price movement that breaks key levels.

- Reversal: Confirm the reversal through volume analysis and candlestick patterns.

London Judas Swing

To refine and delve deeper into trading the London Judas Swing, let’s expand on each of the steps and include more detailed insights and tips. This strategy exploits the increased volatility and liquidity during the London session’s opening hours, focusing on the forex market’s tendency to make a false directional move before reversing – a phenomenon dubbed the “Judas Swing.”

Understanding Market Hours

- The London forex session opens at 8:00 AM GMT. This is when European traders begin their day, and liquidity and volatility significantly increase as a result of the market’s reaction to overnight news and the opening trades.

Identifying Suitable Currency Pairs

- Prioritize major currency pairs with strong liquidity during the London session, such as EUR/USD, GBP/USD, USD/JPY, and EUR/GBP. These pairs are more likely to exhibit the distinct movements characteristic of the Judas Swing.

Observing the Initial Move

- Within the first 1 to 3 hours after the London market opens, watch for a sharp move in one direction. This move is typically driven by the influx of orders and reactions to overnight news. It’s crucial to identify this initial move accurately, as it sets the stage for the Judas Swing.

Determining the Judas Swing

- After the initial move, the market may start showing signs of a reversal. This is the Judas Swing, named for its deceptive nature, as the market appears to “betray” its initial direction. Identifying this reversal is key to the strategy and requires a keen understanding of price action and possibly the use of technical indicators.

Entry Points

- For a sell entry, wait until the market shows a clear reversal signal from an initial upward move. Look for bearish candlestick patterns or a break below significant support levels.

- For a buy entry, wait for the market to reverse from an initial downward move. Bullish candlestick patterns or a break above significant resistance levels can serve as confirmation.

Setting Stop Loss and Take Profit

- Stop Loss: Position your stop loss to manage risk effectively. For sell orders, place it just above the peak of the initial move. For buy orders, place it just below the trough of the initial move.

- Take Profit: Determine your take profit level based on historical price levels where reversals have previously exhausted, or aim for a risk-reward ratio of at least 1:2, ensuring that potential rewards justify the risks.

Risk Management

- Employ strict risk management by risking only a small percentage of your account on each trade, ideally between 1% and 2%. This strategy helps preserve your capital over the long term, especially important given the forex market’s inherent volatility.

Monitoring and Exit Strategy

- Stay vigilant after entering a trade. The London session can bring swift and significant price movements. Be prepared to exit the trade if the market’s behavior negates your initial analysis or if your predetermined stop loss or take profit levels are triggered.

Advanced Tips for Success

- Backtesting and Demo Trading: Before applying this strategy with real money, backtest it using historical data and practice in a demo trading account. This practice helps you gain familiarity with the strategy’s nuances without risking actual capital.

- Economic Calendar: Pay close attention to the economic calendar. News events, especially those from the UK and Eurozone, can have a profound impact on currency pairs during the London session. Adjust your trading strategy accordingly.

- Emotional Discipline: Stick to your trading plan. The fast-paced nature of the London session can be exhilarating but don’t let emotions drive your trading decisions. Discipline and adherence to your strategy are crucial for long-term success.

The New York Judas Swing

The New York Judas Swing strategy leverages the volatility and directional movements that occur during the opening hours of the New York forex market. Similar to the London Judas Swing, this strategy focuses on identifying false moves (the “Judas Swing”) early in the session that reverse direction, providing opportunities for traders to enter the market. The New York forex market opens at 8:00 AM EST, a time when liquidity and volatility increase due to the overlap with the London session and the arrival of U.S. market participants.

Understanding the New York Market Dynamics

The New York session is crucial for forex trading because it includes economic releases and news from the U.S., which can significantly impact the forex market. Currency pairs involving the USD are particularly affected during this session.

Identifying the Judas Swing

After the New York market opens, traders watch for an initial move in one direction that appears to set a trend for the session. This move, however, may be a false signal, leading to a reversal or “Judas Swing,” which is the actual trading opportunity.

Bullish Scenario (Judas Swing to the Upside)

- Observation Phase: After the market opens, identify an initial downward move in a currency pair involving the USD. This move should occur within the first hour or two of the session.

- Confirmation of the Judas Swing: Look for signs that the initial downward trend is losing momentum and that the price is starting to reverse upwards. This could be signaled by bullish candlestick patterns (e.g., hammer, engulfing patterns), a break above a short-term resistance level, or bullish signals from technical indicators (e.g., moving average crossovers, RSI divergence).

- Entry Point: Enter a long (buy) position once the reversal is confirmed, aiming to capitalize on the upward movement following the false initial drop.

- Stop Loss and Take Profit: Place a stop loss below the low of the initial downward move to manage risk. Set a take profit level based on previous resistance levels or a predetermined risk-reward ratio, typically at least 1:2.

Bearish Scenario (Judas Swing to the Downside)

- Observation Phase: Watch for an initial upward move in a USD-involved currency pair right after the New York market opens. This move is potentially deceptive and may reverse.

- Confirmation of the Judas Swing: Look for the upward trend to show signs of reversal, with the price beginning to move downward. Bearish candlestick patterns (e.g., shooting star, engulfing patterns), a break below a short-term support level, or bearish signals from technical indicators can serve as confirmation.

- Entry Point: Enter a short (sell) position once the downward reversal is confirmed, aiming to profit from the subsequent drop after the false initial rise.

- Stop Loss and Take Profit: Set a stop loss just above the high of the initial upward move to limit potential losses. Choose a take profit level based on prior support levels or a preset risk-reward ratio, aiming for at least 1:2.

Risk Management

Effective risk management is crucial. Only risk a small percentage of your trading capital (typically 1-2%) on each trade. Be prepared to adjust your stop loss and take profit levels based on evolving market conditions.

Advanced Tips

- Economic Calendar: Stay informed about scheduled economic news releases, as these can significantly impact currency prices and cause sudden reversals.

- Market Sentiment: Gauge the overall market sentiment and adjust your strategy accordingly. Major news from outside the U.S. can also affect market movements during the New York session.

- Practice and Patience: As with any trading strategy, practice in a demo account and patience are key to understanding the nuances of the New York Judas Swing.

This strategy requires a good understanding of market sentiment, the ability to interpret economic news, and proficiency in technical analysis. As always, no strategy guarantees success, so it’s important to test and refine your approach based on your trading style and risk tolerance.

Conclusion

The Judas Swing offers traders a profound insight into the manipulative forces at play within the markets. By understanding and applying the principles of this strategy, traders can not only avoid the pitfalls of market deceptions but also capitalize on them for substantial gains. However, mastering the Judas Swing demands continuous learning, adaptation, and an unwavering commitment to strategic trading. In the end, the journey to mastering the Judas Swing is as rewarding as it is challenging, enriching traders with invaluable skills and insights that transcend the immediate benefits of profitability.