Market makers play a crucial role in the financial markets by buying and selling assets, like stocks. They earn money through a process that involves a bit of risk. Here’s how it works in a simple and detailed way:

Imagine a market maker as a middleman who has to buy something before they can sell it to someone else. There’s always a chance that the price of what they bought could go down before they get a chance to sell it. Because they’re taking this risk, they make a little bit of money on each transaction to compensate for it. This is done through something called the “spread.”

Let’s break down the “spread” with an example. If you’re using an online platform to buy a stock, you might see two prices: a bid price and an ask price. The bid price might be $100, and the ask price might be $100.05. The market maker buys the stock at $100 and sells it to you for $100.05. The difference of 5 cents is the market maker’s profit. It might seem small, but when they do this lots of times with lots of stocks, it all adds up to a significant amount of money.

However, market makers have to follow certain rules, which are different depending on where they operate and what kind of financial products they’re dealing with, like stocks or options. These rules are set by the exchange they operate on and are overseen by regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States. This ensures that they operate in a fair and transparent manner.

What Are Market Makers?

Market makers are firms or individuals who stand ready to buy and sell securities throughout the trading session. Their main job is to provide liquidity to the market, which means making it easier for traders to buy and sell without causing significant price movements.

Role in Financial Markets

- Provide Liquidity: By constantly offering to buy and sell securities, market makers ensure that traders can execute their trades at any time without waiting for a matching buy or sell order.

- Set Bid and Ask Prices: Market makers quote two prices for a security: the bid (the price at which they’re willing to buy) and the ask (the price at which they’re willing to sell). The difference between these prices is known as the spread, which is a source of profit for the market maker.

- Facilitate Price Discovery: Through their trading activity, market makers help establish fair and accurate prices for securities, reflecting the latest market information and sentiment.

- Reduce Price Volatility: By absorbing excess supply or demand, market makers can help prevent large, sudden price swings, contributing to a more stable market environment.

How Market Makers Operate

Market makers are crucial participants in financial exchanges. They enhance market liquidity by continuously buying and selling securities, competing to provide the best bid (buy price) or offer (sell price) for these securities. This competition is vital for executing trades efficiently and at competitive prices.

Designated Market Makers (DMMs) Explained

Some exchanges, like the New York Stock Exchange (NYSE), employ a system known as designated market makers (DMMs). Previously called specialists, DMMs have exclusive rights to manage the order flow for specific securities. This is a unique aspect of the NYSE, which operates as an auction market where bids and asks (buy and sell orders) are competitively placed by investors.

Role of DMMs

DMMs have several key responsibilities:

- Posting Bids and Asks: They display these for the public, ensuring transparency.

- Accuracy and Timeliness: Ensuring bid and ask prices are reported accurately and promptly.

- Price Maintenance: Guaranteeing that the best price is always available.

- Trade Execution: Making sure that all marketable trades are executed efficiently.

- Order Maintenance: Keeping order on the trading floor.

- Setting Opening Prices: DMMs set the opening price for stocks each day, considering after-hours news and supply and demand to determine the correct market price.

Market Makers by Exchange

Market makers are present across global markets, enhancing liquidity and enabling trades for investors. Here’s a look at some key exchanges and their market makers.

NYSE and Nasdaq

- NYSE: Utilizes lead market makers who are registered to trade securities.

- Nasdaq: Market makers are member firms that trade securities for their own and customer accounts.

Key Market Makers in New York include Credit Suisse, Deutsche Bank, Goldman Sachs, KCG Americas, and Timber Hill.

Frankfurt Stock Exchange (FRA)

Operated by Deutsche Börse AG, it’s Germany’s largest exchange. Market makers, called designated sponsors, include Berenberg, JPMorgan, Morgan Stanley, Optiver, and UBS Europe.

London Stock Exchange Group

A leading European exchange group that includes key market makers like BNP Paribas, GMP Securities Europe, Liberium Capital, Mediobanca, and Standard Chartered.

Tokyo Exchange Group

Merges Tokyo Stock Exchange and Osaka Securities Exchange, offering trading in securities and derivatives. Notable market makers include ABN AMRO Clearing, Nissan Securities, Nomura Securities, Phillip Securities, and Societe Generale.

Toronto Stock Exchange (TSX)

Canada’s largest exchange, located in its financial capital, Toronto. Market makers here are BMO Nesbitt Burns, Integral Wealth Solutions, Questrade, Scotia Capital, and TD Securities.

Market makers and DMMs are foundational to the functioning of financial markets, offering liquidity and facilitating the smooth execution of trades. Each exchange has its system and set of market makers, contributing to a global ecosystem that supports investors and the movement of capital.

Importance to Traders and Investors

For traders and investors, market makers are indispensable. They ensure that there is always a counterparty available for trades, helping to reduce transaction costs and improve market efficiency. Without market makers, trading could become more difficult, and markets might be more prone to extreme volatility and less efficient price discovery.

Market makers are the backbone of the trading ecosystem, providing critical services that facilitate smooth and efficient market operations. Their role in providing liquidity, setting prices, aiding in price discovery, and minimizing volatility is crucial for the healthy functioning of financial markets. Understanding the role and mechanisms of market making is essential for anyone involved in trading or investing.

The Sell Model, particularly in the context of market making, is a fundamental concept that allows market makers to efficiently manage their inventory while providing liquidity to the market. This model is vital for understanding how market makers balance their positions and ensure a stable trading environment.

Strategies Employed in the Sell Model

Market makers use various strategies within the Sell Model to manage their sells effectively:

- Dynamic Pricing: Adjusting ask prices in real-time based on market conditions to remain competitive and profitable.

- Order Splitting: Breaking down large orders into smaller ones to minimize market impact and manage inventory levels more effectively.

- Algorithmic Trading: Employing algorithms to automate the selling process, enhancing efficiency and responsiveness to market changes.

Impact on the Market

The Sell Model has a significant impact on the market, contributing to:

- Enhanced Liquidity: By providing a constant presence as a seller, market makers ensure that buyers can always find available securities, enhancing market liquidity.

- Stabilized Prices: The model helps prevent large price swings by managing the flow of securities into the market, contributing to price stability.

The Sell Model is a critical component of market making, allowing market makers to sell securities efficiently while managing risk and contributing to the overall health of the financial markets. Understanding this model provides insight into the intricate balance market makers maintain to support liquidity and price stability in trading environments.

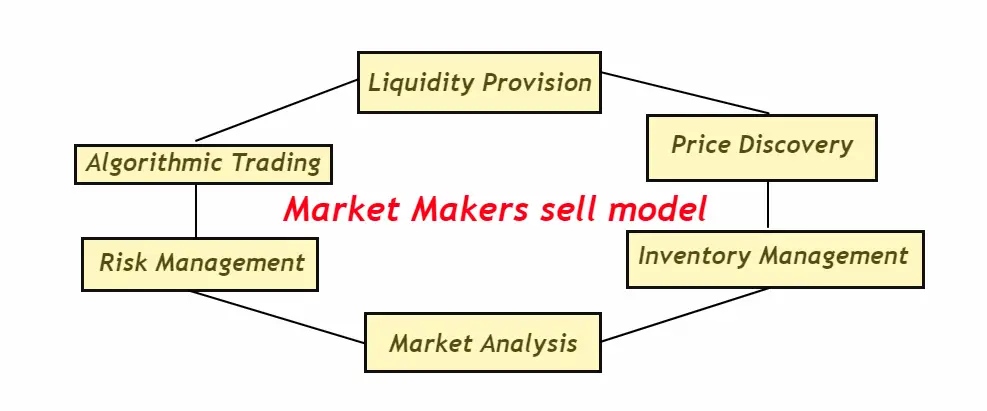

Key Components of the Sell Model

The Sell Model, especially within the realm of market making, involves several key components that ensure market makers can effectively manage their inventory and provide liquidity to the market. Understanding these components is essential for grasping how market makers influence market dynamics through their selling strategies.

1. Liquidity Provision

- Objective: To ensure buyers are always able to find available securities.

- Mechanism: Market makers continuously offer securities for sale, maintaining a steady flow of sell orders to meet buy-side demand.

- Impact: Enhances market depth and reduces the risk of liquidity shortages, contributing to smoother price movements.

2. Price Discovery

- Objective: To assist in establishing fair and accurate prices for securities.

- Mechanism: Sell orders are priced based on real-time market conditions, reflecting current supply and demand dynamics.

- Impact: Aids in aligning securities prices with their intrinsic values, ensuring a more efficient market.

3. Inventory Management

- Objective: To balance the inventory of securities, avoiding overexposure to market fluctuations.

- Mechanism: Adjusting selling strategies based on current inventory levels, utilizing techniques such as dynamic pricing and order splitting.

- Impact: Minimizes risk for market makers, ensuring they can continue to provide liquidity without incurring significant losses.

4. Risk Management

- Objective: To mitigate potential losses due to adverse market movements.

- Mechanism: Employing stop-loss orders, hedging strategies, and algorithmic trading to manage and distribute risk effectively.

- Impact: Protects market makers from volatile market swings, ensuring financial stability and continued operation.

5. Algorithmic Trading

- Objective: To enhance the efficiency and responsiveness of sell strategies.

- Mechanism: Utilizing algorithms to automate sell order execution, adjusting strategies in real-time based on market conditions.

- Impact: Increases the speed and accuracy of sell orders, optimizing profitability and reducing the risk of error.

6. Market Analysis

- Objective: To inform selling strategies with comprehensive market insights.

- Mechanism: Analyzing market trends, news, and economic indicators to predict future market movements and adjust sell strategies accordingly.

- Impact: Ensures sell strategies are proactive and aligned with market conditions, maximizing effectiveness.

The Sell Model’s components work together to ensure market makers can sell securities efficiently, manage their inventories, mitigate risks, and contribute to the overall health of the financial markets. By understanding these key components, one gains insight into the critical role market makers play in providing liquidity, facilitating price discovery, and maintaining market stability.

Advantages of the Market Maker Sell Model

The Market Maker Sell Model offers several advantages that contribute significantly to the efficiency and stability of financial markets. By employing this model, market makers can optimize their operations and provide critical services that benefit the entire trading ecosystem. Here are some of the primary advantages:

1. Enhanced Market Liquidity

- Direct Impact: Market makers ensure that securities are always available for trading, reducing the time and cost associated with finding a buyer or seller.

- Benefit for Traders: Traders can execute orders quickly and at desired prices, enhancing the overall trading experience.

2. Narrower Bid-Ask Spreads

- Direct Impact: By continuously quoting both buy and sell prices, market makers reduce the gap between the bid and ask prices.

- Benefit for Traders: Smaller spreads mean lower trading costs, improving profitability for traders and investors.

3. Improved Price Discovery

- Direct Impact: The constant buying and selling activity of market makers helps to quickly incorporate new information into prices.

- Benefit for the Market: Accurate pricing reflects the true value of securities, contributing to a more efficient and transparent market.

4. Increased Trading Volume

- Direct Impact: The liquidity provided by market makers encourages more trading activity, as participants know they can enter and exit positions easily.

- Benefit for the Market: Higher volumes lead to more vibrant markets, attracting a wider array of participants and investment opportunities.

5. Stability in Market Conditions

- Direct Impact: Market makers can absorb large orders without causing significant price disruptions, dampening potential volatility.

- Benefit for the Market: This stability is crucial during turbulent times, helping to prevent panic selling and excessive market movements.

6. Facilitation of New Listings

- Direct Impact: Market makers play a key role in the introduction of new securities to the market, providing initial liquidity.

- Benefit for Issuers and Investors: Ensures a smoother launch and initial trading period for new listings, benefiting both issuers and early investors.

7. Risk Management

- Direct Impact: The Sell Model includes strategies to manage and mitigate risks associated with holding and trading securities.

- Benefit for Market Makers: Effective risk management ensures the sustainability of market makers’ operations, allowing them to continue providing essential services to the market.

The Market Maker Sell Model offers critical advantages that facilitate efficient, stable, and transparent financial markets. By enhancing liquidity, narrowing bid-ask spreads, and aiding in price discovery, market makers play an indispensable role in the trading ecosystem, benefiting all market participants.

Strategies Employed by Market Makers

Market makers employ a variety of strategies to manage their positions, mitigate risks, and ensure profitability while providing liquidity to the markets. These strategies are crucial for their day-to-day operations, enabling them to fulfill their role effectively. Here are some key strategies used by market makers:

1. Price Improvement Strategy

- Description: Market makers strive to offer prices slightly better than the competition for a fraction of their orders, enhancing their attractiveness to traders.

- Objective: To attract more order flow by providing better buying or selling prices than those quoted by other market participants.

2. Layering and Spoofing (Note: Legal Risks)

- Description: Layering and spoofing involve placing orders with no intention of executing them to create a false impression of demand or supply.

- Objective: To manipulate the market perception of a security’s price to benefit from the induced price movement. However, it’s crucial to note that these practices are illegal and heavily penalized.

3. Volume Weighted Average Price (VWAP) Trading

- Description: Market makers use VWAP trading to execute orders at an average price based on the volume of trades over a specific time period.

- Objective: To minimize the market impact of large orders and ensure a fair execution price for both the market maker and their clients.

4. Hedging

- Description: Market makers hedge their positions to protect against adverse price movements in the securities they hold.

- Objective: To reduce risk by taking an offsetting position in a related security or derivative, such as options or futures.

5. Quote Matching

- Description: Market makers often match the quotes of competitors to ensure they remain competitive in the market without significantly undercutting their own margins.

- Objective: To balance the need for competitive pricing with the goal of maintaining profitability.

6. Inventory Management

- Description: Effective inventory management involves adjusting buy and sell positions based on current holdings to avoid overexposure to market movements.

- Objective: To maintain a balanced portfolio that minimizes risk while still providing ample liquidity to the market.

7. Algorithmic Trading

- Description: Market makers use sophisticated algorithms to automate trading decisions and execution, based on pre-defined criteria and real-time market analysis.

- Objective: To enhance trading efficiency, react instantaneously to market changes, and manage large volumes of trades with minimal human intervention.

8. Scalping

- Description: Scalping is a strategy used by market makers to profit from small price gaps created by bid-ask spreads.

- Objective: To make small profits on a large number of trades throughout the day, capitalizing on the spread rather than significant price movements.

Market makers utilize a blend of strategies to navigate the complexities of the financial markets, balancing their roles as liquidity providers with the need to manage risk and maintain profitability. These strategies, when employed effectively, contribute to the overall health and efficiency of the trading environment, benefiting all market participants.

Impact on Traders and Investors

The activities and strategies of market makers significantly impact traders and investors, shaping the trading environment and influencing market dynamics. Understanding these impacts can provide valuable insights into how market operations affect individual trading experiences and investment outcomes.

1. Improved Market Liquidity

- For Traders: Enhanced liquidity means traders can execute orders more quickly and with less slippage, reducing the cost of trading and allowing for more timely market entry and exit.

- For Investors: Improved liquidity facilitates easier portfolio adjustments and rebalancing, enhancing the ability to respond to market changes or personal financial needs.

2. Narrower Bid-Ask Spreads

- For Traders: Smaller spreads reduce the cost of trading, particularly beneficial for high-frequency traders who operate on thin margins.

- For Investors: Lower transaction costs improve investment returns over time, especially for those who trade more frequently as part of their investment strategy.

3. Enhanced Price Discovery

- For Traders: Accurate price discovery allows traders to make more informed decisions, relying on market prices that accurately reflect the current supply and demand.

- For Investors: Ensures that the securities in their portfolios are priced fairly, contributing to a more transparent and equitable market.

4. Stabilized Market Conditions

- For Traders: Reduced volatility and more stable prices allow for better risk management and strategy planning, reducing the likelihood of large, unexpected losses.

- For Investors: Stability is key for long-term investment strategies, as it leads to a more predictable environment for growth and reduces the risk of sudden market downturns.

5. Facilitation of New Listings

- For Traders and Investors: Market makers play a crucial role in the introduction of new securities to the market, providing the initial liquidity necessary for trading. This offers traders and investors early access to new investment opportunities and the ability to diversify portfolios.

6. Risk Management

- For Traders: The strategies employed by market makers to manage their own risks indirectly benefit traders by maintaining orderly markets, even under volatile conditions.

- For Investors: A stable market environment, ensured by effective risk management by market makers, helps protect the value of long-term investments.

The influence of market makers extends beyond their role as intermediaries; they are fundamental to the functioning of financial markets, offering benefits that impact both traders and investors. By enhancing liquidity, narrowing bid-ask spreads, ensuring accurate price discovery, stabilizing market conditions, and facilitating new listings, market makers contribute to a more efficient, fair, and accessible market. For traders, this means better execution and lower costs, while investors benefit from greater stability and transparency, enhancing the overall investment landscape.

While the role of Market Makers sell model is crucial in maintaining liquidity and stability in financial markets, they also face several challenges and considerations that can impact their effectiveness and the broader market dynamics. Understanding these challenges is essential for both market participants and regulators to ensure that markets function efficiently and transparently.

Regulatory Compliance

- Challenge: Market makers must navigate a complex web of regulatory requirements designed to ensure fair trading practices and protect investors.

- Consideration: Compliance with these regulations can require significant resources and constant vigilance to keep up with evolving rules and standards.

Market Volatility

- Challenge: High levels of volatility can increase the risk of market making, as rapid price movements can lead to significant losses.

- Consideration: Market makers need to employ sophisticated risk management strategies to mitigate these risks, which can be costly and resource-intensive.

Technology and Infrastructure

- Challenge: The effectiveness of Market Makers sell model heavily relies on the use of advanced technology and infrastructure for trading and analysis.

- Consideration: Continuous investment in technology is required to stay competitive, which can be a barrier to entry for smaller firms and exacerbate market concentration.

Competition

- Challenge: The market making space is highly competitive, with firms constantly vying for market share and order flow.

- Consideration: This competition can drive innovation and efficiency but also pressure market makers to take on greater risks or reduce margins.

Ethical and Legal Risks

- Challenge: Practices such as layering and spoofing, although illegal, highlight the potential for manipulation and unethical behavior in the quest for profits.

- Consideration: Maintaining ethical standards and rigorous oversight is crucial to prevent abuse and maintain trust in financial markets.

Liquidity Provision in Less Popular Assets

- Challenge: Providing liquidity in less popular or more volatile assets can be more risky and less profitable, which may lead market makers to focus on more liquid assets.

- Consideration: This can lead to liquidity disparities across different segments of the market, impacting price discovery and trading efficiency.

Dependency on Market Makers

- Challenge: Over-reliance on a few major market makers can create systemic risks if one or more of these entities fail or withdraw from the market.

- Consideration: Ensuring a diverse and robust pool of market makers is critical to mitigate these systemic risks and ensure market resilience.

Market makers play an indispensable role in ensuring the smooth operation of financial markets. However, they face numerous challenges and considerations that require careful management and oversight. Balancing these factors is crucial for maintaining a fair, efficient, and stable market environment that benefits all participants. Addressing these challenges effectively requires a collaborative effort among market makers, regulators, and other market participants to foster innovation, ensure compliance, and mitigate risks.

Conclusion

The role of market makers in the financial markets is both complex and critical, acting as the linchpins that ensure liquidity, efficiency, and stability. Through their activities, market makers facilitate smoother transactions, provide vital liquidity, assist in price discovery, and help maintain orderly markets, even during volatile conditions. Their strategies, ranging from price improvement to risk management, are essential for their success and the overall health of the markets.

However, market making is not without its challenges and considerations, from regulatory compliance and market volatility to the ethical and systemic risks associated with their operations. These factors necessitate a delicate balance between profit-making activities and the broader responsibility to the market and its participants.

The impact of market makers extends beyond their immediate trading activities, affecting traders, investors, and the market structure as a whole. For traders, market makers enhance liquidity and reduce transaction costs, while investors benefit from more stable and efficient markets conducive to long-term investment strategies. Nonetheless, the reliance on market makers also underscores the importance of having robust regulatory frameworks and ethical practices in place to prevent market manipulation and ensure fairness.

In conclusion, market makers are indispensable to the fabric of financial markets, facilitating transactions that underpin market dynamics and economic growth. As the financial landscape continues to evolve, the role of market makers will undoubtedly adapt, but their fundamental contribution to market liquidity and efficiency will remain a cornerstone of trading ecosystems worldwide. Addressing the challenges they face and leveraging their benefits will continue to be a critical task for regulators, market participants, and the makers themselves, ensuring that markets remain vibrant, fair, and resilient.