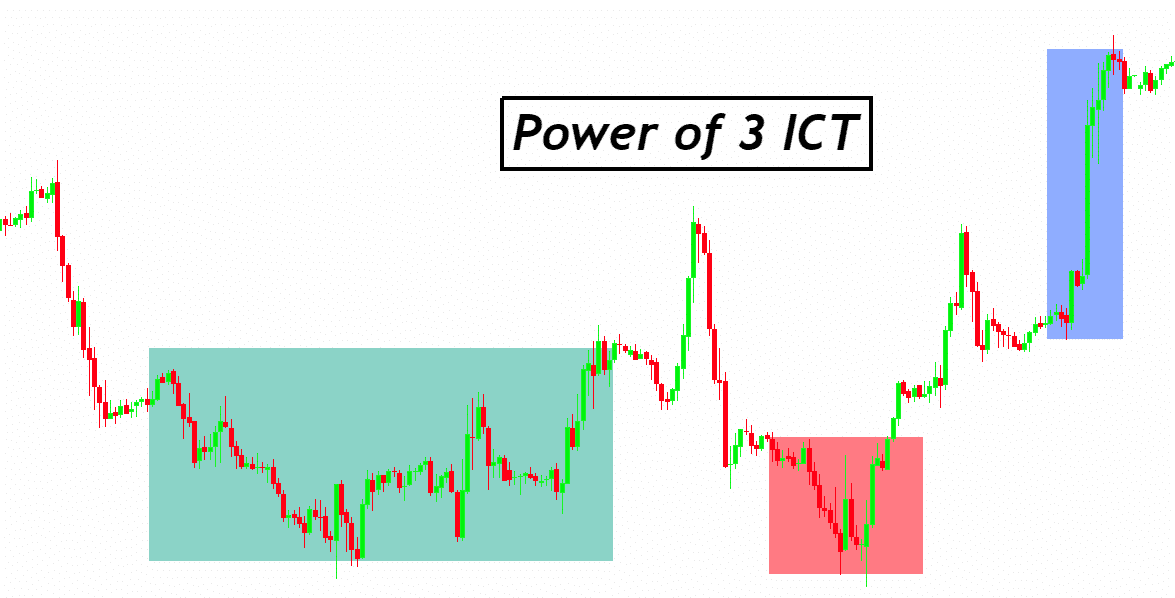

The ICT Power of Three (PO3) strategy is a distinctive approach in the world of Forex trading, focusing on the three critical phases of market movement: accumulation, manipulation, and distribution. This strategy offers a deep dive into the mechanics of how prices move in the financial markets, providing traders with a blueprint to decode the actions of big players like banks and financial institutions.

Accumulation Phase:

This is the first cornerstone of the PO3 strategy, where informed traders gradually buy or sell an asset at or near a specific price level. The significance of this phase lies in its stealthy nature; it’s where smart money positions itself before making a significant move. Unlike traditional trading strategies that might focus on overt price movements, PO3 teaches traders to recognize the subtle signs of accumulation, offering a head start before a price surge.

The Accumulation phase is foundational in the ICT Power of 3 (PO3) strategy, marking a period where institutional investors, often referred to as “smart money,” strategically build their positions in the market. This phase is characterized by a discreet and systematic buying (or selling, in the case of a bearish outlook) of an asset, executed in a way that minimizes the impact on the market’s price. The goal during this phase is to amass a significant position at optimal prices, setting the stage for substantial future market movements.

Understanding the Accumulation Phase

During accumulation, price movements tend to be subtle, with the asset trading within a relatively tight range. This lack of volatility is intentional; it’s designed to avoid drawing attention to the activities of institutional investors as they accumulate their positions. To the untrained eye, the market may seem inactive or directionless. However, this period is crucial for setting up the groundwork for a strong market move that follows in the distribution phase.

The Significance of Accumulation for Smart Money

For institutional investors, the accumulation phase is a strategic period of preparation. By quietly building a position at favorable prices, they can maximize their potential profit while minimizing the risk of adversely moving the market against their interests. The careful management of their market impact during this phase is a testament to the sophistication and patience of institutional trading strategies.

Why Retail Traders Should Pay Attention

For retail traders, identifying the accumulation phase can be both challenging and rewarding. While the signs of accumulation are subtle, clues such as consistent price levels with low volatility, or volumes that don’t match the apparent lack of market activity, can indicate that accumulation is taking place. Recognizing these signs early can align retail traders with the likely direction of the market once the smart money begins to move, offering opportunities for profit by “following the footsteps” of institutional investors.

In essence, the Accumulation phase is about stealth and preparation. It’s where smart money positions itself for future moves, often under the radar of the broader market. For those able to detect and interpret the signs of accumulation, this phase presents a prime opportunity to align with the most powerful forces in the market before significant price movements unfold.

Manipulation Phase:

Following accumulation, the market enters the manipulation phase. Here, prices are pushed to levels that trigger the stop losses of retail traders, effectively ‘shaking out’ the weak hands. This phase is pivotal because it demonstrates the cunning aspect of market psychology employed by institutional traders. In contrast to conventional strategies, which may view such price movements as noise or outliers, PO3 identifies them as critical cues for upcoming price direction changes.

The Manipulation phase is the second key component of the ICT Power of 3 (PO3) strategy, where institutional investors, or “smart money,” engage in strategic price movements designed to mislead and outmaneuver less informed market participants. This phase involves deliberate price actions to create false market signals, triggering retail traders to act in ways that ultimately benefit institutional positions.

Understanding the Manipulation Phase

This phase typically follows the quiet accumulation of assets. Smart money begins to make more noticeable moves in the market, often leading to price breaking out of the previously established range. These actions can appear as a setup for a new trend but are actually intended to trigger stop losses and encourage premature entries from retail traders. The manipulation phase is characterized by sudden spikes in volatility and price reversals that seem to defy the market’s earlier direction.

The Significance of Manipulation for Smart Money

For institutional investors, manipulation is a tactical phase that allows them to optimize their entry and exit points. By creating scenarios where the market appears to be moving definitively in one direction, they can complete the accumulation of their positions at better prices or start distributing their holdings by pushing the market to react in a predictable manner. The manipulation phase leverages the psychological responses of the wider market, using fear and greed to smart money’s advantage.

Why Retail Traders Should Pay Attention

For retail traders, the manipulation phase represents a period of heightened risk and opportunity. Recognizing this phase requires understanding that sudden market moves may not always indicate a genuine trend but could be traps set by institutional investors. Retail traders need to look beyond surface-level market movements and question the validity of abrupt changes in price direction. Identifying manipulation attempts can protect retail traders from being caught in unfavorable positions and allows them to align their strategies with the underlying market dynamics rather than against them.

The Manipulation phase is about strategic deception and positioning. It’s a period where the market’s apparent direction can be misleading, serving the interests of those who initiated it. Smart money uses this phase to fine-tune their market positions, capitalizing on the reactive nature of less informed participants. For retail traders, navigating this phase successfully involves a keen sense of market sentiment, a critical assessment of price movements, and an understanding that not all market activity is as it appears on the surface.

Distribution Phase:

The final phase is where the accumulated positions are offloaded, leading to a significant price movement. This phase is marked by a shift in market dynamics, as the smart money begins to take profits, causing the price to move sharply in the intended direction. Traditional trading strategies might only recognize this move after it has occurred, whereas PO3 provides the foresight to anticipate these moves before they happen, allowing traders to position themselves advantageously.

The Distribution phase marks the culmination of the ICT Power of 3 (PO3) strategy, where institutional investors, often referred to as “smart money,” start to offload their positions amassed during the accumulation phase. This stage is critical because it directly impacts the market’s direction, finally revealing the true intentions of the smart money after the deceptive tactics employed in the manipulation phase.

Detailed Understanding of the Distribution Phase

During this phase, the market experiences significant price movements as smart money begins to sell (or buy, in the case of a bearish outlook) their large positions. These actions result in sharp price increases or decreases, depending on the market’s direction. The distribution phase is characterized by strong, sustained movements that confirm the market’s trend, which was obscured during the manipulation phase.

The Importance of Distribution for Smart Money

The distribution phase is where the profits are realized for institutional investors. By selling their positions at higher prices (or buying back cheaper in a bearish scenario), they capitalize on the price discrepancies created through manipulation. This phase is meticulously timed to maximize profits and minimize the impact on the price as they exit their positions. It is a testament to the strategic planning and market understanding of institutional investors.

Why Retail Trainers Should Pay Attention

For retail traders, the distribution phase offers critical insights into market trends and the end of a particular market cycle. Recognizing the onset of distribution can prevent them from entering trades late in the cycle or holding onto positions that are contrary to the market’s real direction. By aligning their trading actions with the distribution phase, retail traders can ride the wave created by smart money, potentially securing profits or avoiding losses.

Understanding the Distribution phase involves recognizing sustained market movements and distinguishing them from the volatility of the manipulation phase. It’s about seeing through the market’s noise and aligning with its true direction. For retail traders, this phase is their best opportunity to act in harmony with the market’s actual trend, leveraging the groundwork laid by institutional investors for their advantage.

The Distribution phase is the payoff period for smart money and a critical alert for retail traders to adjust their strategies. It underscores the importance of timing, market analysis, and strategic action in trading, offering a clear signal of when to enter or exit the market based on the actions of the most influential players.

Application of the ICT PO3 Strategy

Applying the ICT Power of 3 (PO3) strategy effectively requires understanding how it adapts to different market conditions. Here’s how to leverage PO3 in both bullish and bearish scenarios, with a focus on the critical initial phase – accumulation.

Bullish Market Scenario: Application of PO3

Step-by-step Guide:

- Identify the Accumulation Phase: Look for a period where price movement is limited, indicating that smart money may be quietly buying. This phase often occurs after a downtrend or a period of consolidation.

- Monitor for Manipulation: After accumulation, watch for a sharp move down that fails to sustain. This “false breakout” is often a manipulation to shake out weak positions and confirm smart money’s bullish intent.

- Enter at Distribution: Once the manipulation phase clears, and the price begins to move up convincingly, signaling the start of the distribution phase, plan your entry. The rise should be on increasing volume, confirming smart money’s move to take profits.

Practical Tips for Identifying the Accumulation Phase:

- Volume Analysis: Look for subtle increases in volume without significant price movement. This can indicate smart money is accumulating.

- Price Stability: A price moving sideways after a decline might suggest accumulation.

- Support Levels: Accumulation often occurs near historical support levels.

Bearish Market Scenario: Application of PO3

Applying PO3 in Bearish Conditions:

- Spot the Accumulation Phase: In a bearish setup, accumulation may look like a quiet gathering of sell positions, typically after a rally or during a period where the market flattens.

- Watch for Manipulation: Be alert for a sudden spike up, which fails to hold. This is the manipulation phase, intending to trap buyers before the market turns.

- Act on Distribution: When the price starts to fall sharply, indicating the distribution phase, this is your cue to consider entering a sell position. The drop should come with increased volume, signifying that smart money is offloading positions.

Key Factors for Successful Strategy Implementation:

- Resistance Levels: Bearish accumulation often happens below key resistance levels.

- Volume and Price Action: Pay attention to declining volume during price rises and sharp increases in volume as the price starts to drop.

- Market Sentiment: Be wary of overly bullish sentiment during accumulation and manipulation phases; it might indicate a setup for a bearish turn.

Implementing the PO3 strategy in both bullish and bearish markets requires keen observation, patience, and the ability to read subtle market signals. Whether the market is setting up for a rise or a fall, the key lies in aligning your trading strategy with the actions of institutional players, using the accumulation, manipulation, and distribution phases as your roadmap.

Preferred Time Frame for PO3

The preferred time frame for executing the ICT Power of 3 (PO3) strategy effectively falls within the 5 to 15-minute range. This selection is strategic, catering to the nuanced requirements of tracking and capitalizing on the accumulation, manipulation, and distribution phases identified by the PO3 approach.

Why 5 to 15 Minutes?

1. Balance Between Detail and Overview: The 5 to 15-minute time frame strikes an optimal balance, offering enough granularity to observe the subtle shifts characteristic of the PO3 phases, without being overwhelmed by the ‘noise’ common in shorter time frames. This range allows traders to discern genuine market movements from mere fluctuations.

2. Responsiveness to Market Conditions: This time frame is sufficiently agile to allow traders to respond promptly to the market signals that precede shifts in phase, especially the transition from manipulation to distribution, which is critical for timing entries and exits.

3. Adaptability Across Instruments: Whether trading forex, commodities, or indices, the 5 to 15-minute window is versatile enough to apply the PO3 strategy across different markets, each with its unique volatility and trading volume patterns.

Adjusting the Strategy to Different Market Conditions

The application of the PO3 strategy within this time frame does require adjustments based on prevailing market conditions:

1. High Volatility Markets: During periods of high volatility, the phases of PO3 might unfold more rapidly. Traders might need to lean towards the shorter end of the time frame spectrum (closer to 5 minutes) to catch the quick transitions between phases, especially the manipulation phase which can be fleeting.

2. Low Volatility Markets: In contrast, in less volatile market environments, the transitions between PO3 phases can be more gradual, necessitating patience. Here, utilizing the longer end of the preferred time frame (closer to 15 minutes) can provide a clearer view of the accumulation phase, allowing traders to prepare for the eventual breakout and subsequent phases.

3. Market Open and Close: The strategy may also need adjustment around the opening and closing times of major markets, as these periods can see increased volatility. Traders might opt for shorter time frames to capitalize on quick moves or extend their analysis to avoid being caught in misleading price actions that don’t follow through.

While the 5 to 15-minute time frame is generally preferred for the PO3 strategy, successful application requires an adaptive approach. Traders must consider the specific characteristics of the market they are trading in, including volatility, time of day, and the particular phase of the PO3 strategy being targeted. This nuanced application enhances the potential for making informed decisions, aligning closely with the principles of accumulation, manipulation, and distribution central to the PO3 strategy.

Conclusion

The ICT Power of 3 (PO3) strategy is a powerful approach to trading that focuses on understanding the market through the phases of accumulation, manipulation, and distribution. By recognizing these phases, traders can align their strategies with the actions of institutional investors, or “smart money,” to make informed decisions. The preferred time frame for applying the PO3 strategy ranges from 5 to 15 minutes, offering a balance between detail and overview while allowing for responsiveness to market conditions. Adjusting the strategy based on the market’s volatility and the time of day can enhance its effectiveness. Ultimately, mastering the PO3 strategy involves observing market patterns, adapting to conditions, and learning to anticipate moves before they happen, guiding traders towards more strategic and profitable trading decisions.