Fair Value Gaps (FVGs) in trading occur when there’s a significant difference between the current price of a currency or financial asset and its fair value. These gaps are typically represented on charts by large candlesticks, indicating a substantial move in price over a short period. The concept hinges on the market’s efficiency or inefficiency in accurately pricing assets.

Types of Fair Value Gaps

FVGs are categorized into two types based on the nature of the fair value difference:

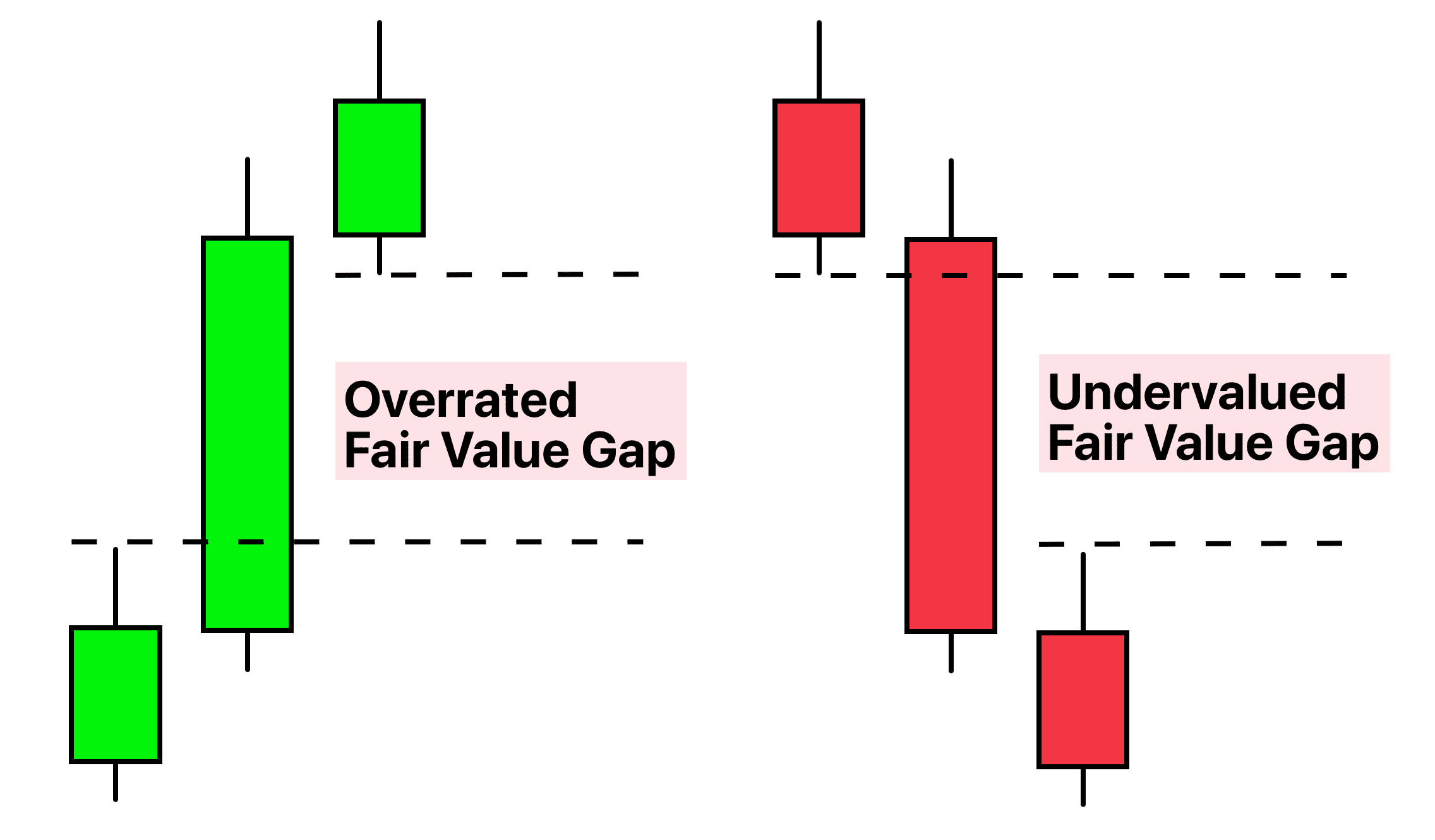

- Undervalued FVG: This type of gap occurs when an asset’s price is lower than its fair value. It suggests that the price is likely to increase in the future to correct this undervaluation. Technically, this is often shown by a big bearish candlestick, indicating the presence of an Undervalued FVG.

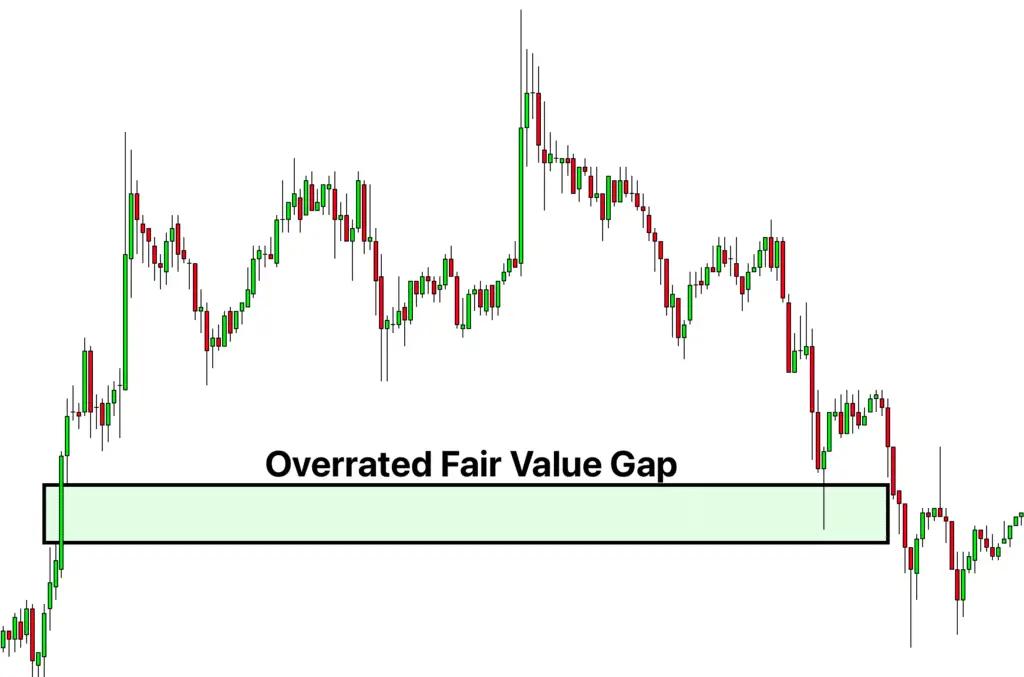

- Overrated FVG: Conversely, an Overrated FVG happens when an asset’s price is higher than its fair value. In this scenario, the price is expected to decrease to balance out this overvaluation. In technical analysis, this is typically indicated by a large bullish candlestick.

Role as Price Magnets

Both types of FVGs act as price magnets in the market. They represent areas where the price is likely to return to in the future, either to rise in the case of undervalued gaps or to fall in the case of overrated gaps. Traders watch these gaps closely as they can provide key insights into potential future price movements and opportunities for strategic trading decisions.

Understanding Fair Value and Market Price

Fair Value Explained

In trading, fair value refers to the genuine or actual value of a financial asset, such as a stock or currency. It represents the price at which a knowledgeable, willing buyer and a willing seller, under no pressure to act, would agree to transact. Fair value takes into account various factors including the asset’s fundamentals, market conditions, and future earnings potential.

- Determining Fair Value: Fair value is often calculated using data analysis and financial models. It may include looking at the company’s financial health, market trends, or economic indicators in the case of currencies.

- Dynamic Nature: Fair value is not static; it changes with evolving market conditions and new information. It’s a trader’s or analyst’s best estimate of what an asset is truly worth.

Fair Value vs. Market Price

The market price is the current price at which an asset is trading in the market. It’s what you see on stock tickers and forex rate boards. This price can differ from fair value due to various reasons:

- Market Sentiment: Short-term market sentiments, news, and speculation can cause the market price to deviate from the fair value. For instance, a sudden market panic can drive prices below fair value, or excessive optimism can push them above.

- Market Inefficiencies: Sometimes, due to lack of information or irrational trading behavior, the market price may not reflect the fair value accurately.

Fair Value Gaps as Price Targets

Traders use Fair Value Gaps (FVGs) as significant markers for setting price targets or take-profit levels in their trading strategies. These gaps are seen as areas where the market is likely to move towards, either to fill the gap or to correct the discrepancy between the market price and the fair value.

- Attraction to Fair Value Gaps: The market often moves towards these gaps in an attempt to ‘fill’ them. For example, if a stock is trading below its fair value (undervalued FVG), traders might set their price targets higher, anticipating that the market will eventually recognize this undervaluation and adjust upwards.

- Take-Profit Levels: In the case of an overrated FVG, where the stock is trading above its fair value, traders might set lower price targets, expecting the price to fall back down to more realistic levels.

Strategy in Setting Targets

Setting and adjusting price targets based on FVGs involves careful analysis and a strategic approach:

- Analysis of Gap Size and Volume: The size of the gap and the trading volume that created it can provide clues about the strength of the future price movement. Larger gaps with higher volumes might indicate stronger market sentiment, leading to more significant price corrections.

- Alignment with Technical Indicators: While FVGs are strong indicators, aligning them with other technical analysis tools can provide a more comprehensive view. For instance, using support and resistance levels or moving averages can help in validating the potential price target indicated by an FVG.

- Adapting to Market Changes: Traders need to remain flexible and adjust their price targets if new information or market changes suggest a different fair value. Keeping up-to-date with market news, financial reports, and economic indicators is crucial in this regard.

Utilizing Fair Value Gaps for Trade Decisions

Entry and Exit Strategies

Fair Value Gaps (FVGs) can be instrumental in shaping entry and exit strategies in trading. They provide a framework for identifying potential turning points in the market.

- Entry Strategies:

- For Undervalued FVGs: When a security is trading below its fair value, creating an undervalued gap, traders might consider entering a long position. The expectation is that the market will eventually recognize this undervaluation and the price will rise to fill the gap.

- For Overrated FVGs: In cases where a security is trading above its fair value, indicating an overrated gap, traders might take a short position, anticipating that the price will fall to a level more in line with its fair value.

- Exit Strategies:

- Traders can use the target level set by the fair value gap as a point to exit their positions. For instance, in a long position opened due to an undervalued FVG, the upper boundary of the gap might serve as a take-profit level.

- It’s also crucial to set stop-loss orders to manage potential losses if the market doesn’t move as expected towards the FVG.

Conclusion

To wrap it up, Fair Value Gaps are pretty handy for traders. They help you see where the price might go, especially if it’s higher or lower than it should be. Using these gaps, you can make smarter choices about when to buy or sell.

But remember, these gaps aren’t magic. It’s best to use them along with keeping an eye on what’s happening in the whole market.

Excelent basic Concepts to learn!