Understanding ICT (Inner Circle Trader) Trading Models involves grasping a series of concepts and strategies designed by Michael J. Huddleston aimed at dissecting the intricacies of the forex market for retail traders. These models are not just techniques but a holistic approach to trading that emphasizes precision, discipline, and a deep understanding of market dynamics. Below, we break down the essence of ICT trading models to offer a clearer view.

What Are ICT Trading Models?

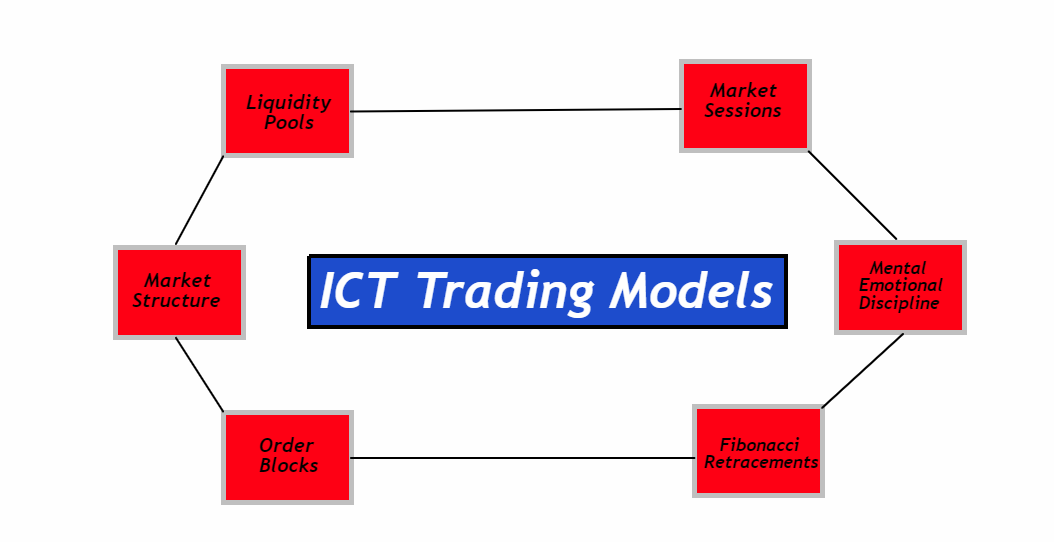

ICT Trading Models refer to a comprehensive framework for financial market analysis, particularly in forex trading. These models combine various technical analysis tools, trading concepts, and psychological insights to identify high-probability trading opportunities. The term “Inner Circle Trader” hints at the exclusive, in-depth knowledge that these models aim to impart to traders, enabling them to trade with the insight and precision often associated with institutional traders.

Core Principles of ICT Trading Models

The models rest on several foundational principles:

- Market Structure: Understanding the higher highs, higher lows (bullish market structure), and lower highs, lower lows (bearish market structure) provides the backbone for identifying potential market directions.

- Liquidity Pools: ICT models emphasize the importance of liquidity pools, which are price levels where large orders are likely to be located. These are areas where institutional traders are expected to enter or exit the market, causing significant price movements.

- Order Blocks: An essential concept in ICT trading models, order blocks refer to areas on the chart where institutional orders are believed to be placed. Identifying these can provide insight into potential reversal points in the market.

- Time of Day / Market Sessions: ICT models stress the significance of trading during specific times when liquidity and volatility are higher, such as during the opening of the London or New York sessions.

- Fibonacci Retracements and Extensions: These tools are used to identify potential support and resistance levels, entry points, and take profit targets.

- Mental and Emotional Discipline: Beyond technical strategies, ICT trading models heavily emphasize the importance of trader psychology, including discipline, patience, and risk management.

Implementing ICT Trading Models

To effectively use ICT trading models, traders need to:

- Educate Themselves: Spend time learning each component of the ICT trading models through courses, videos, and practice.

- Analyze the Market: Apply the models to analyze currency pairs, focusing on market structure, liquidity pools, and order blocks.

- Develop a Trading Plan: Based on ICT principles, create a trading plan that includes specific entry, exit, and risk management rules.

- Practice: Use a demo account to practice trading with ICT models without financial risk, refining techniques and strategies.

- Reflect and Adjust: Regularly review trading performance, identify areas for improvement, and adjust strategies accordingly.

ICT Trading Models offer a unique approach to navigating the forex market, combining traditional trading concepts with a deeper understanding of market dynamics and psychology. While they require a significant investment of time and effort to master, the precision and insight they provide can be a game-changer for dedicated traders. As with any trading strategy, success with ICT models comes down to education, practice, discipline, and continuous learning.

Key Components of ICT Trading Models

The ICT (Inner Circle Trader) Trading Models comprise several key components that are fundamental to understanding and applying this approach effectively in the forex market. Each component plays a crucial role in the overall strategy, enabling traders to identify high-probability trading opportunities by analyzing market behavior through a specific lens. Let’s delve into these components:

1. Market Structure

Understanding the market structure is paramount in ICT models. It involves recognizing patterns in price movements that indicate the underlying trend or potential reversals. Market structure is typically categorized into two main types:

- Bullish Structure: Characterized by a series of higher highs and higher lows, indicating an uptrend.

- Bearish Structure: Defined by a series of lower lows and lower highs, signaling a downtrend.

Identifying these structures helps traders determine the market’s direction and potential turning points.

2. Liquidity Pools

Liquidity pools refer to price levels where large volumes of orders are expected to be executed. These areas are significant because they often lead to substantial price movements when these orders are filled. ICT traders use knowledge of liquidity pools to predict price reactions at certain levels, allowing for strategic entry and exit points.

3. Order Blocks

Order blocks are essentially areas on the price chart where institutional orders are believed to be placed. Recognizing order blocks can provide insights into potential areas of support and resistance. An order block in an uptrend is typically a bearish candle preceding a move higher, while in a downtrend, it is a bullish candle before a move lower. Identifying these blocks helps in anticipating reversals or continuations in the market.

4. Time of Day / Market Sessions

The forex market operates 24 hours a day but is divided into several key trading sessions (Asian, London, and New York). ICT models emphasize the importance of trading during specific sessions or at specific times of the day when liquidity and volatility are higher, which can lead to more pronounced price movements.

5. Fibonacci Retracements and Extensions

ICT trading models incorporate Fibonacci tools to identify potential support and resistance levels, entry points, and targets for taking profits. These tools are based on mathematical ratios derived from the Fibonacci sequence, which are applied to price charts to forecast possible future movements.

6. Mental and Emotional Discipline

A crucial, often overlooked component of ICT models is the emphasis on the psychological aspects of trading. This includes maintaining discipline, managing emotions, and adhering to a strict risk management protocol. Success in trading requires not just technical skills but also a strong mindset to make rational decisions under pressure.

The ICT Trading Models are a comprehensive approach to forex trading that covers technical analysis, market psychology, and strategic planning. By understanding and applying these key components, traders can develop a more nuanced view of the market, enabling them to make informed decisions and improve their trading performance over time. Mastery of these elements requires dedication, practice, and continuous learning, but the potential rewards in terms of trading success can be significant.

Benefits of Using ICT Trading Models

The ICT (Inner Circle Trader) Trading Models offer several benefits that attract both novice and experienced traders seeking to enhance their trading strategies in the forex market. These models, developed by Michael J. Huddleston, provide a structured approach to understanding market dynamics, helping traders to navigate the complexities of forex trading with greater confidence and precision. Here are the key benefits of using ICT Trading Models:

Enhanced Market Understanding

- In-depth Analysis: ICT Trading Models encourage a comprehensive analysis of market structures, enabling traders to recognize trends, reversals, and potential entry and exit points more accurately.

- Predictive Insights: By focusing on liquidity pools and order blocks, traders gain insights into where significant price movements may occur, allowing for predictive trading strategies rather than reactive ones.

Precision in Entry and Exit Points

- Strategic Positions: The use of specific ICT concepts like order blocks and Fibonacci retracements helps traders to identify precise entry and exit points, reducing guesswork and enhancing the potential for profit.

- Optimized Risk-Reward Ratios: Carefully selected entry and exit points contribute to better risk-reward ratios, as traders can set tighter stop-loss orders and more ambitious profit targets.

Improved Risk Management

- Calculated Exposure: ICT models emphasize the importance of understanding and managing risk, teaching traders to only take positions with a favorable risk-reward balance.

- Emotional Control: The focus on trader psychology and discipline aids in controlling emotional responses, promoting decisions based on analysis and strategy rather than fear or greed.

Potential for Higher Profits

- Efficient Market Timing: Learning the best times to trade, based on market sessions and liquidity, can lead to capturing more significant price movements, potentially increasing profit margins.

- Leveraging Market Dynamics: A deep understanding of market dynamics, including institutional trading patterns, allows traders to align their strategies with those of market movers, often leading to more profitable outcomes.

Development of a Professional Trading Mindset

- Discipline and Patience: ICT Trading Models instill the virtues of discipline and patience, teaching traders to wait for the optimal setup rather than chasing the market.

- Continuous Learning: The complexity and depth of ICT strategies encourage ongoing education and refinement of trading skills, fostering a professional approach to trading.

The benefits of using ICT Trading Models are significant, offering traders a robust framework for analyzing and engaging with the forex market. By providing tools for precise market analysis, strategic entry and exit points, and effective risk management, ICT models can help traders achieve greater consistency and profitability. Moreover, the emphasis on psychological discipline prepares traders to face the market’s challenges with a calm, calculated approach, ultimately contributing to their overall success.

How to Implement ICT Trading Models in Your Strategy

Implementing ICT (Inner Circle Trader) Trading Models into your trading strategy requires a comprehensive approach that encompasses understanding the core concepts, applying them in real market conditions, and continuously refining your process based on outcomes. Here’s a step-by-step guide to help you incorporate ICT models into your forex trading strategy effectively:

1. Educate Yourself on ICT Concepts

- Study the Basics: Begin with the foundational elements of ICT Trading Models such as market structure, order blocks, liquidity pools, and time of day/market sessions. Resources include ICT’s own tutorials, videos, and trading forums.

- Understand Risk Management: Grasp the principles of managing risk, including how to set stop losses, calculate appropriate position sizes, and maintain a favorable risk-reward ratio.

2. Technical Setup

- Charting Software: Ensure you have access to reliable charting software that allows you to analyze market trends, and identify order blocks and liquidity pools. Many platforms offer tools for drawing Fibonacci retracements and extensions, which are crucial for ICT strategies.

- Demo Account: Use a demo trading account to practice implementing ICT strategies without financial risk. This step is critical for gaining confidence and understanding of the models.

3. Market Analysis

- Identify Market Structure: Regularly analyze currency pairs to identify their current market structure. Determine whether they are in an uptrend, downtrend, or consolidation phase.

- Spot High-Probability Setups: Look for ICT specific setups, including order blocks near liquidity pools and significant levels identified by Fibonacci tools.

4. Plan Your Trades

- Develop a Trading Plan: For each trade, define your entry point, stop loss, and take profit levels based on ICT concepts. Include the rationale for the trade, the risk-reward ratio, and the market conditions that would invalidate your trade setup.

- Journaling: Keep a detailed trading journal to record your analysis, decisions, and the outcomes of your trades. This documentation is vital for reviewing your strategy and making adjustments.

5. Practice and Refine

- Backtesting: Test your understanding of ICT models by backtesting your strategy on historical data. This process can help you refine your approach and build confidence.

- Demo Trading: Apply your strategy in real-time market conditions using a demo account. Monitor how well your trades align with ICT predictions and principles.

6. Continuous Learning and Adjustment

- Review and Reflect: Regularly review your trades to assess what worked and what didn’t. Pay close attention to your entry and exit decisions, risk management practices, and the accuracy of your market analysis.

- Adjust Your Strategy: Based on your review, make necessary adjustments to your trading plan. This might involve refining your criteria for trade entries, improving your risk management techniques, or deepening your understanding of ICT concepts.

7. Transition to Live Trading

- Start Small: When you feel confident in your strategy, transition to live trading but start with smaller stakes to manage risk effectively.

- Scale Gradually: Increase your trading size gradually as you become more consistent and confident in your application of ICT models.

Implementing ICT Trading Models into your strategy is a journey that involves education, practice, and continuous refinement. The complexity and depth of these models require dedication and a willingness to learn from both successes and failures. By systematically applying ICT principles and maintaining a disciplined approach to trading and risk management, traders can enhance their ability to navigate the forex market more effectively and profitably.

Common Mistakes to Avoid

Incorporating ICT (Inner Circle Trader) trading models into your trading strategy can significantly enhance your market analysis and decision-making skills. However, as with any sophisticated trading approach, there are common pitfalls that traders, especially those new to ICT concepts, should strive to avoid. Recognizing and steering clear of these mistakes can save time, reduce losses, and improve overall trading performance. Here are some of the most prevalent errors to watch out for:

1. Overcomplication

- Simplicity is Key: Traders often fall into the trap of adding too many indicators or overly complex analysis techniques, which can lead to analysis paralysis. Focus on mastering a few core ICT concepts at a time and keep your strategy as straightforward as possible.

2. Ignoring Market Context

- Understanding is Crucial: Applying ICT models without considering the broader market context (e.g., economic news, market sentiment) can lead to misinterpretation of signals. Always align your trading decisions with the overall market environment.

3. Neglecting Risk Management

- Risk Management is Essential: Failing to apply strict risk management principles is a significant mistake. Never enter a trade without a clear plan for managing potential losses, including setting appropriate stop-loss levels and only risking a small percentage of your trading capital on any single trade.

4. Inconsistent Application

- Consistency Matters: Inconsistently applying ICT principles or frequently changing strategies leads to erratic trading results. Commit to a specific set of ICT concepts, and apply them consistently across all your trades to build a reliable trading pattern.

5. Unrealistic Expectations

- Be Patient and Realistic: Expecting quick profits or believing ICT trading models will always result in winning trades can lead to disappointment and risky trading behaviors. Understand that trading is a long-term endeavor, and success requires patience, discipline, and continuous learning.

6. Trading Without a Plan

- Plan Every Trade: Entering trades based on intuition or vague signals without a detailed plan—including entry, exit, and stop-loss points—increases the likelihood of making emotional decisions. Always base your trades on a well-thought-out plan that follows ICT principles.

7. Not Learning From Mistakes

- Reflection Leads to Growth: Not reviewing your trades to learn from your mistakes and successes is a missed opportunity for improvement. Regularly analyze your trading performance to identify areas for refinement.

8. Underestimating the Importance of Psychology

- Mindset is Everything: Neglecting the psychological aspects of trading, such as dealing with loss, fear, and greed, can undermine even the most well-thought-out strategies. Focus on developing a strong trading mindset that supports disciplined decision-making.

Avoiding these common mistakes can significantly enhance your effectiveness in implementing ICT trading models. Successful trading is not just about applying the right strategies but also about developing the right habits, mindset, and discipline. Continuous learning, practice, and self-reflection are key components of trading success.

Conclusion

Implementing ICT (Inner Circle Trader) trading models into your forex trading strategy can significantly enhance your ability to analyze and navigate the market with greater precision and confidence. The journey to mastering these models involves a commitment to understanding the core principles of market structure, liquidity pools, order blocks, and the psychological aspects of trading. By focusing on these elements, traders can develop a deeper insight into the dynamics of the forex market, leading to more informed and strategic trading decisions.

Avoiding common pitfalls such as overcomplication, neglecting risk management, and unrealistic expectations is crucial in applying ICT models effectively. Embracing a disciplined approach, coupled with continuous learning and adjustment based on real-world experiences, will pave the way for sustained success.

The benefits of using ICT trading models, including enhanced market understanding, precision in entry and exit points, improved risk management, and the development of a professional trading mindset, are substantial. These models offer not just a set of trading techniques but a comprehensive framework for engaging with the forex market at a higher level of sophistication.

In conclusion, while the path to proficiency in ICT trading models may be challenging, the rewards in terms of improved trading outcomes and personal growth are well worth the effort. Dedication to education, practice, and self-reflection will be your allies in this journey. Embrace the process, learn from each trade, and remain committed to refining your approach. With time and experience, the ICT trading models can become a powerful tool in your trading arsenal, helping you to achieve your financial goals and become a more skilled and confident trader.