ICT (Inner Circle Trader) Trading Sessions refer to a strategic approach to trading. It emphasizes understanding market structure, identifying liquidity pools, and recognizing order blocks. Developed by the trading mentor known as “The Inner Circle Trader,” this methodology aims to equip traders with insights and techniques that go beyond conventional trading wisdom. The sessions are essentially educational content that covers a range of topics designed to enhance a trader’s ability.

Let’s simplify and detail the explanation of the ICT Kill Zones, making it easy to understand for everyone.

1. ICT Asian Kill Zone: A Prime Time for Currency Trading

Imagine a busy marketplace, but this one is all about trading currencies like the Australian dollar, New Zealand dollar, and Japanese yen. This marketplace gets bustling from 8:00 PM to 10:00 PM Eastern Time, which we call the ICT Asian Kill Zone. It’s when people in countries like Australia, New Zealand, and Japan are wide awake, buying and selling a lot. This time is special because a lot of important news comes out, causing prices to jump up and down more than usual. If you watch closely, you might catch a good opportunity to trade and make some money.

Key Points to Remember:

- Timing: This busy period happens between 8:00 PM and 10:00 PM Eastern Time.

- Opportunities: Keep an eye out for quick trades that could net you a small but fast profit, usually between 15 to 20 pips.

- Best Currencies: Trading pairs with NZD and JPY are more lively and potentially more profitable.

- Tips: Focus on other currencies over the US dollar as it doesn’t move much during this time.

2. ICT London Kill Zone: Where the Forex Action is

Next, we have the ICT London Kill Zone, running from 2:00 AM to 5:00 AM Eastern Time. It’s when London’s forex market buzzes with activity, especially with currencies like the Euro and British pound. London is a major trading hub, so there’s a lot of action and chances to make good trades. This time often shows the day’s lowest prices in a rising market or the highest in a falling one, helping traders decide when to jump in.

Key Takeaways:

- Timing: Look for action between 2:00 AM and 5:00 AM Eastern Time.

- Opportunities: You might win 25 to 50 pips during this period, a pretty sweet deal.

- Busy Times: This period is known for the highest number of orders, making it a hot spot for forex trading.

3. ICT New York Kill Zone: A Crucial Trading Window

After London sets the stage, the ICT New York Kill Zone comes into play from 8:00 AM to 11:00 AM Eastern Time. It’s a vital period for traders, especially for those trading with the US dollar. With New York being a significant trading center, there’s a flurry of buying and selling, offering many chances to profit.

What Makes It Special:

- Timing: The market is most alive from 8:00 AM to 11:00 AM Eastern Time.

- Opportunities: Look for patterns that might result in a profit of 20 to 30 pips.

- Overlap Advantage: Trading during this time is great because of the overlap with the London session, bringing even more action.

4. ICT London Close Kill Zone: Last Call for Trades

The London Close Kill Zone is like the final round for trading in the forex market, happening around 8:00 AM to 9:00 AM Eastern Time. It’s a rush to catch the last opportunities for good deals before the London market closes for the day. This period might offer quick profits of about 10 to 20 pips by catching the market’s final movements.

Why It’s Worth Watching:

- Timing: This brief window is your last chance to make profitable trades for the day.

- Opportunities: Keep an eye on the clock from 10:00 AM to Noon New York time for the best trading chances.

Understanding ICT Kill Zones and Daylight Saving Time (DST)

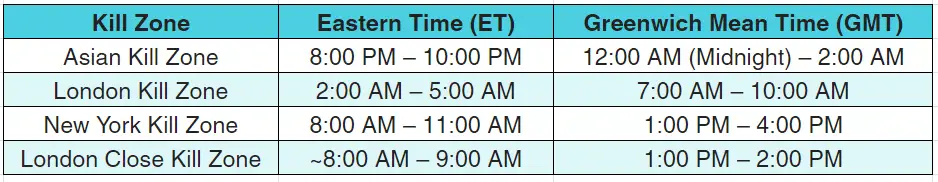

ICT Kill Zones Timing Overview:

We’ve outlined times when the forex market is especially active. These periods are crucial for traders looking for opportunities to make money. Here’s a quick guide on when these kill zones occur:

- Asian Kill Zone: 8:00 PM – 10:00 PM ET / 12:00 AM – 2:00 AM GMT

- London Kill Zone: 2:00 AM – 5:00 AM ET / 7:00 AM – 10:00 AM GMT

- New York Kill Zone: 8:00 AM – 11:00 AM ET / 1:00 PM – 4:00 PM GMT

- London Close Kill Zone: Around 8:00 AM – 9:00 AM ET / 1:00 PM – 2:00 PM GMT

Adjusting for Daylight Saving Time:

DST can affect trading times. In the spring and fall, clocks move one hour forward or back, changing how we match up with Universal Coordinated Time (UTC) and trading times in ET.

Time Difference Between New York and London:

The time gap

between New York and London varies, affecting when markets open or close in relation to each other. Normally, New York is 5 hours behind London, but this changes briefly during the DST transitions.

Keeping track of these times and adjustments can help you catch the ICT Kill Zones at the right moment, maximizing your trading opportunities.

Here’s a table displaying the ICT Kill Zones across different time zones:

| Kill Zone | Eastern Time (ET) | Greenwich Mean Time (GMT) |

|---|---|---|

| Asian Kill Zone | 8:00 PM – 10:00 PM | 12:00 AM (Midnight) – 2:00 AM |

| London Kill Zone | 2:00 AM – 5:00 AM | 7:00 AM – 10:00 AM |

| New York Kill Zone | 8:00 AM – 11:00 AM | 1:00 PM – 4:00 PM |

| London Close Kill Zone | ~8:00 AM – 9:00 AM | 1:00 PM – 2:00 PM |

This table helps visualize the specific times these trading “kill zones” occur in both Eastern Time (like New York’s time) and Greenwich Mean Time (GMT), facilitating traders around the globe to align their schedules accordingly.

Tips for Maximizing Success with ICT Trading Sessions

Maximizing success with ICT (Inner Circle Trader) Trading Sessions involves a blend of diligent study, practical application, and ongoing self-reflection. Here are some tips to help you get the most out of ICT methodologies in your trading journey:

1. Deepen Your Market Understanding

- Continuous Learning: Regularly revisit and study ICT concepts to deepen your understanding. The markets are dynamic, and continuous learning is key to keeping up.

- Analyze Historical Data: Spend time analyzing charts and historical data to see how ICT principles apply in different market conditions.

2. Practice Consistently

- Demo Trading: Before risking real money, practice trading with ICT strategies in a demo account.

- Start Small: When you transition to live trading, begin with smaller stakes to manage risk while gaining confidence.

3. Develop a Comprehensive Trading Plan

- Plan Your Trades: Clearly outline your trading strategy, including entry and exit criteria, risk management rules, and how you’ll apply ICT concepts.

- Stick to Your Plan: Discipline is crucial. Follow your trading plan closely to avoid impulsive decisions based on emotions.

4. Master Risk Management

- Manage Your Risk: Never risk more than a small percentage of your trading capital on a single trade. Proper risk management is essential for long-term success.

- Use Stop Loss Orders: Always use stop loss orders to cap potential losses. This is crucial for preserving your capital.

5. Maintain a Trading Journal

- Document Your Trades: Keep a detailed record of all your trades, including your rationale, execution, outcomes, and how you applied ICT principles.

- Review and Reflect: Regularly review your trading journal to learn from your successes and mistakes. This reflection can provide valuable insights for improving your strategy.

6. Embrace Patience and Discipline

- Wait for the Right Opportunities: ICT trading requires patience to wait for high-probability setups that align with your strategy. Don’t force trades.

- Maintain Emotional Control: Trading can be emotionally challenging. Work on maintaining discipline and emotional control, avoiding decisions based on fear or greed.

7. Stay Connected with the ICT Community

- Join Forums and Groups: Engage with the ICT community through forums, social media groups, or trading communities. Sharing insights and discussing strategies with peers can be incredibly valuable.

- Learn from Others: Be open to learning from the experiences and insights of other traders. Collaboration can lead to new perspectives and improvements in your trading approach.

8. Adapt and Evolve

- Be Flexible: The markets are always changing. Be prepared to adapt your strategies as market conditions evolve.

- Personalize Your Approach: While ICT provides foundational concepts, personalize these strategies to fit your trading style, goals, and risk tolerance.

Achieving success with ICT Trading Sessions is a process that requires dedication, patience, and continuous improvement. By applying these tips, you can maximize your learning and performance.

Conclusion

ICT Trading Sessions offer a comprehensive and nuanced approach to trading that goes beyond conventional technical analysis. By focusing on the core principles of market structure, liquidity pools, order blocks, and incorporating an understanding of institutional behaviors and psychological aspects. The ICT provides traders with a framework to navigate the markets more effectively.

The successful implementation of ICT strategies requires learning and disciplined practice. The benefits of integrating ICT methodologies into your trading approach include improved market understanding, enhanced decision-making, more precise entry and exit strategies, and robust risk management.

To maximize success with ICT trading sessions, it’s crucial to continuously deepen your market knowledge and practice consistently. Engaging with the ICT community and learning from both successes and setbacks can also provide valuable insights and support.