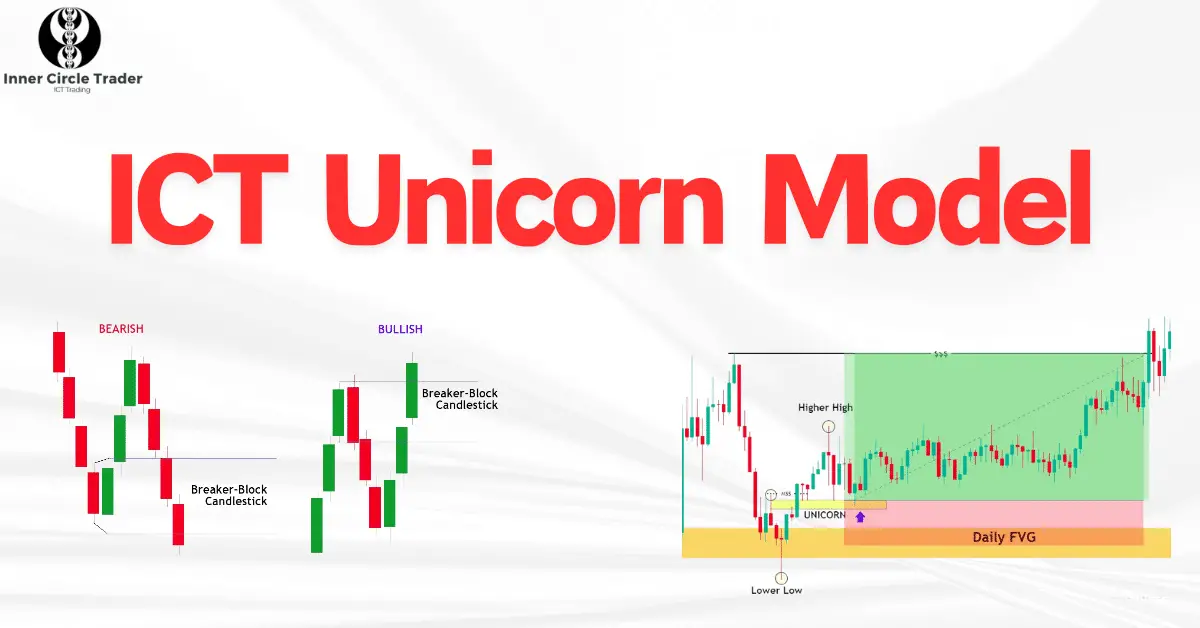

The ICT Unicorn Model is a powerful trading tool that can help you make smarter decisions and increase your profits. This model is considered more reliable than using a Fair Value Gap or a Breaker Block on their own because it combines both into one strategy. By understanding and applying the Unicorn Model, you can identify strong areas of support and resistance, improving your chances of entering successful trades.

What Is the ICT Unicorn Model?

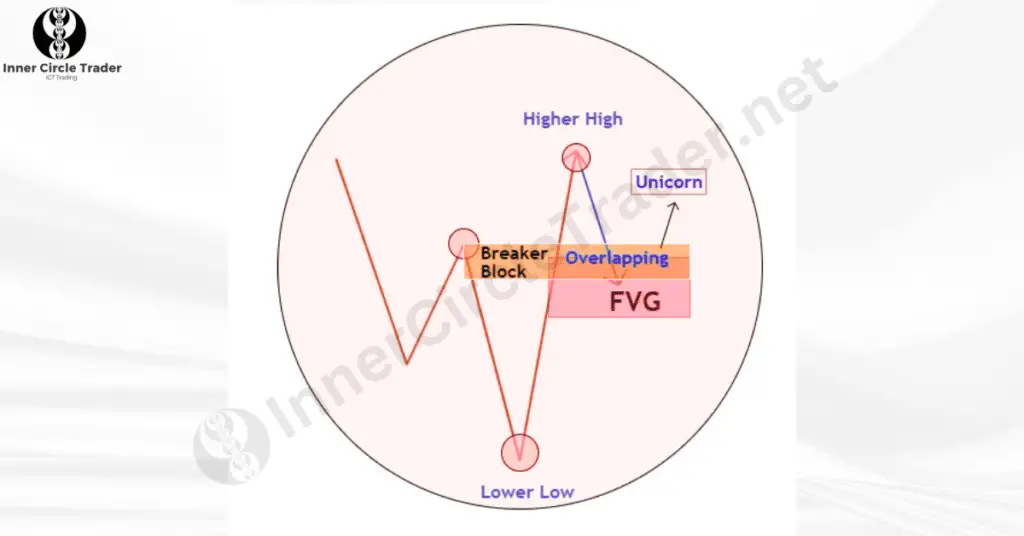

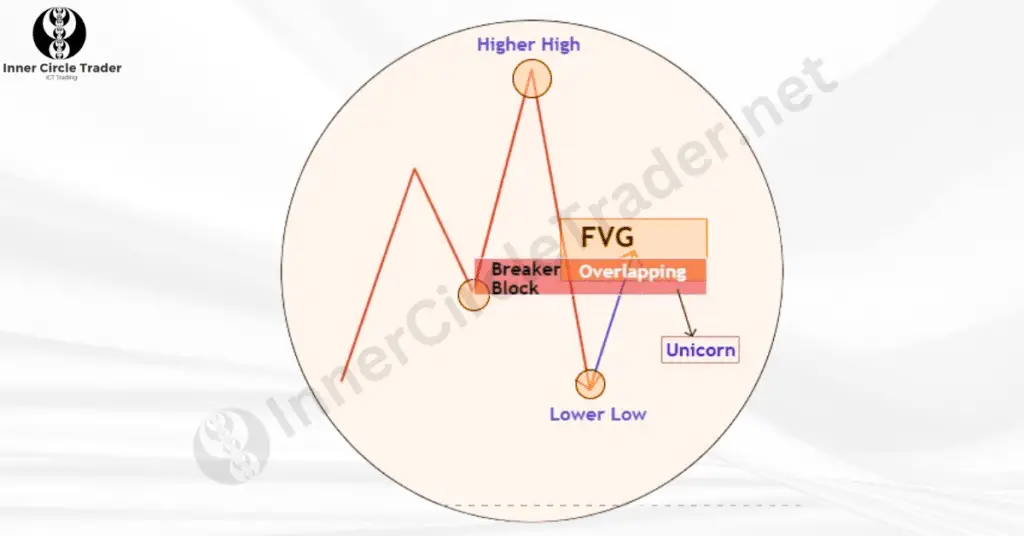

The ICT Unicorn Model is where a Fair Value Gap overlaps with a Breaker Block on your trading chart. This overlap creates a unique zone that often signals a potential change in price direction. Because it merges two important trading concepts, the model provides a stronger and more reliable signal for trade entries. It helps traders spot when the price might reverse or continue in a new direction.

How to Identify the ICT Unicorn Model

To find the ICT Unicorn Model on your chart, follow these simple steps:

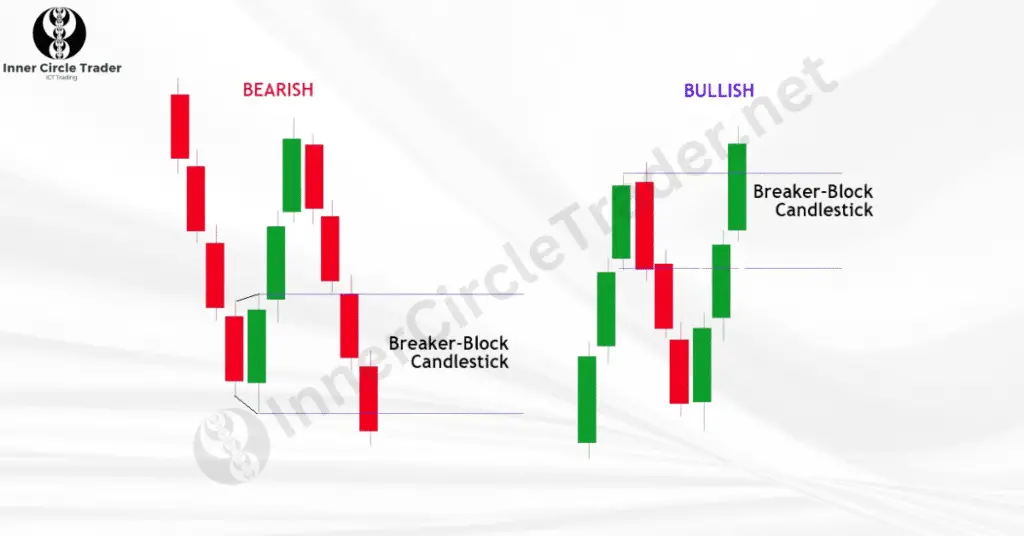

- Identify Breaker Blocks: First, mark all the Breaker Blocks on your chart. A Breaker Block is formed after the price changes direction and sweeps liquidity. It represents a failed Order Block where the price breaks through and keeps moving in the new direction.

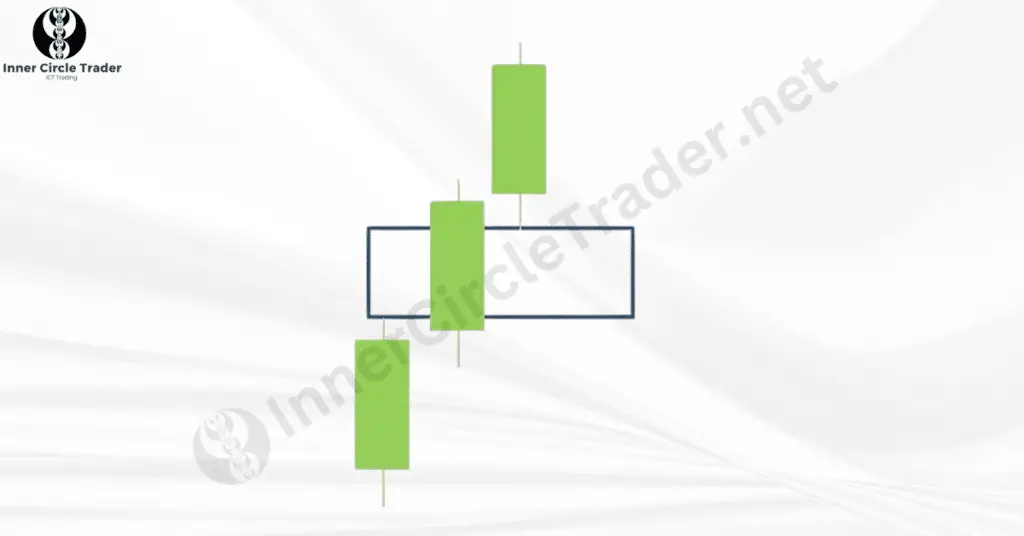

- Look for Fair Value Gaps: Next, look for Fair Value Gaps. A Fair Value Gap is a gap in the market where there is an imbalance between buyers and sellers. It appears as a space between three consecutive candles, where the middle candle moves quickly in one direction, leaving a gap.

- Find the Overlap: Check if any of the Breaker Blocks overlap with a Fair Value Gap. When they do, this overlapping area is the ICT Unicorn Model.

Types of ICT Unicorn Models

The ICT Unicorn Model can be either bullish or bearish, depending on the market’s direction.

- Bullish ICT Unicorn Model: This forms at the end of a downward price move. It occurs when the price makes a lower low followed by a higher high. A bullish Breaker Block overlaps with a bullish Fair Value Gap. When the price retests this overlapping area and starts to move up, it confirms the model.

- Bearish ICT Unicorn Model: This appears at the end of an upward price move. It happens when the price makes a higher high followed by a lower low. A bearish Breaker Block overlaps with a bearish Fair Value Gap. A successful retest of this area, followed by a downward move, confirms the model.

Using the ICT Unicorn Model in Your Trading Strategy

To trade using the ICT Unicorn Model, it’s important to determine the market’s daily bias whether it’s more likely to go up or down. Here’s how you can incorporate the model into your strategy:

- Find the Daily Bias: Analyze the market to understand its overall direction for the day.

- Wait for the Price to Reach Key Levels: Look for the price to approach premium or discount areas, known as PD arrays. These are levels where the price is likely to react.

- Watch for a Market Structure Shift: When the price reaches these levels, wait for a shift in the market structure. This means the price starts to change direction.

- Identify the ICT Unicorn Model: Once the market shifts, look for the Unicorn Model by finding the overlap between a Breaker Block and a Fair Value Gap.

- Enter the Trade: When the price retraces back to the Unicorn Model area, you can enter the trade. Place your stop loss a few pips below the low (for bullish trades) or above the high (for bearish trades) of the candle that created the Fair Value Gap.

- Set Profit Targets: Aim for the next liquidity level, such as equal highs or lows, or another significant area on a higher timeframe.

Best Time Frames for the ICT Unicorn Model

The Unicorn Model is best used on lower time frames because it helps with precise entry points. Time frames like 15 minutes or lower, especially the 5-minute chart, are ideal. These shorter time frames allow you to see the detailed price movements necessary to spot the Unicorn Model.

Best Trading Instruments for the ICT Unicorn Model

Initially, the ICT Unicorn Model was introduced for trading indices like the Nasdaq 100 (NQ) and the S&P 500 (ES). However, traders have found it effective in the forex market with currency pairs like GBP/USD and EUR/USD. It’s also been successfully applied to trading metals like gold (XAU/USD) and silver (XAG/USD), as well as cryptocurrencies. This shows the model’s versatility across different markets.

Final Thoughts

The ICT Unicorn Model is a valuable tool for traders looking to improve their trade entries. By combining the concepts of Breaker Blocks and Fair Value Gaps, it offers a more reliable signal. However, no trading strategy is foolproof. Always use proper risk management, and never risk more than you can afford to lose. Use stop losses to protect your capital and ensure you stay in the game for the long term.

Frequently Asked Questions About the ICT Unicorn Model

The ICT Unicorn Model is considered more reliable because it combines two strong trading concepts: the Breaker Block and the Fair Value Gap. When these two overlap, it creates a stronger signal than if you were using either one alone. This overlap often indicates a significant area of support or resistance, increasing the chances of a successful trade.

Yes, the ICT Unicorn Model is versatile and can be used on various trading instruments. While it was initially introduced for indices like the Nasdaq 100 and the S&P 500, traders have successfully applied it to forex pairs like GBP/USD and EUR/USD, metals like gold and silver, and even cryptocurrencies. It’s effective across different markets due to its focus on price action patterns.

Lower time frames, such as the 5-minute or 15-minute charts, provide more detailed price movements. This detail is crucial for identifying the precise overlap between Breaker Blocks and Fair Value Gaps that define the Unicorn Model. Using lower time frames helps traders find better entry points and manage their trades more effectively.

For a bullish Unicorn Model, place your stop loss a few pips (usually 10 to 20 pips) below the low of the candle that created the overlapping Fair Value Gap. For a bearish Unicorn Model, place it a few pips above the high of the corresponding candle. This approach helps protect your trade from unexpected market moves while allowing enough room for normal price fluctuations.

While the ICT Unicorn Model involves some advanced concepts, its principles can be understood with practice and study. Beginners can benefit from learning this model as it provides a structured approach to identifying high-probability trade entries. However, it’s important for new traders to first familiarize themselves with basic trading concepts like support and resistance, market structure, and price action before applying the Unicorn Model.