What is Mitigation Block?

Mitigation Block refers to a strategic approach in trading that involves identifying potential risks to one’s investment and implementing measures to reduce or block these risks. It is a proactive risk management technique designed to minimize potential losses without significantly reducing potential gains.

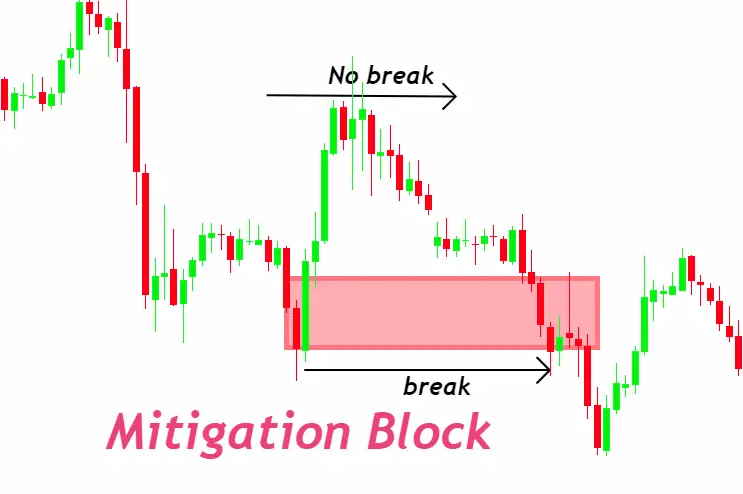

- Definition and Analogy: A mitigation block in trading is akin to reaching for something just out of reach, blocked by an unseen obstacle. It represents a price level where an accumulation of orders prevents the price from reaching new highs or lows.

- Formation and Impact: These blocks are formed when the market attempts to break through to a new price level but is halted by significant buying or selling pressure, acting as a temporary barrier to price movement.

Liquidity Voids: The Dynamics of Sparse Trading Areas

- Conceptual Overview: Imagine an empty space on a dance floor, allowing for swift movement. A liquidity void in the market is similar, characterized by a range where trading is thin, allowing price to move rapidly through this segment.

- Creation and Aftermath: Following the formation of a mitigation block, the price moves away, leaving behind a liquidity void. The market’s natural inclination to fill these voids results in prices returning to these areas, often partially filling the gap.

Interplay Between Mitigation Blocks and Liquidity Voids

- Market Revisits: The price’s return to a liquidity void is a phenomenon traders watch closely, interpreting it as the market’s attempt to ensure no trading opportunities within the void are missed.

- Strategic Significance: Mitigation blocks act as reference points for future price movements. As prices return to fill the voids, these blocks serve as markers, guiding traders on potential entry or exit points.

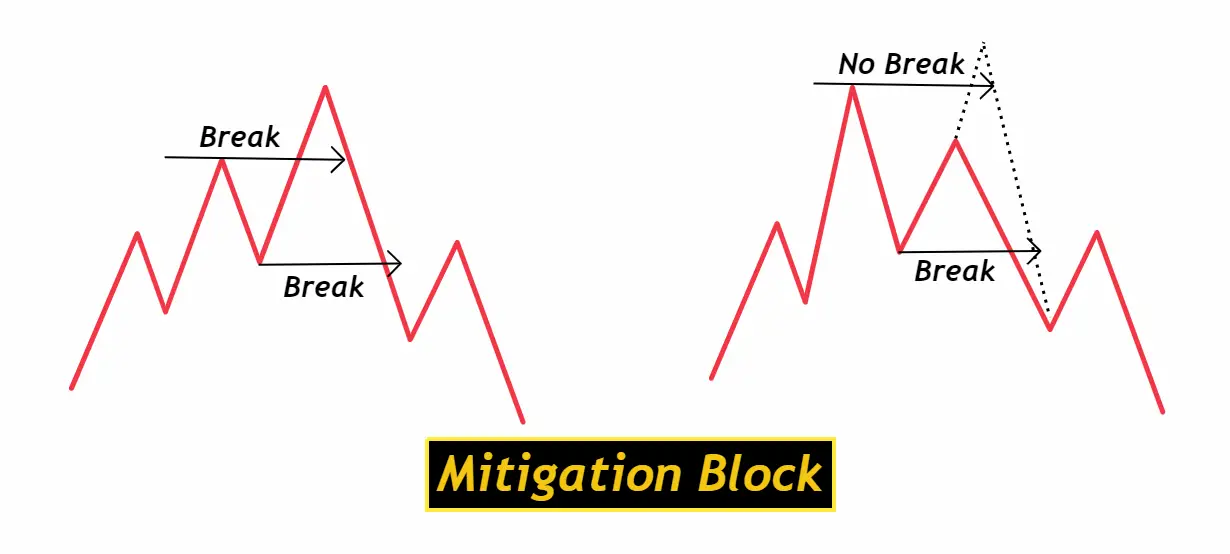

Types of Mitigation Blocks

Bullish Mitigation Blocks

- Characteristics and Indications: Occurs when the price fails to push lower, indicating a shift towards buying pressure. The price forms a higher low, suggesting a potential upward trend.

- Trading Implications: The formation of a bullish mitigation block, followed by an upward movement to fill a liquidity void, signals a buying opportunity, predicting a continuation of the uptrend.

Bearish Mitigation Blocks

- Characteristics and Indications: Forms when the price’s attempt to reach higher is thwarted by a lack of buyers, leading to a lower high and signaling increased selling pressure.

- Trading Implications: A bearish mitigation block suggests a selling opportunity, as the price is expected to continue its downward trajectory after filling the liquidity void.

Comparing Breakers and Mitigation Blocks

Breakers: Momentum Indicators

- Definition: Breakers are characterized by strong price movements creating new highs or lows, indicating significant market momentum.

- Market Implication: A breaker signifies the market’s capacity to reach new price levels, collecting liquidity at these points.

Mitigation Blocks: Reversal and Hesitation Signals

- Definition: Unlike breakers, mitigation blocks indicate a price’s failure to breach new levels, suggesting potential market reversal or pause.

- Strategic Importance: Following a mitigation block, the price retraces to fill the liquidity void, offering insights into potential shifts in market direction.

Trading Strategies: Leveraging Mitigation Blocks and Breakers

Trading Mitigation Blocks

- Bullish Scenario: For bullish blocks, observe the price’s return to fill the gap as a buying signal, particularly if it reaches a previous low.

- Bearish Scenario: In bearish blocks, the price’s descent to cover the void indicates a selling opportunity, especially if it touches a former high.

Trading Breakers

- Bullish Breaker Strategy: A new high suggests strong buying interest. A subsequent minor pullback provides a buying opportunity, anticipating an uptrend continuation.

- Bearish Breaker Strategy: A new low indicates selling pressure. A slight rise followed by further decline can be a selling point, predicting continued downward movement.

Enhancing Trading with Confluences

Integrating Order Flow, Fair Value Gaps, and Liquidity Voids

- Order Flow Analysis: Understanding the movement of money in the market can signal support for continued direction or potential reversals.

- Identifying Fair Value Gaps: These gaps indicate rapid price movements with minimal trading, suggesting areas the price may return to fill.

- Recognizing Liquidity Voids: Similar to fair value gaps, liquidity voids are areas of sparse trading the price is likely to revisit, providing strategic entry or exit points.

Combining these concepts with the understanding of mitigation blocks and breaker blocks offers traders a comprehensive toolkit for navigating the complexities of market dynamics.

How to Implement Mitigation Block in Your Trading Strategy

Implementing Mitigation Block in your trading strategy is a systematic approach that requires careful planning, execution, and monitoring. Here’s a step-by-step guide to effectively incorporate Mitigation Block into your trading activities:

Step 1: Identify Potential Risks

- Conduct Market Analysis: Regularly analyze market trends, economic indicators, and news events to identify potential risks.

- Understand Asset Specifics: Gain a deep understanding of the assets you are trading, including factors that may affect their prices.

Step 2: Develop a Mitigation Plan

- Set Risk Management Goals: Define what you aim to protect against – is it volatility, loss, or market downturns? Set clear, achievable goals.

- Choose Mitigation Techniques: Depending on the identified risks, select appropriate mitigation techniques such as stop-loss orders, options for hedging, diversification across assets and sectors, or adjusting the leverage used in trading.

Step 3: Implement the Strategy

- Apply Mitigation Measures: Execute the chosen mitigation techniques as part of your trading strategy. This may involve setting stop-loss levels, buying protective options, or diversifying your portfolio.

- Stay Disciplined: Stick to your mitigation plan even in volatile market conditions. Emotional trading can lead to significant losses.

Step 4: Execute and Monitor

- Continuous Monitoring: Keep a close eye on the market and your investments. Mitigation Block is not a set-and-forget strategy; it requires ongoing adjustment.

- Adjust as Necessary: Be prepared to adjust your mitigation strategies in response to changing market conditions or shifts in your investment goals.

Step 5: Review and Learn

- Evaluate Performance: Regularly review the effectiveness of your Mitigation Block strategy. Analyze both successes and failures to understand what worked and what didn’t.

- Adapt and Improve: Use your findings to refine your approach. Continual learning and adaptation are key to successful trading.

Tools and Resources

- Software and Analytics: Utilize trading platforms and analytics tools that offer real-time data, risk management features, and the ability to set automatic orders.

- Educational Resources: Engage with trading communities, attend workshops, and consume educational content to enhance your understanding of risk management strategies.

Implementing a Mitigation Block strategy is a dynamic and ongoing process. It requires a proactive approach to risk management, centered around continuous learning, discipline, and the willingness to adapt. By following these steps, traders can protect their investments, minimize losses, and position themselves for long-term success in the trading world.

Key Tools and Resources for Mitigation Block

Implementing a Mitigation Block strategy effectively requires the right set of tools and resources. These tools help in identifying risks, developing mitigation plans, executing these plans efficiently, and monitoring their effectiveness. Below, find a curated list of essential tools and resources that can significantly enhance your Mitigation Block strategy:

Trading Platforms with Advanced Analytics

- MetaTrader 4/5: Offers comprehensive tools for market analysis, including technical indicators and charting tools, ideal for spotting potential risks.

- Thinkorswim by TD Ameritrade: Known for its powerful analysis tools that help in risk assessment and strategy testing.

Risk Management Software

- Riskalyze: Helps in assessing risk tolerance and aligning your trading strategies with your risk profile.

- TradingView: Provides a range of indicators and drawing tools for market analysis, including features for planning and testing mitigation strategies.

Economic Calendars and News Aggregators

- Investing.com Economic Calendar: Offers real-time updates on global economic events that could impact markets.

- Bloomberg Terminal: Provides extensive financial news and analysis, crucial for identifying potential market risks.

Educational Resources

- Babypips: Great for beginners and experienced traders alike, offering comprehensive lessons on forex trading, including risk management.

- Coursera and Udemy: Host a variety of courses on trading, financial markets, and risk management strategies taught by industry experts.

Forums and Community Platforms

- Reddit (subreddits like r/Forex and r/Daytrading): A place to exchange ideas, strategies, and experiences with other traders.

- TradingView Community: Offers a platform to share and discuss trading ideas and strategies with a large community of traders.

Technical Analysis Tools

- Fibonacci Retracement Levels: Useful for identifying potential support and resistance levels, helping in setting stop-loss orders.

- Volatility Indexes (VIX): Provides a measure of market risk and sentiment, crucial for risk assessment.

Portfolio Management Tools

- Personal Capital: Offers tools for tracking investments and assessing diversification across your portfolio.

- Mint: While primarily a personal finance app, Mint can help track investments and analyze how they fit into your overall financial picture.

Equipping yourself with the right tools and resources is essential for effectively implementing a Mitigation Block strategy in your trading. By leveraging these platforms, software, and educational materials, traders can enhance their ability to manage risks, make informed decisions, and strive for long-term success in the markets. Always remember to continuously update your knowledge and tools as markets evolve.

Conclusion

The implementation of Mitigation Block strategies in trading and investment portfolios is a testament to the power of proactive risk management. As demonstrated through the exploration of its concept, benefits, practical implementation steps, essential tools and resources, and illustrative case studies, Mitigation Block serves as a cornerstone for achieving both stability and success in the volatile realm of financial markets.

Mitigation Block not only helps in safeguarding investments from unforeseen downturns but also empowers traders and investors with the confidence to make informed decisions. The strategy’s emphasis on identifying potential risks, developing tailored mitigation plans, and employing continuous monitoring and adjustment processes ensures that individuals can navigate through market uncertainties with greater assurance.

Key takeaways from this comprehensive look into Mitigation Block include the importance of:

- A clear understanding of market risks and the mechanisms to mitigate them.

- Strategic planning and disciplined execution of risk management techniques.

- Leveraging advanced tools and resources for effective implementation.

- Learning from real-world applications and success stories to refine one’s approach.

The journey towards mastering Mitigation Block is one of continuous learning and adaptation. The financial markets are ever-evolving, and so should our strategies to manage risk. By embracing the principles of Mitigation Block, traders and investors can protect their capital, optimize their performance, and pursue long-term growth with an informed perspective and a robust defense against volatility.

In conclusion, Mitigation Block is more than just a strategy; it’s a critical mindset for anyone looking to thrive in the financial markets. By prioritizing risk management and employing the practices outlined in this guide, you can enhance your trading or investment approach, achieve your financial goals, and navigate the complexities of the market with confidence and success.