Elements To A Trade Setup

Context or Framework surrounding the idea.

- Expansion = Judas swing

- Retracement = New york session

- Reversal = London swing

- Consolidation = Asian range

Reference Points In Institutional Order Flow

- Orderblocks

- Fair Value Gaps & Liquidity Voids

- Liquidity Pools & Stop Runs

- Equilibrium

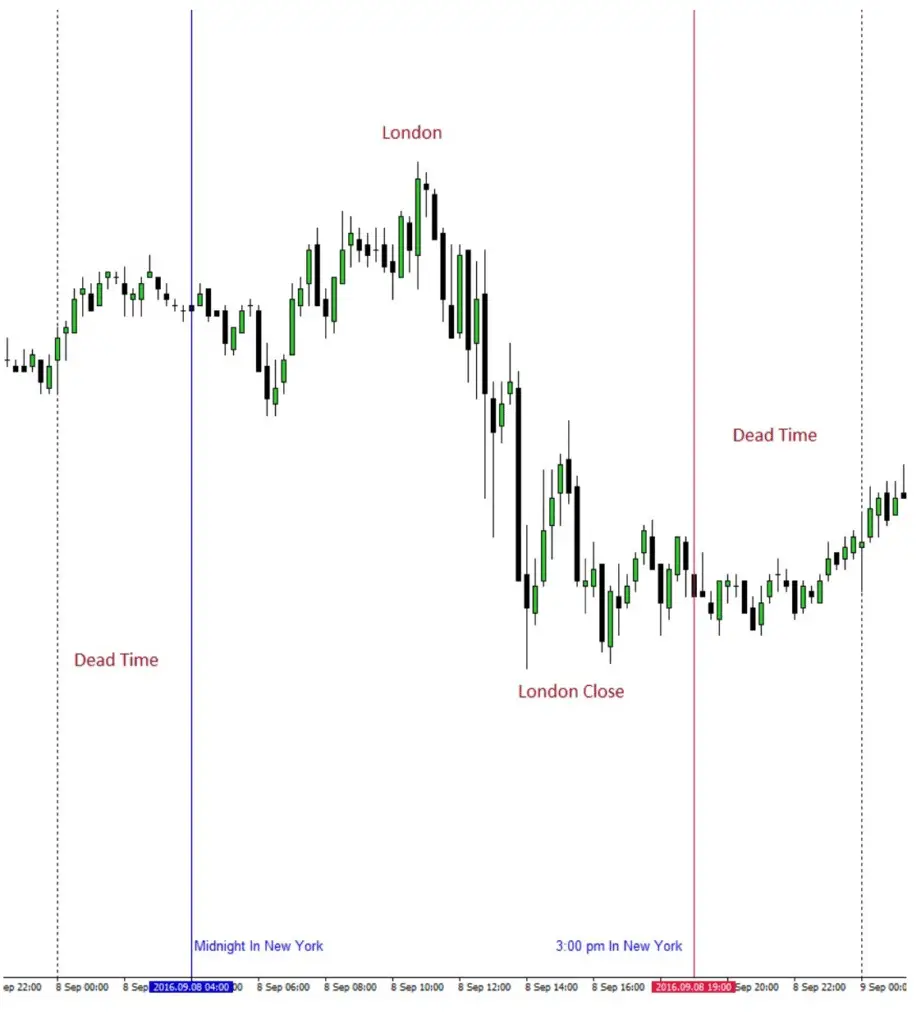

True Day – Daily Trading Range

The IPDA, a system used to provide price information to banks and financial institutions globally, sets the daily trading period from midnight to 3:00 pm in New York. Any time outside this range is usually called “dead time” and is considered less reliable for predictions.

Expansion

This occurs when the price rapidly moves away from a stable level.

Why is it important?

A quick price change from a stable level shows that Market Makers are ready to show their new pricing strategy.

What to observe in price?

Look for the Orderblock left by Market Makers close to the stable level.

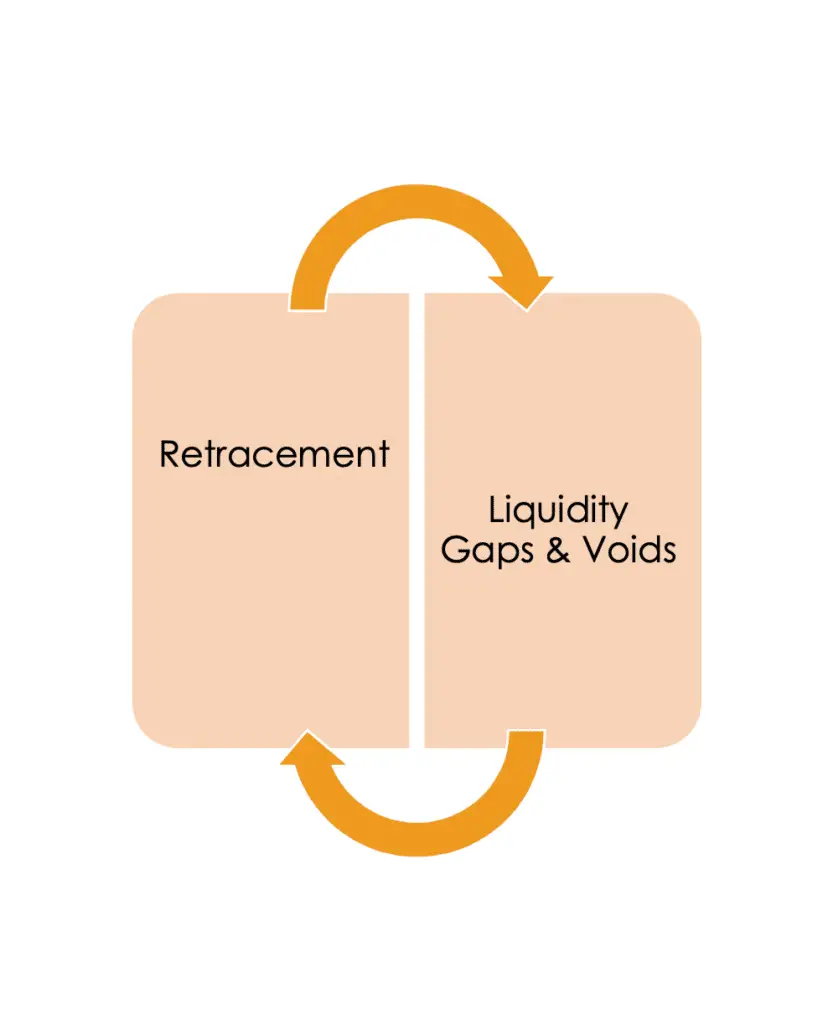

Retracement

Retracement happens when the price goes back into the price range that was recently established.

Importance

When the price moves back into a recent price range, it shows that Market Makers are open to adjusting prices to levels that were not previously traded at fair value.

What to Look for in Price

Pay attention to the Fair Value Gaps and Liquidity Voids.

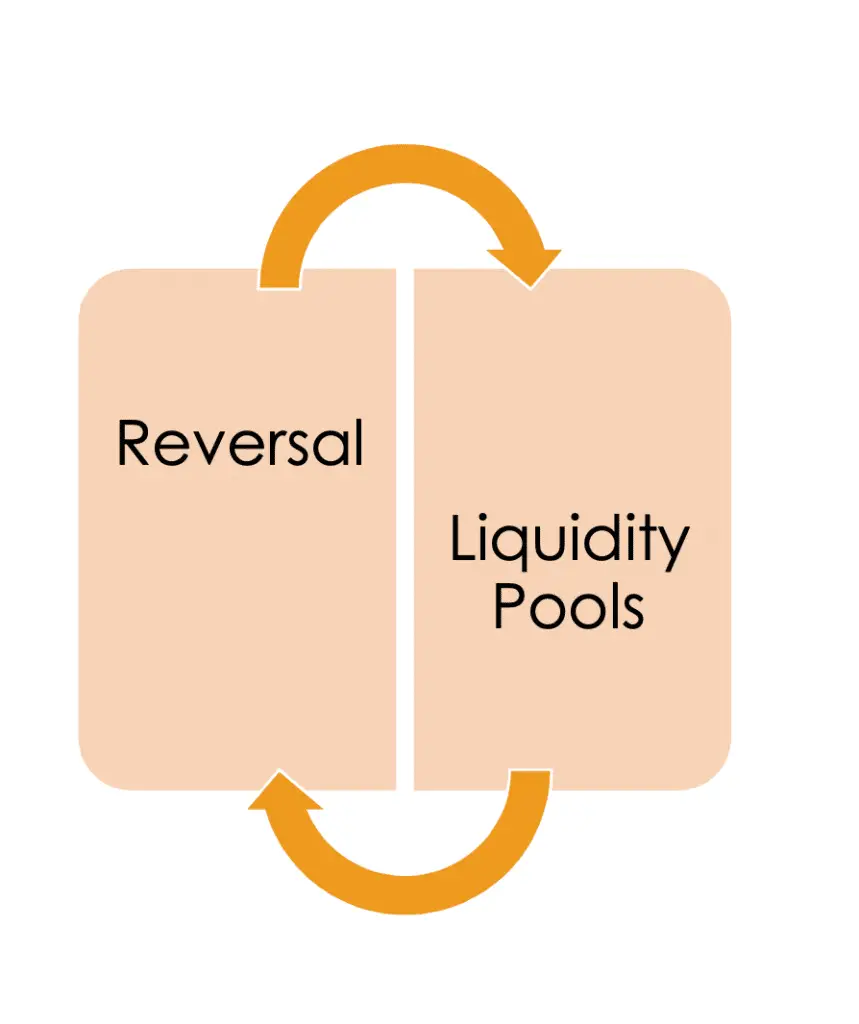

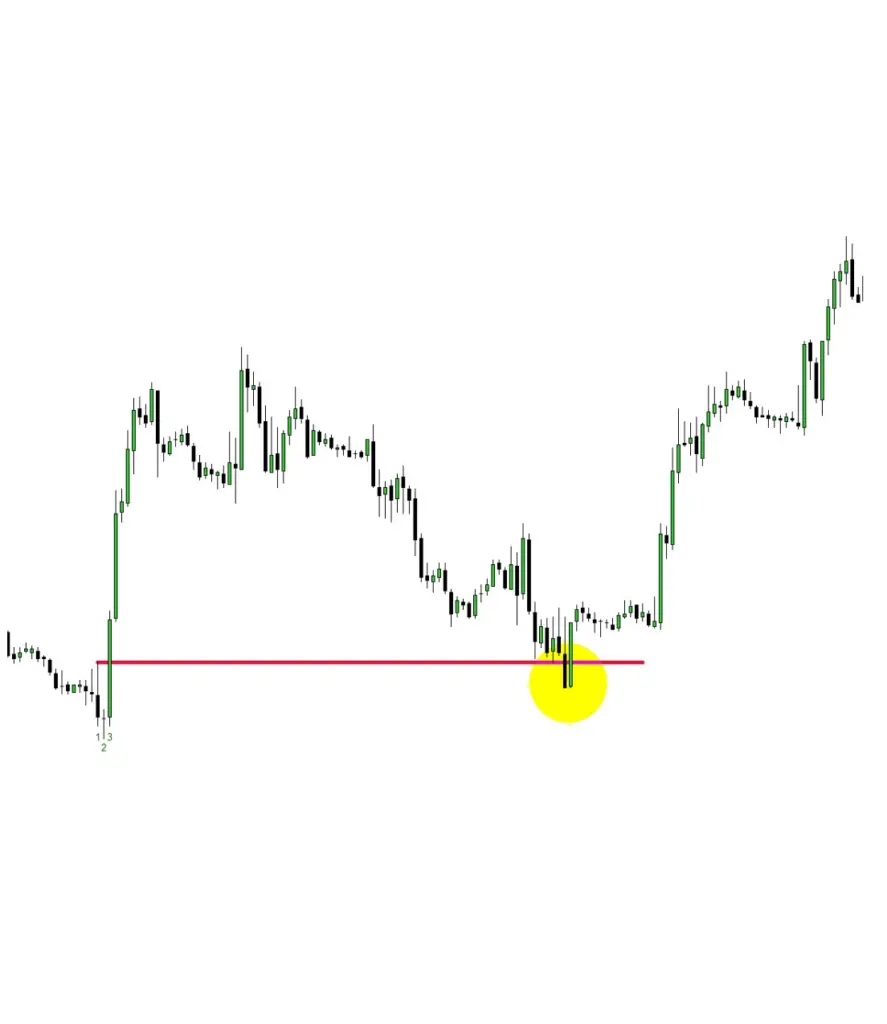

Reversal

Reversal occurs when the price starts moving in the opposite direction of its current trend.

Importance

A price reversal suggests that Market Makers have hit a stop level, hinting at a significant move in this new direction.

What to Look for in Price

Focus on the Liquidity Pools located just above an old price high and just below an old price low.

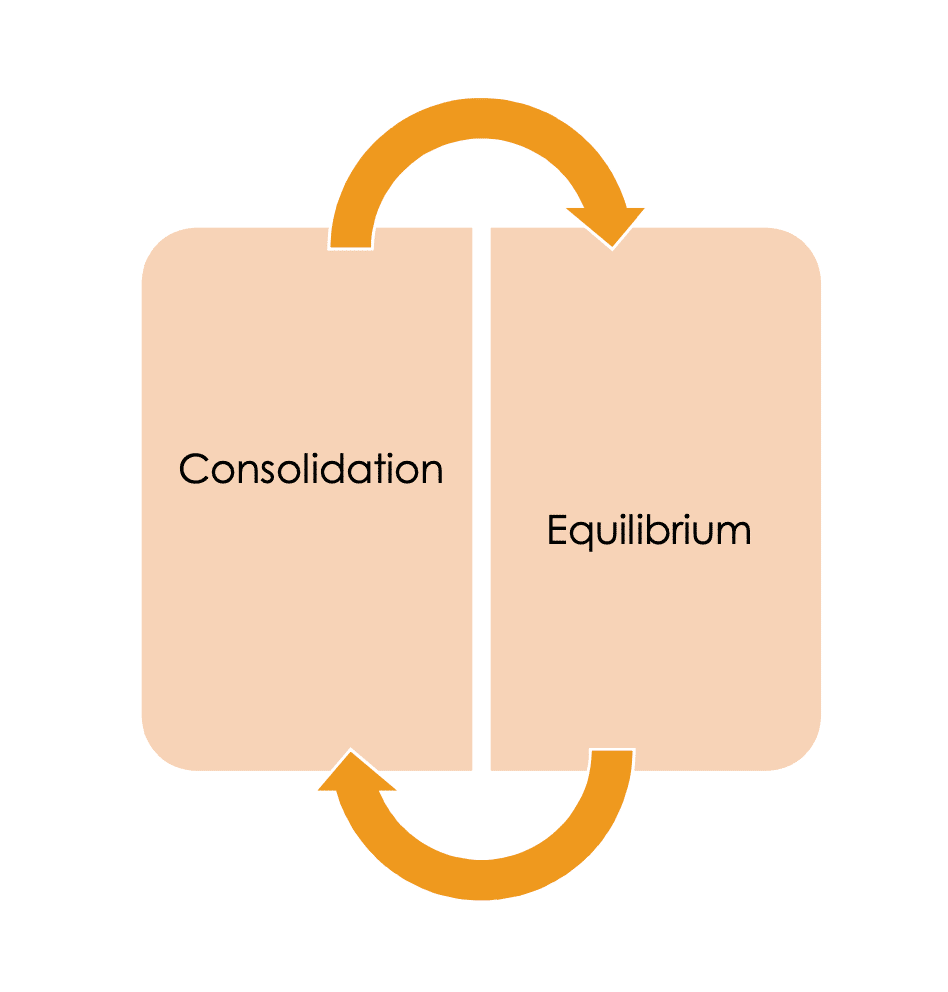

Consolidation

Consolidation happens when the price stays within a defined trading range, showing no strong intent to move significantly higher or lower.

Importance

Consolidation signals that Market Makers are gathering orders on both sides of the market, suggesting an upcoming Expansion in the near future.

What to Look for in Price

Look for the Impulse Swing in price moving away from the Equilibrium price, which is located precisely at the midpoint of the Consolidation range.

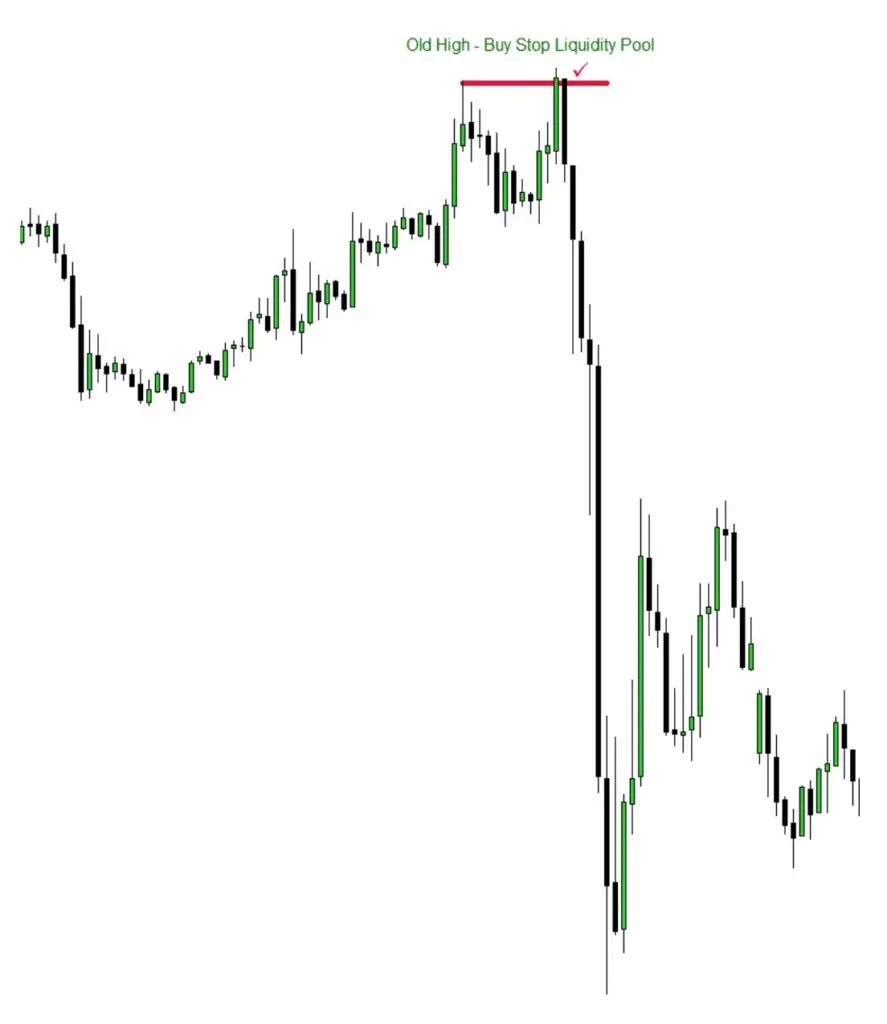

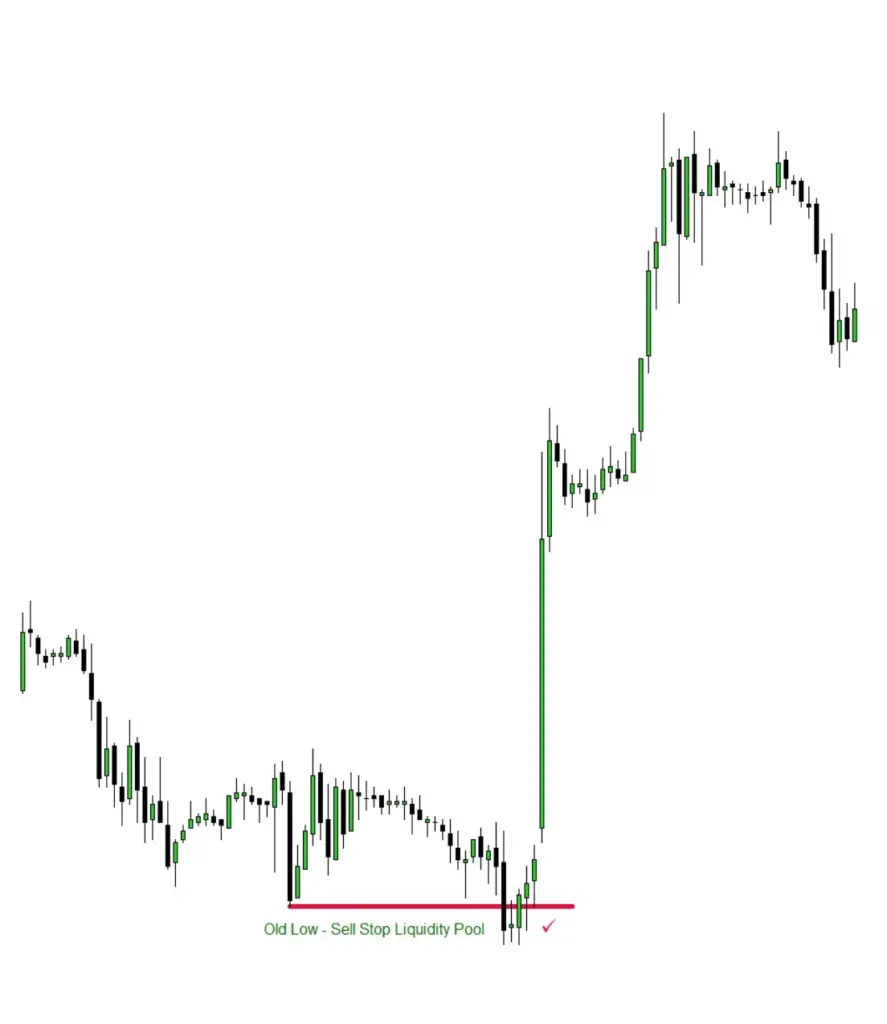

What To Focus On

Old Highs – Look for Buy Stops or Buy Side Open Float.

Old Lows – Watch for Sell Stops or Sell Side Open Float.

Clean Highs – Identify Liquidity Pools of Buy Stops.

Clean Lows – Observe Liquidity Pools of Sell Stops.

Sharp Runs In Price – Pay attention to Liquidity Voids.

Swing High – Notice the three-candle pattern, specifically the up candle.

Swing Low – Look for the three-candle pattern, particularly the down candle.

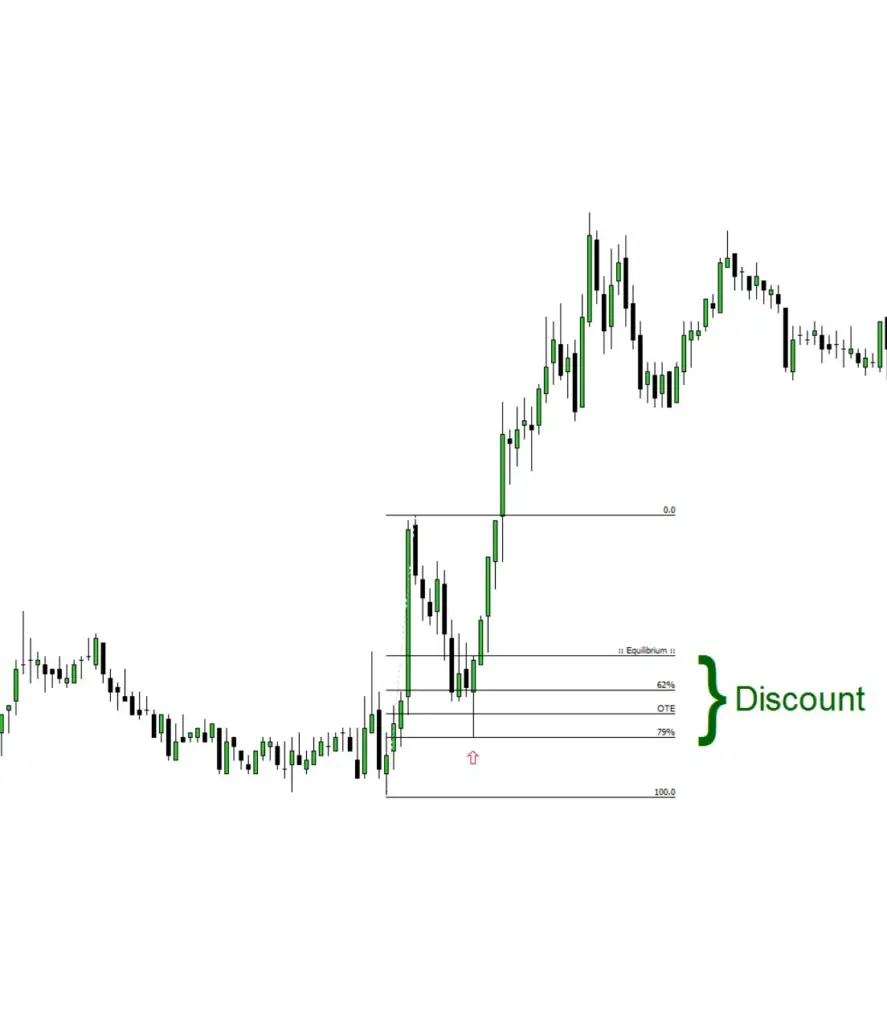

Equilibrium vs. Discount

When a market has risen and starts to retrace downwards, watch for a fall below 50% of the initial price increase. If the price drops below this 50% mark or Equilibrium, it suggests that the price is now at a Discount, setting up ideal opportunities for buying.

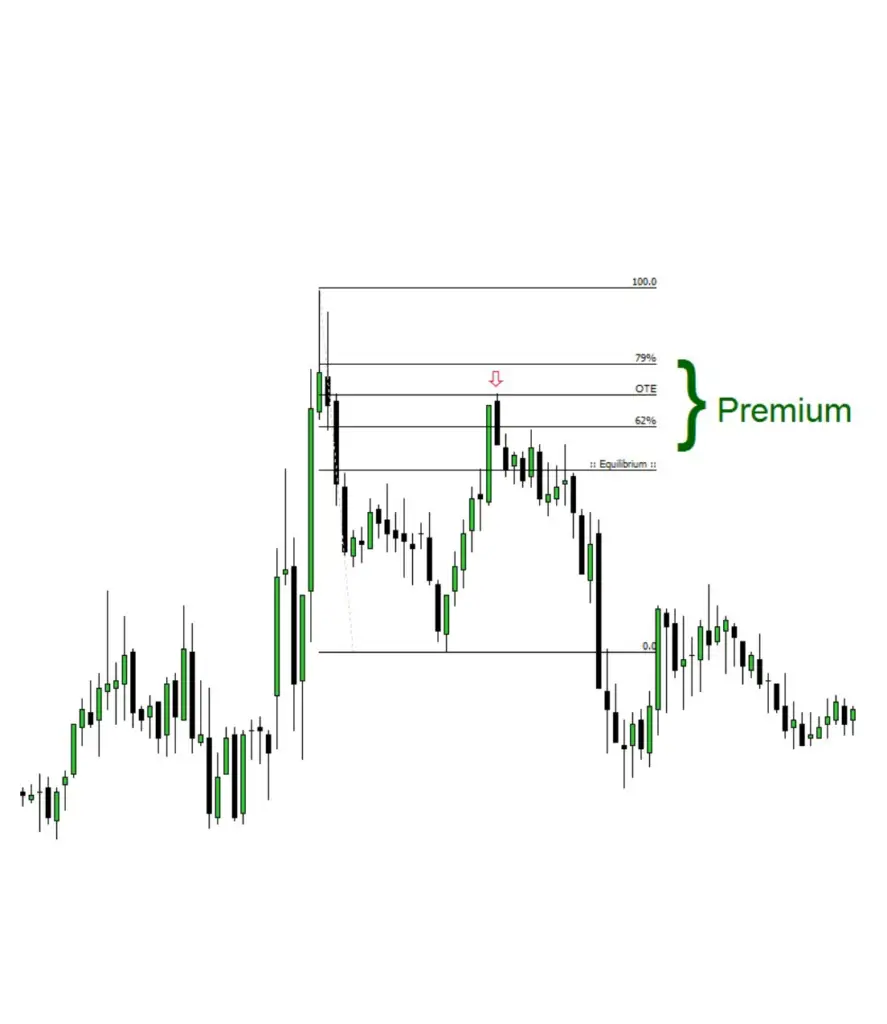

Equilibrium vs. Premium

When a market experiences a downturn and then starts to recover, observe for a rise above 50% of the initial price drop. If the price climbs above this 50% level or Equilibrium, it implies that the price is now at a Premium, creating optimal conditions for selling setups.

Liquidity Void

Following a rapid movement in price, the large candle formations are often the least efficiently traded within that range. These sudden jumps in price can create gaps in the price action, which are usually filled at a later stage. This phenomenon is known as a lack of market liquidity, or a Liquidity Void.

Fair Valuation

Fair Valuation occurs when the price moves back into its current range, returning to levels from which it had recently moved away. In this scenario, Smart Money often liquidates long positions and frequently initiates new short positions. This makes it a favorable spot to take profits on a long position without needing a move outside the current trading range.

Fair Value Gap

A Fair Value Gap is identified when the price departs from a specific level and exhibits a small segment of price action that is predominantly one-directional. This concept closely resembles what is traditionally referred to as a “Common Gap” in technical analysis. Fair Value Gaps can serve as targets for profit-taking or as opportunities for new setups, depending on the prevailing market conditions.

Low Resistance Liquidity Run

A Low Resistance Liquidity Run occurs when the price encounters minimal resistance on its path to a liquidity area. This is commonly observed just below an Old High or above an Old Low. Price often surges sharply, usually in response to the release of economic news. High Probability setups are based on the expectation that the market will face little resistance as it moves towards apparent Liquidity Pools.

Market Protraction

Market Protraction refers to occasions during specific times of the day when sudden movements in the market occur in the opposite direction of the day’s overall trend. Previously termed as a “Judas Swing” in earlier works, this event represents a micro expansion in price that targets nearby liquidity before changing direction.

Take Away

Key point to remember: There’s no need to fear missing out on setups or trades. Opportunities arise daily for traders who adopt an institutional mindset. Stay focused on strategy and market patterns, and you’ll find regular chances to engage effectively.