Introduction

In the world of trading, handling losses effectively is just as important as securing wins. In the fifth teaching of the second month of the ICT Mentorship, we delve into this crucial aspect of trading – how to mitigate losing trades effectively. This session is a vital part of the mentorship, as it addresses a scenario that every trader, whether novice or experienced, will inevitably face.

Losing trades are a reality in the trading world, but they don’t have to define your trading journey. This teaching focuses on strategies and insights to not only cope with losses but to use them as learning opportunities to enhance future trading decisions. We’ll explore various methods to manage and minimize losses, adjust strategies after a loss, and maintain a resilient trading mindset.

Understanding how to effectively mitigate losses is key to long-term success in trading. It’s about striking a balance between accepting losses as a part of the trading process and learning from them to improve your overall strategy. This session aims to equip traders with the knowledge and tools necessary to turn potential setbacks into valuable learning experiences.

Analyzing a Trade Setup: A Practical Example

Let’s walk through a real-world trade setup, using simple terms and focusing on key trading concepts. We’ll use the Aussie dollar as our example, a favorite among many traders for its clear patterns and trends.

Step 1: Looking at the Price Action

- First things first, we check out how the Aussie dollar has been moving. Is it trending up or down? Have there been any big jumps or drops recently? This big picture view helps us get a sense of what might come next.

Step 2: Setting Up the Trade

- With our trend in mind, we start sketching out where we might want to jump in and out of the market. For a rising trend, we look for spots where the price dipped a bit but didn’t crash – these could be our chances to buy.

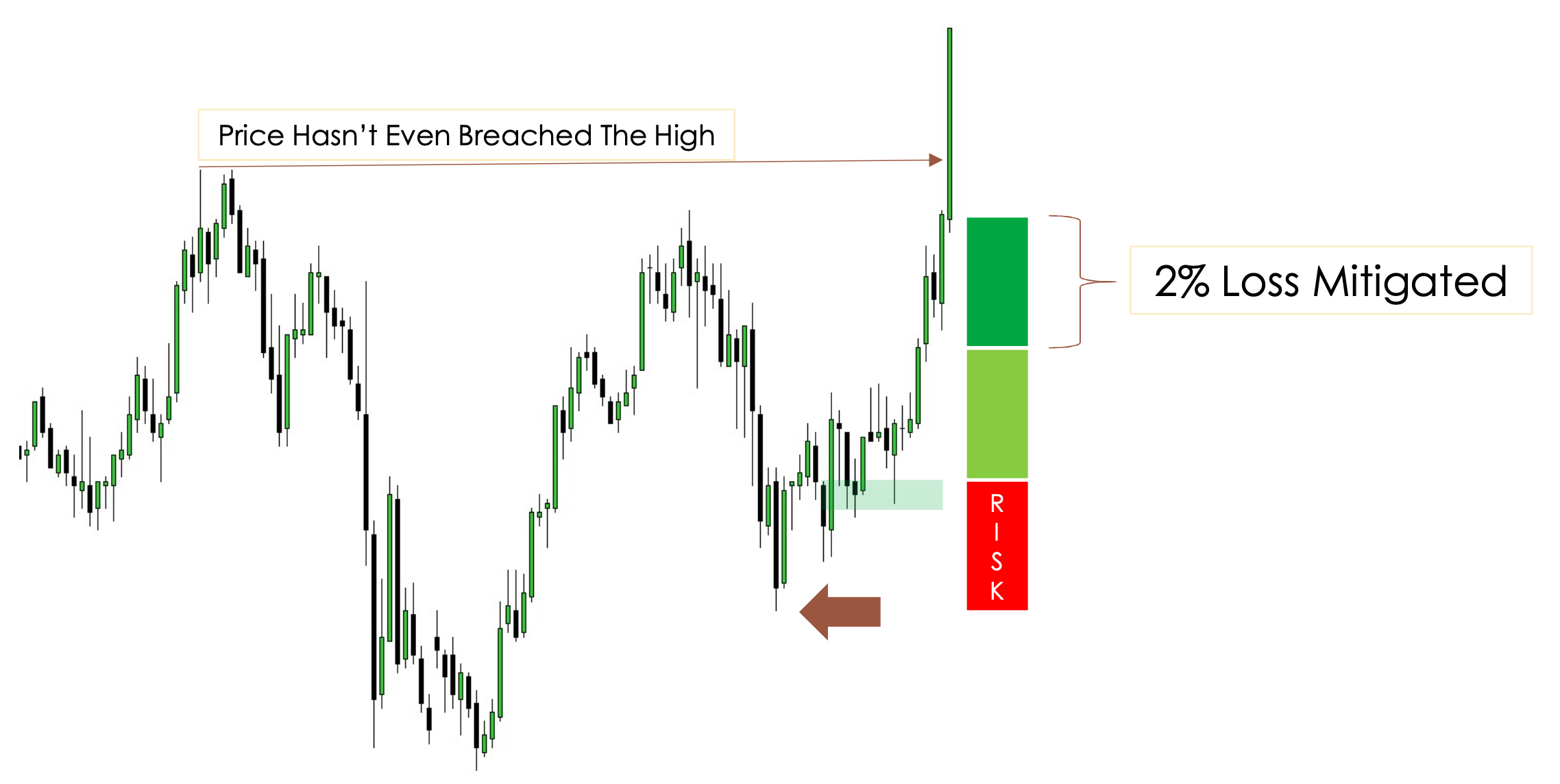

Step 3: Spotting Bullish Order Blocks

- A ‘bullish order block’ is just a fancy way of saying a spot on the chart where it looks like a bunch of buyers jumped in previously, pushing the price up. We look for these because they can be like magnets to the price – areas where it might bounce back up.

Step 4: The Mean Threshold

- This is about finding a sort of average price level – a line that the price tends to hover around. In a rising market, if the price dips but stays above this line, it’s like a signal that buyers are still interested, and it might be a good time to buy.

By breaking down this Aussie dollar trade, we get a practical look at how to spot good trading opportunities.

Managing Losing Trades

In trading, not every trade will go as planned. Managing these situations effectively is key to long-term success. Here’s a simple guide on handling losing trades and using stop-loss orders wisely.

1. Handling Trades That Don’t Go As Planned:

- Accept that losses are part of trading. It’s impossible to win every time.

- After a losing trade, take a step back. Review what happened and why. This can help you learn and avoid similar mistakes in the future.

- Don’t rush into another trade to try to make up for a loss. This often leads to more losses because the decision is driven by emotion, not analysis.

2. Using Stop-Loss Orders Effectively:

- A stop-loss order is your safety net. It automatically closes a trade at a pre-set level to prevent further losses.

- Place your stop-loss at a level that makes sense in the context of your trading strategy and the market conditions. Don’t set it too close to your entry point, as normal market fluctuations might trigger it unnecessarily.

- Consider using a trailing stop-loss in winning trades. This adjusts your stop-loss level as the trade moves in your favor, locking in profits while still giving the trade room to grow.

3. The Importance of Stop-Loss Placement:

- Good stop-loss placement balances between protecting your capital and giving a trade enough space to breathe.

- Avoid placing stop-loss orders at obvious levels where everyone else might place theirs, like just below a recent low for a long position. These levels are often targeted by market movements.

By managing losing trades calmly and using stop-loss orders strategically, you can keep your losses small. This allows your winning trades to more than make up for these losses over time, leading to overall profitability.

Reevaluating Trade Setups

Every trader faces stop-outs, but what you do afterward can really make a difference. Let’s talk about how to bounce back by reassessing your trade setups and adjusting your approach.

After a Stop-Out:

- It’s normal to feel a bit down after a stop-out, but this is actually a great time to learn. Ask yourself, why did this trade not work? Was it the market conditions, or was your analysis off? This reflection can sharpen your trading skills.

- Revisit the charts. Sometimes, the market gives a second chance. Look for any changes or new patterns that might suggest another opportunity.

Adjusting Your Approach:

- If you’ve just had a loss, it might be tempting to bet big on the next trade to make it back. But that’s a risky move. A better approach is to scale back a bit.

- Lower your leverage and reduce your position size for the next few trades. This helps manage risk and gives you some breathing room to regain confidence without the pressure of needing a big win.

- Remember, trading is not about winning big overnight; it’s about consistent and smart decision-making over time.

The Role of Patience and Adjusting Strategies

In trading, patience isn’t just a virtue; it’s a necessity, especially after facing a losing trade. Let’s talk about how staying patient and adjusting your strategies can lead to better trading decisions.

Patience After a Loss:

- It’s easy to feel rushed to ‘make back’ what you lost after a losing trade. But this is when patience is most critical. Hasty decisions often lead to more losses.

- Give the market time to show its hand. Sometimes, waiting reveals new trends or opportunities that weren’t apparent right after your loss.

Adjusting Your Strategies:

- Every trade outcome, win or loss, gives you feedback. Use this feedback to refine your trading strategies.

- For example, if you notice that your stop-loss orders are consistently hit before the market moves in your predicted direction, you might need to adjust your stop-loss placement strategy.

- If certain strategies or assets are not working well for you, don’t hesitate to shift your focus. Flexibility in trading is key.

Balancing Patience with Action:

- Being patient doesn’t mean being inactive. It means being thoughtful about your next move. Sometimes the best action is to wait for a clearer opportunity.

- Keep analyzing the markets and be ready to act when your analysis signals a strong opportunity. This balance between patience and decisiveness is what often separates successful traders from the rest.

Patience in trading, particularly after setbacks, helps maintain a clear head, which is essential for making sound trading decisions.

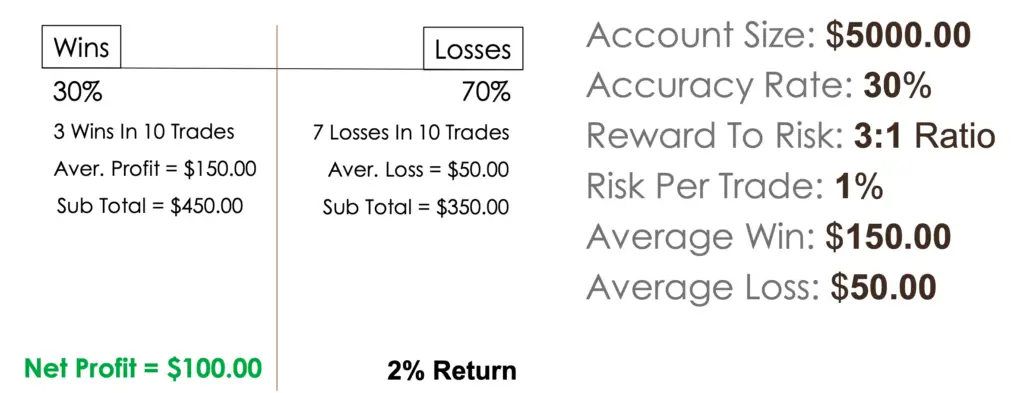

Risk Management and Position Sizing

In trading, how you handle losses can be just as important as how you secure wins. Effective risk management and smart position sizing are crucial, especially after a losing trade.

| Aspect | What to Do | Why It Matters |

|---|---|---|

| Reducing Position Size | After a loss, lower your position size for the next trades. | Smaller positions mean less risk, helping you stay in the game without risking too much. |

| Adjusting Risk Parameters | Use tighter risk parameters, like closer stop-losses. | This limits potential losses, allowing for a more controlled and cautious approach to recoup losses. |

| Recouping Losses | Aim for small, consistent gains rather than big wins. | Steady gains can gradually offset previous losses, moving your account back to a positive state without unnecessary risks. |

| Review and Learn | Analyze the losing trade to understand what went wrong. | Learning from losses is key to improving your strategy and avoiding similar mistakes in the future. |

| Patience and Persistence | Don’t rush to make back the loss; be patient and stick to your plan. | Patience ensures you wait for the right opportunities, avoiding impulsive and potentially risky trades. |

Conclusion

To wrap it up, making smart moves in trading, especially after a loss, is all about staying cool-headed and strategic. Remember, losses are part of the game, but they don’t define your trading journey. It’s how you respond that counts.

Keep your trades smaller and more controlled after a setback. This way, you protect your account and give yourself a better chance to recover steadily. Don’t chase big wins to make up for losses; instead, focus on consistent, small gains. Every trade is a learning opportunity, so take the time to review what went right or wrong.