Introduction

Welcome to Lesson Three of our mentorship program. In this session, we’re going to delve into a crucial aspect of trading: understanding and identifying institutional sponsorship in trading setups.

This knowledge is key to recognizing the bigger market forces at play and aligning our trading strategies accordingly. We’ll explore how institutional movements shape the market and learn how to spot these influential players’ actions, enhancing our ability to make informed trading decisions.

Institutional Sponsorship in Long Setups

Understanding institutional sponsorship in long (buy) setups is crucial for traders looking to align their strategies with significant market movements. Here are the key concepts to recognize such sponsorship:

Higher Timeframe Price Displacement

- Reversals, Expansions, or Returns to Fair Value: Recognize shifts in the market trend on a higher timeframe. These can manifest as trend reversals, market expansions, or a return to what is considered a fair value for the asset.

- Significance of Price Movements: Large movements in price on higher timeframes often indicate institutional activity, whether it’s initiating new positions or unwinding existing ones.

Intermediate-Term Price Imbalance

- Moves to Discounts or Sell-Side Liquidity Runs: Identify scenarios where the price moves significantly towards areas of perceived value or discounts. This often leads to sell-side liquidity runs, which are crucial for spotting long setup opportunities.

- Balance Between Supply and Demand: Intermediate-term imbalances reflect shifts in supply and demand dynamics, often driven by institutional activities.

Importance of Short-Term Buy Liquidity Above the Market

- Identifying Buy Stops: Understand where short-term buy liquidity, such as clusters of buy stops, is likely to be positioned above the market. These areas are potential targets for institutional players to push the price towards.

- Momentum Indicators: The presence of buy liquidity above the market can signal potential upward momentum, as institutions may drive the price higher to trigger these stops.

Time of Day Influences

- London Open or New York Session Low Formation: Pay attention to the specific times of day when these market shifts often occur. The London open and the formation of lows during the New York session can be critical periods for institutional entry, influencing the direction for the rest of the session.

- Market Rhythms and Institutional Activity: Recognizing these time-of-day patterns helps in aligning with the rhythms of institutional trading activity, providing an edge in predicting market movements.

Criteria for Institutional Sponsorship

To effectively navigate and profit from the financial markets, it’s essential to understand the criteria for institutional sponsorship. This concept is pivotal in identifying significant market movements and aligning your trading strategies with those of large institutions.

Understanding the Staging for Institutional Sponsorship

- Higher Timeframe Displacement: Recognizing large-scale movements in price over longer timeframes is the first step. This displacement often signals the involvement of institutional players, who have the capital to influence such significant trends.

- Intermediate-Term Price Imbalance: Detecting price movements that diverge from the norm over an intermediate period is crucial. These imbalances can indicate an impending reversal or continuation of the trend, often initiated by institutional activity.

Recognizing Actual Institutional Sponsorship

- Push Towards Buy-Side Liquidity Above the Market: After the initial steps, actual institutional sponsorship is often revealed by a concerted effort to push prices towards areas with high buy-side liquidity. This typically includes targeting levels above the market where buy stops are clustered.

- Analysis of Price Action: Sharp, decisive moves towards these areas can be a strong indication of institutional buying. Monitoring such price action helps in confirming the presence of institutional sponsorship.

Importance of the Market Maker Perspective

- Selling High and Finding Higher Buyers: Adopting a market maker perspective involves understanding the necessity to sell at high prices and identifying potential higher buyers in the market.

- Strategic Positioning: This perspective enables traders to strategically position their trades, anticipating areas where the market is likely to move based on institutional activity. It’s about being one step ahead in recognizing where large players are likely to enter or exit the market.

- Market Dynamics Understanding: A deep understanding of market dynamics, including supply and demand, liquidity pools, and stop clusters, plays a key role in successfully identifying institutional sponsorship.

Institutional Sponsorship in Short Setups

Identifying institutional sponsorship in short (sell) setups is as crucial as in long setups, albeit with a reverse approach. By adapting the criteria used for long positions, traders can effectively spot opportunities for short positions driven by institutional movements.

Adapting Long Setup Criteria for Short Setups

- The methodology used to identify institutional sponsorship in long setups can be mirrored to find similar patterns in short setups. Understanding this symmetry in market behavior is key to a balanced trading strategy.

Higher Timeframe Price Displacement in Reverse

- Focus on Reversals, Expansions, or Returns to Fair Value: In short setups, this involves identifying downward reversals, market contractions, or a return to a lower fair value.

- Price Displacement Indicators: High timeframe displacement indicating a downward trend or bearish sentiment can signal institutional selling activity.

Identifying Moves to Premiums or Buy-Side Liquidity Runs

- Moves to Premiums: This refers to price movements that approach or exceed perceived value levels, suggesting overbought conditions that are ripe for a reversal.

- Buy-Side Liquidity Runs: Spotting these runs involves identifying areas where buy stops might have accumulated, which institutions could target for triggering a sell-off.

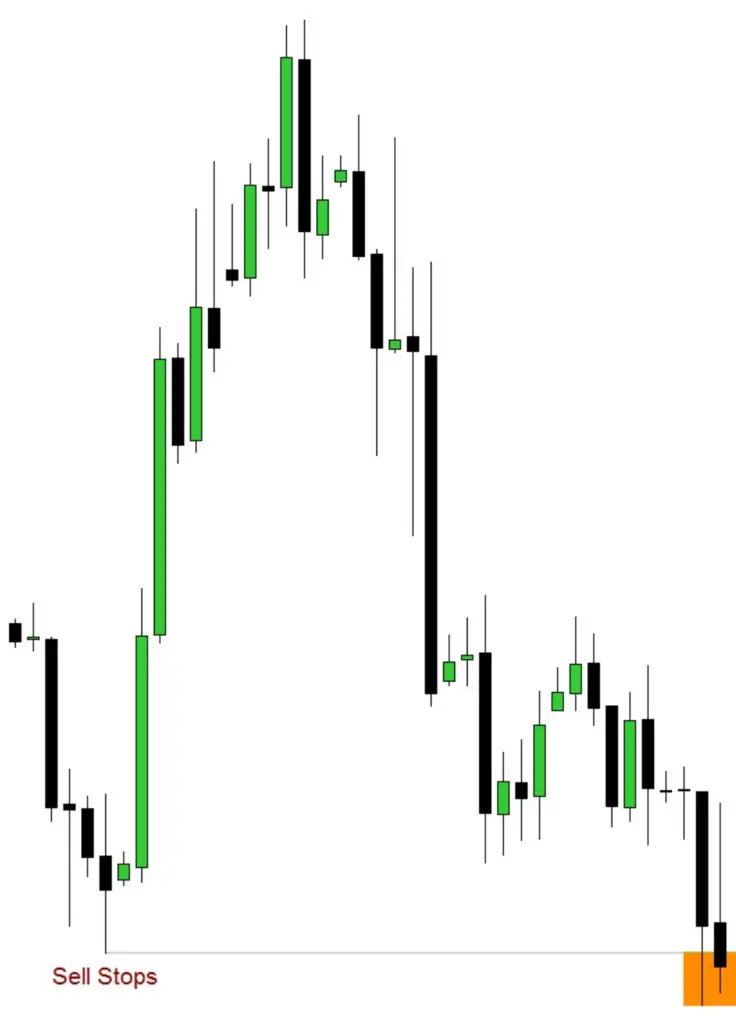

Seeking Short-Term Sell Liquidity Below the Market

- Locating Sell Stops: Understanding where short-term sell liquidity, such as clusters of sell stops, is positioned below the current market price.

- Predicting Downward Momentum: These areas are potential targets for institutional players to push the price downwards, signaling a robust downward momentum.

Time of Day Influences for Short Setups

- Mirroring Long Setup Timings: The timing for identifying short setups often mirrors that of long setups. Key times include the London open or the formation of highs during the New York session.

- Recognizing Bearish Market Rhythms: These time-of-day patterns are crucial in aligning with the rhythms of institutional trading activity, particularly when they suggest a bearish market direction.

By understanding and adapting these criteria, traders can effectively identify short setups influenced by institutional sponsorship.

Practical Example: Japanese Yen vs US Dollar

A detailed examination of the Japanese Yen versus the US Dollar provides an excellent real-world example to understand institutional sponsorship in trading. Here’s how you can analyze and interpret institutional activities in this currency pair.

Detailed Analysis of Daily Chart: Japanese Yen vs US Dollar

- Examining Price Trends and Movements: Start by observing the daily price chart of the Japanese Yen against the US Dollar. Look for significant trends, pivot points, and noticeable reversals or expansions in price.

- Historical Context: Consider the historical context of major price movements, understanding the background can often provide insights into future market behavior.

Identifying Characteristics of Institutional Sponsorship

- Large Scale Movements: Notice large-scale movements or shifts in the trend, as these can be indicative of institutional activities.

- Volume and Price Action: High trading volumes accompanying significant price changes can further confirm the presence of institutional players.

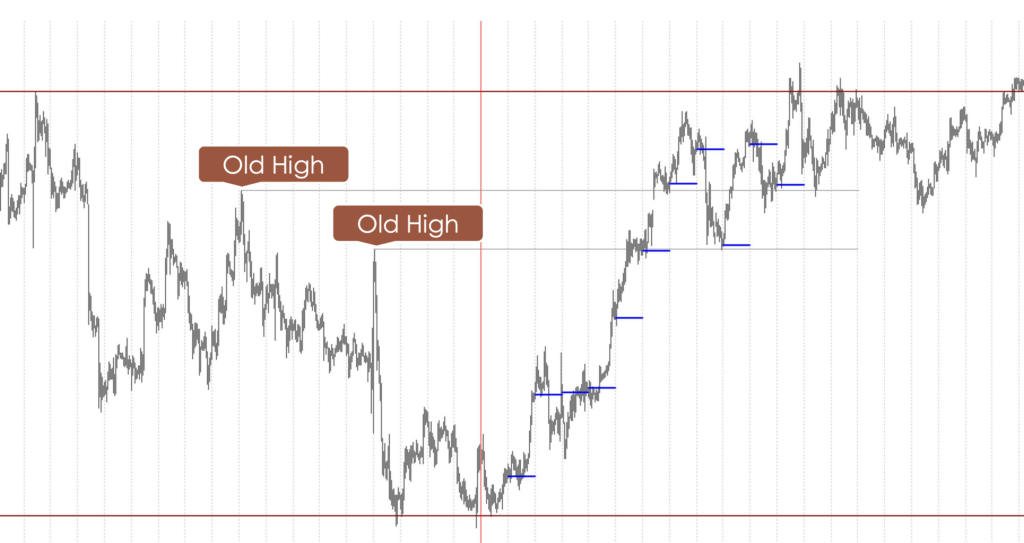

Analyzing Price Movements Below Old Lows

- Running Out Sell Stops: Pay attention to price movements that dip below previous lows. These are often strategic moves by institutions to trigger sell stops accumulated below these lows.

- Liquidity Pools: Understand that these lows often act as liquidity pools where sell stops cluster, making them attractive targets for institutions to trigger.

Identifying Bullish Order Blocks

- Spotting Bullish Signals: Identify bullish order blocks on the chart, which are indicative of potential upward price movements.

- Contextual Analysis: Analyze the circumstances leading to the formation of these bullish order blocks, such as preceding downtrends or consolidations.

Understanding the Significance of Bullish Order Blocks

- Indicator of Institutional Buying: Bullish order blocks can often signal institutional buying activity, marking areas where the market might find strong support.

- Strategic Entry Points: For traders, these blocks can offer strategic entry points for long positions, aligning their trades with potential institutional buying.

Importance of Dynamic Market Response

- Indicator of Institutional Activity: A dynamic market response, such as a swift and significant price change following the touch of a bullish order block, can be a strong indicator of institutional activity.

- Monitoring Price Reaction: Closely monitor how the market reacts to reaching these order blocks. A strong bullish response can validate the hypothesis of institutional support at these levels.

Lower Timeframe Analysis

Breaking down higher timeframe analysis into actionable insights on lower timeframes is a critical skill for traders. This approach allows for a more detailed and nuanced understanding of market dynamics and the influence of institutional sponsorship.

Translating Higher Timeframe Insights into Lower Timeframes

- Actionable Trading Decisions: Utilize the broad trends and movements identified on higher timeframes to inform trading decisions on a shorter scale.

- Alignment of Trends: Ensure that the insights gained from higher timeframe analysis align with what is observed on lower timeframes. Consistency across timeframes can reaffirm the strength of a trading signal.

Recognizing Order Blocks and Liquidity Pools on Shorter Timeframes

- Identifying Key Levels: Spot order blocks and liquidity pools on lower timeframes that correspond to significant levels identified on higher timeframes.

- Relevance of Order Blocks: Understand that order blocks on lower timeframes can offer entry and exit points that align with the broader market trend observed on higher timeframes.

- Liquidity Pools as Targets: Pay attention to how price interacts with these liquidity pools. Sharp reactions to these areas can indicate institutional activity and potential market turning points.

Understanding the Interplay of Price Action Across Different Timeframes

- Interconnectedness of Timeframes: Recognize that price action on one timeframe does not exist in isolation but is interconnected with trends and patterns on other timeframes.

- Institutional Footprints: Look for signs of institutional sponsorship, such as significant volume spikes or abrupt price movements at key levels across multiple timeframes.

- Consistency in Price Action: Consistent price behavior across timeframes can reinforce the validity of a potential trade setup. Inconsistencies may warrant a reassessment of the trading strategy.

Contextualizing Lower Timeframe Movements

- Micro vs. Macro Analysis: While lower timeframes provide granularity, it’s important to contextualize these movements within the larger picture painted by higher timeframe analysis.

- Adaptive Strategies: Be prepared to adapt trading strategies as new information unfolds on lower timeframes, always ensuring alignment with the overall market direction identified on higher timeframes.

In essence, effective lower timeframe analysis involves a blend of detailed examination of shorter-term price movements while keeping in mind the broader trends and institutional activities identified on higher timeframes.

Conclusion

In conclusion, mastering the art of identifying institutional sponsorship in trading setups, whether for long or short positions, is vital for aligning with the market’s significant players. By dissecting and understanding higher timeframe movements and how they translate into actionable insights on lower timeframes, traders can enhance their strategies effectively.