Introduction to Market Maker Traps

Welcome to our final lesson this month in the ICT mentorship, where we’re tackling a key topic for traders: market maker traps. Today, we’re zeroing in on false breakouts, especially in markets that are trending downwards.

In trading, understanding market maker traps can be a game-changer. These traps can trick you into making the wrong move, thinking the market is heading one way when it’s actually going the other. We’ll dive into how these traps work in bearish markets, where false signals can lead to hasty decisions.

By the end of this lesson, you’ll have a clearer picture of how to spot and avoid these traps. This is crucial knowledge for any trader looking to stay one step ahead in the markets. Let’s get started and unlock the secrets behind these market maker maneuvers.

False Breakout Above Price Consolidation

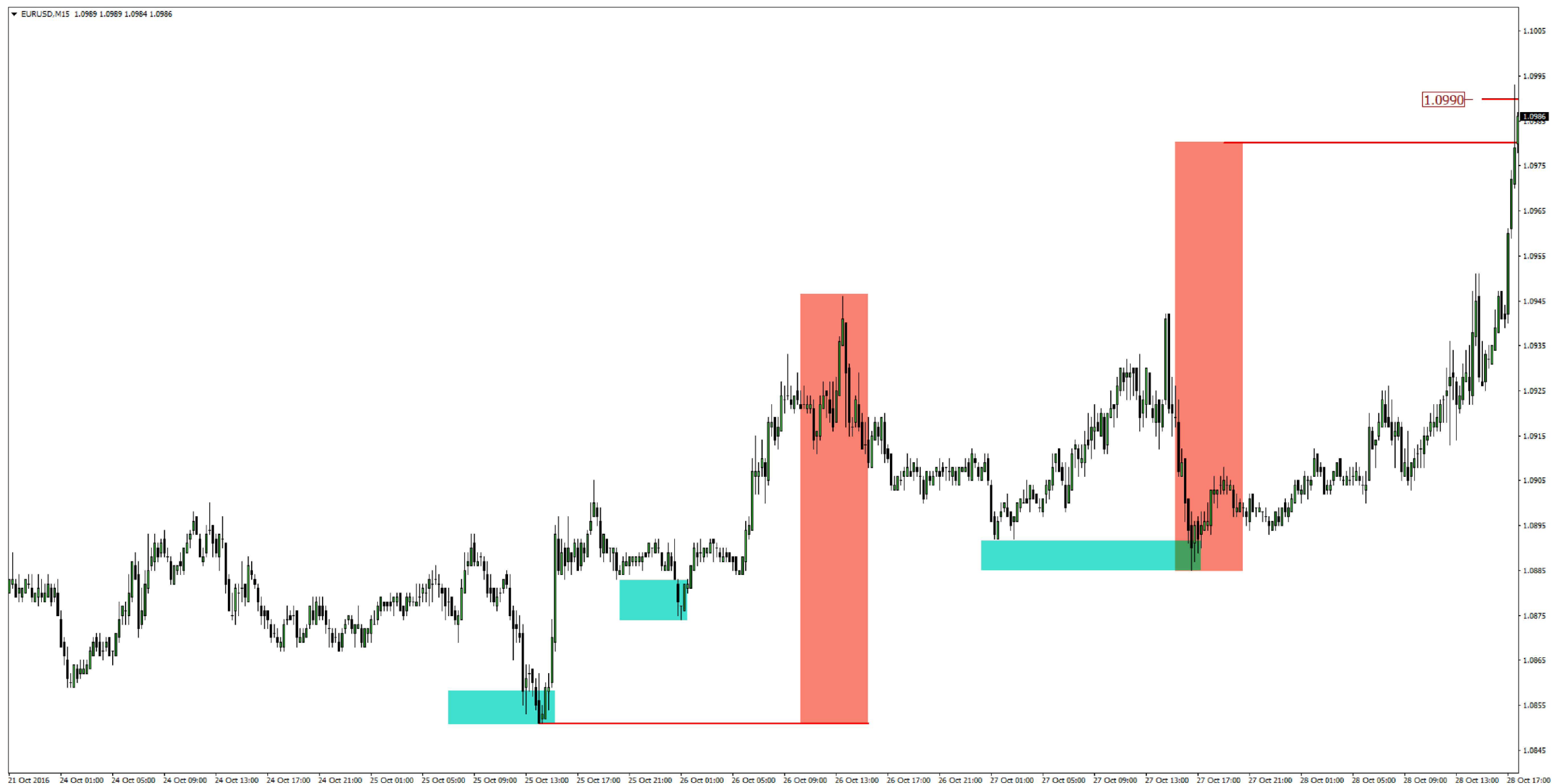

In our journey through understanding market maker traps, one key concept stands out: false breakouts above price consolidation, especially in primary bearish markets.

What Happens in False Breakouts:

- In a typical bear market, where the overall trend is downward, false breakouts can often occur.

- Here’s the scene: the market has been moving downwards and then enters a period of consolidation – where prices move sideways, forming a range. Traders keeping an eye on this start to expect a breakout.

- The trap is set when the market suddenly breaks above this consolidation range. Many traders interpret this as a sign of a trend reversal or the start of a bullish phase and jump in to buy.

The Trap for Breakout Traders:

- Breakout traders, who like to catch early trends, often place buy orders above the consolidation range, hoping to catch the market as it breaks out and starts climbing.

- However, in a false breakout, the market only breaks above the range briefly before resuming its downward trend. This quick, deceptive move upwards triggers the buy orders, only to leave the breakout traders caught in a losing position as the market falls back down.

- This scenario is common in bearish markets and is a classic market maker tactic to trigger and clear buy stops, creating a short-lived illusion of a bullish reversal.

Behavior of Market Makers

Grasping the behavior of market makers is crucial for any trader, especially when it comes to their tactics in bearish markets. Let’s delve into how market makers operate and their objectives in these scenarios.

Driving Prices to Trigger Buy Stops:

- In a bearish market, market makers often manipulate prices to move above a consolidation range. This is a strategic move aimed at triggering buy stops.

- Buy stops are typically placed above the consolidation range by traders who believe that a breakout above this range indicates a potential upward trend.

- Market makers push the price up briefly, activating these buy stops. Unsuspecting traders enter the market, thinking they’re catching the start of an uptrend.

Market Maker Objectives in Bearish Markets:

- The primary goal of market makers here is not to sustain the upward price movement but to create liquidity by triggering buy stops.

- Once the buy stops are triggered and the market is saturated with buyers, market makers then reverse the price direction, resuming the bearish trend. This move often catches traders off guard, resulting in losses for those who bought in during the false breakout.

- This strategy allows market makers to sell their positions at higher prices before the market continues its downward movement.

False Breakout Below Price Consolidations

In bullish markets, the scenario flips, and we encounter the opposite phenomenon: false breakouts below trading ranges. Let’s explore how these play out and the role of market makers in this context.

False Breakouts in Bullish Markets:

- In a market that’s generally trending upwards, a false breakout can occur when prices temporarily dip below a consolidation range or support level.

- Traders watching for breakouts might interpret this dip as the start of a bearish trend and place sell orders.

- However, similar to the false breakouts in bearish markets, these dips are often short-lived. The market quickly reverses back into the bullish trend, trapping those who acted on the perceived breakout.

Market Makers’ Role in Manipulating Prices:

- Market makers play a significant role in these scenarios. They intentionally drive the price below the consolidation range, targeting the accumulation of sell stops placed there by traders.

- When prices dip below the consolidation, these sell stops are triggered, creating a surge of selling activity. Market makers use this opportunity to buy at lower prices.

- Once the sell stops are exhausted, market makers reverse the trend, pushing prices back up into the bullish territory. This sudden reversal can leave traders who sold in response to the false breakout in a losing position.

Trader’s Perspective on Breakouts

From a trader’s standpoint, breakouts represent critical moments of opportunity and risk. Let’s explore the typical approach to trading breakouts and the challenges faced in the context of market maker strategies.

How Traders Approach Breakouts:

- Traders often monitor consolidation zones, identifying these as potential areas for breakouts.

- Buy stops are placed above the consolidation range, anticipating a breakout to the upside, while sell stops are positioned below the range, preparing for a potential downward breakout.

- The expectation is that a breakout will signal the start of a new trend, offering a chance to enter early and capitalize on this momentum.

Pitfalls of This Approach:

- Traders can be vulnerable to market maker tactics that exploit these breakout strategies.

- False breakouts, where market makers intentionally push prices beyond the consolidation zone only to quickly reverse direction, can trigger these stops and lead traders into unfavorable positions.

- The reliance solely on breakout signals without considering broader market dynamics or market maker behavior can result in frequent traps and losses.

Market Maker’s Perspective

Understanding how market makers view and manipulate these situations is key to navigating them successfully.

Market Makers and Consolidation Zones:

- Market makers often see consolidation zones as opportunities to create liquidity by triggering a large volume of stop orders.

- They are aware that numerous buy and sell stops are placed around these zones and can manipulate prices to activate these stops.

Strategies Market Makers Use:

- In a false breakout scenario, market makers might drive the price up to activate buy stops, then quickly reverse the trend, selling at higher prices before the market falls.

- Conversely, they might push the price down to trigger sell stops, buying at lower prices before reversing the trend upwards.

- Market makers leverage their understanding of trader behavior around these zones to maximize their profits, often at the expense of retail traders.

Conclusion

In wrapping up our exploration of market maker traps and false breakouts, it’s clear that these elements are pivotal in the complex world of trading. Understanding both the trader’s and market maker’s perspectives provides invaluable insights into navigating these scenarios more effectively.

Key Takeaways:

- Be Cautious with Breakouts: While breakouts can signal significant market moves, they can also be traps set by market makers. As a trader, it’s crucial to approach these with a degree of skepticism and a broader view of the market context.

- Understand Market Maker Tactics: Recognizing that market makers may manipulate prices to trigger buy and sell stops around consolidation zones can help in avoiding common pitfalls associated with false breakouts.

- Incorporate Comprehensive Analysis: A successful trading strategy involves more than just recognizing patterns. It requires an understanding of the broader market dynamics, including the actions and motives of market makers.

- Stay Informed and Adaptive: The market is ever-changing, and so are the strategies of market makers. Continuously educating yourself and adapting your strategies is essential for staying ahead in the trading game.

Wow, incredible blog format! How lengthy have you been running a blog for?

you made running a blog glance easy. The overall look of your site

is great, let alone the content material! You can see similar:

sklep internetowy and here sklep online