Welcome to the third lesson in our eight-part series for the ICT Mentorship’s first month. This session focuses on developing a successful trading mindset, challenging traditional retail trading approaches. This is especially beneficial for new traders, offering a new outlook unclouded by common misconceptions.

Understanding Market Psychology

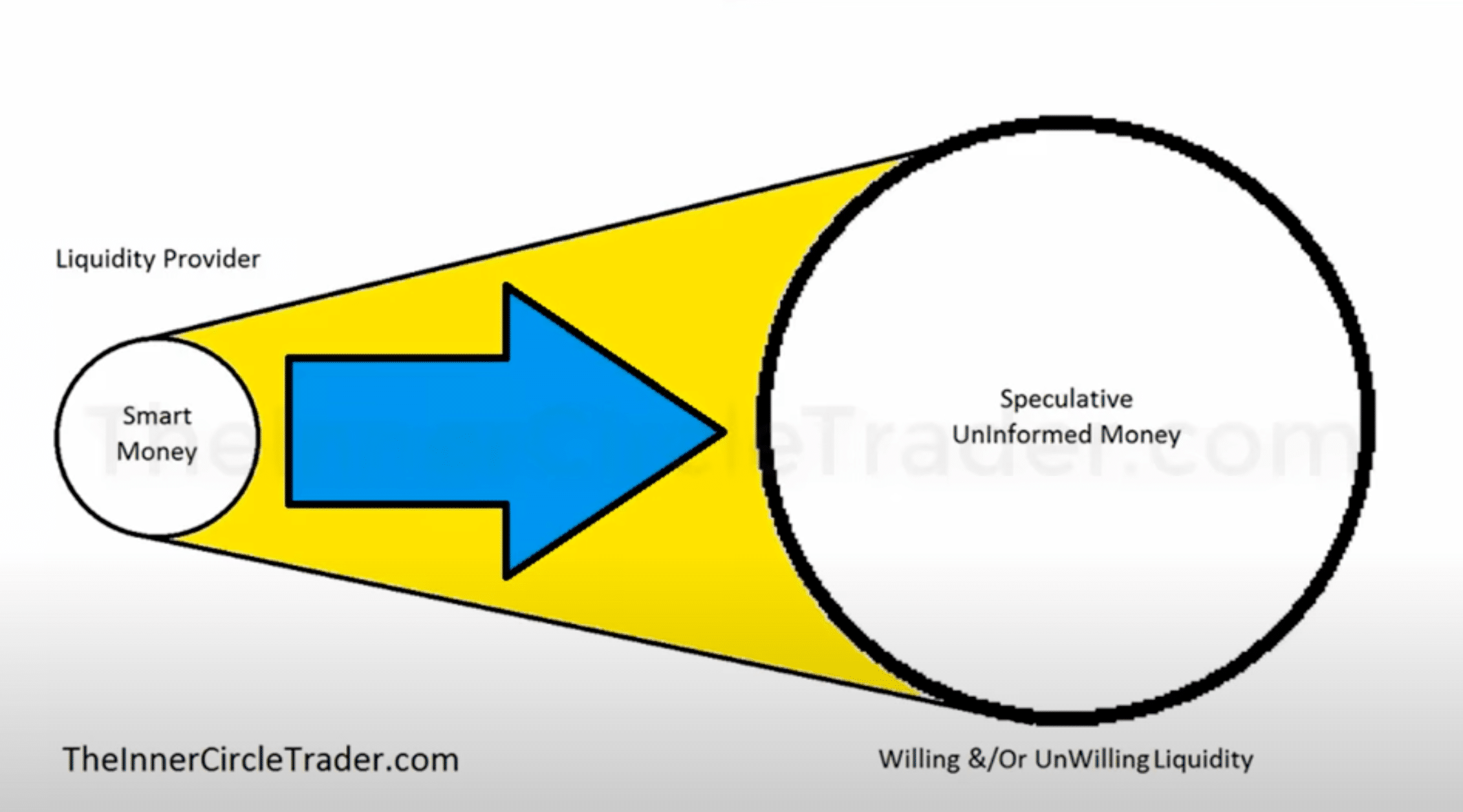

Key Point: The crux of this mentorship is to grasp the psychology of informed trading, contrasting sharply with the approach of uninformed or speculative traders.

- Informed vs. Uninformed: Understanding the difference between informed decisions and speculative guesses.

- Role of ‘Victim’ in Trading: Identifying the less informed party in a trade.

- Myth-Busting: Dispelling the myth that market movements are solely based on technical indicators.

The Uninformed Trader’s Perspective

Key Point: Many traders, particularly those new or less experienced, believe that market movements are largely controlled by technical indicators like overbought or oversold conditions.

- Belief System: The assumption that indicators are the primary drivers of market movement.

- Mindset Change: The session’s goal is to shift this belief towards a more nuanced understanding of market dynamics.

- Indicator Reliance: Addressing the common pitfall of relying too heavily on technical indicators for trading decisions.

Shifting Your Trading Mindset

To adopt a smart money perspective, traders need to change how they view the market. Realize that the market is not just about equal opportunities – big players like central banks and financial giants often have the upper hand in setting prices. Understanding this power dynamic is crucial for creating a trading strategy that works in the real world, not just in theory.

Understanding the Core of Market Movements

Key to market analysis are four main concepts: Retracement, Expansion, Reversal, and Consolidation. These are the primary drivers of price action.

- Retracement: A temporary reversal in the existing trend, offering new entry points.

- Expansion: A strong directional movement, indicating a powerful trend.

- Reversal: A complete change in the market direction, signaling a new trend.

- Consolidation: A period where prices stabilize, indicating a balance between buyers and sellers.

First Steps for New Traders

For those new to trading, the mentorship suggests starting with the basics. This includes:

- Daily Price Action Log: Keeping a record of daily market movements.

- Chart Analysis: Regularly analyzing charts to understand significant price movements and patterns.

- Highs and Lows: Noting important highs and lows and areas where prices shift rapidly.

Building a Strong Trading Foundation

The mentorship encourages a deep understanding of the market context. This foundational knowledge is vital before exploring specific trading techniques, helping traders make more informed decisions.

Conclusion

The ICT Mentorship provides a holistic view of financial markets from an informed trading standpoint. Moving away from traditional retail trading thinking, it helps traders gain a deeper insight into market workings. Both new and experienced traders can benefit from this approach, building a strong foundation and refining their strategies for better trading success.